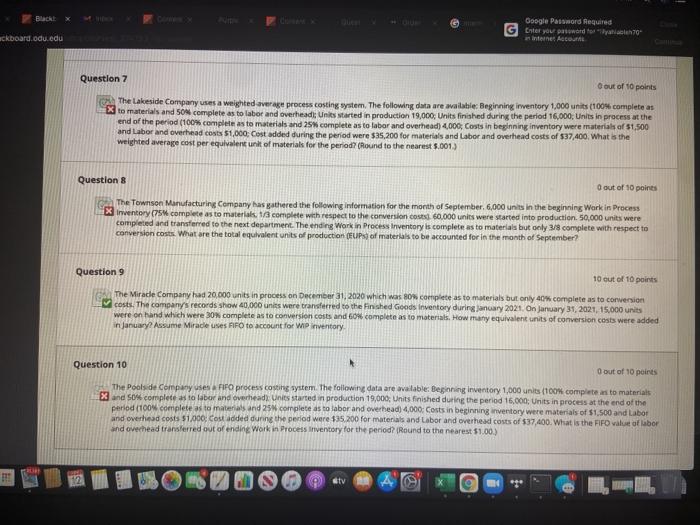

Black Google Password Required Enter your answer to th70" internet Account ackboard.odu.edu Question 7 O out of 10 points The Lakeside Company uses a weighted average process costing ystem. The following data are wailable: Beginning inventory 1.000 units (100% complete as X to materials and 50% complete as to labor and overhead: Unks started in production 19,000 Units finished during the period 16,000, Units in process at the end of the period (100% complete as to materials and 25 complete as to labor and overhead) 4,000, Costs in beginning inventory were materials of $1.500 and Labor and overhead costs 51,000: Cost added during the period were 535,200 for materials and Labor and overhead costs of 37,400. What is the weighted average cost per equivalent unit of materials for the period (Round to the nearest 5.001) Question 8 O out of 10 points The Townson Manufacturing Company has gathered the following information for the month of September 6,000 units in the beginning Work in Process X Inventory (75M complete as to material. 13 complete with respect to the conversion cost 60.000 units were started into production. 50,000 units were completed and transferred to the next department. The ending Work in Process Inventory is complete as to materials but only 3/8 complete with respect to conversion costs. What are the total equivalent units of production (FUPs of materials to be accounted for in the month of September? Question 9 10 out of 10 points The Miracle Company had 20.000 units in process on December 31, 2020 which was so complete as to materials but only 40 complete as to conversion costs. The company's records show 40,000 units were transferred to the finished Goods Inventory during january 2021. On January 31, 2021, 15.000 units were on hand which were 30 complete as to conversion costs and 60% complete as to materials. How many equivalent units of conversion costs were added in January? Assume Miracleuses FIFO to account for WP inventory Question 10 O out of 10 points The Pools de company uses a FIFO process costing system. The following data are available: Beginning inventory 1,000 units (100% complete as to materials X and so complete all to labor and overhead: Units started in production 19,000, Units finished during the period 16.000: Units in process at the end of the period 100 complete as to materials and 25 complete as to labor and overhead) 4,000 Costs in beginning inventory were materials of $1.500 and Labor and overhead costs $1.000: Cost added during the period were $35.200 for materials and Labor and overhead costs of $37,400. What is the FIFO value of labor and overhead transferred out of ending Work in Process inventory for the period? (Round to the nearest $1.00)