Question

Blake Company has ten employees who each earn $160 per day. If they accumulate vacation time at the rate of 1.5 vacation days for

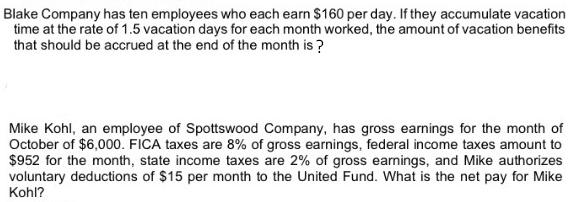

Blake Company has ten employees who each earn $160 per day. If they accumulate vacation time at the rate of 1.5 vacation days for each month worked, the amount of vacation benefits that should be accrued at the end of the month is? Mike Kohl, an employee of Spottswood Company, has gross earnings for the month of October of $6,000. FICA taxes are 8% of gross earnings, federal income taxes amount to $952 for the month, state income taxes are 2% of gross earnings, and Mike authorizes voluntary deductions of $15 per month to the United Fund. What is the net pay for Mike Kohl?

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Calculation of vacation benefits accrued Each employee earns 160 per day ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Nicola M. Young, Irene M. Wiecek, Bruce J. McConomy

10th Canadian Edition Volume 2

1118300858, 978-1118300855

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App