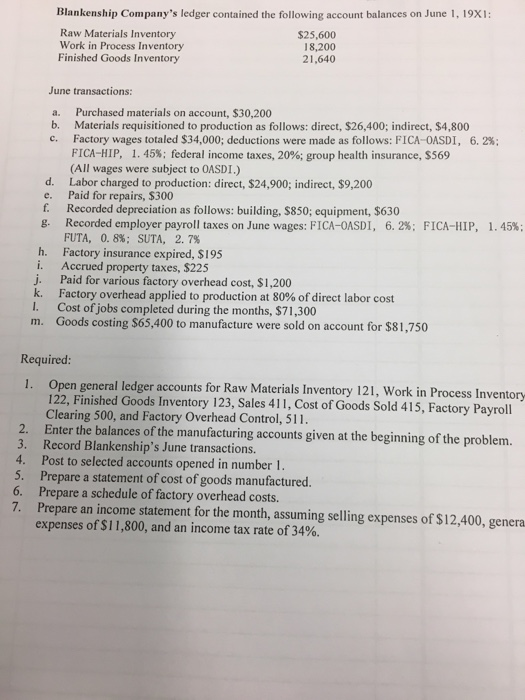

Blankenship Company's ledger contained the following account balances on June 1, 19X1: Raw Materials Inventory Work in Process Inventory Finished Goods Inventory $25,600 18,200 21,640 June transactions Purchased materials on account, $30,200 Materials requisitioned to production as follows: direct, $26,400; indirect, $4,800 Factory wages totaled $34,000, deductions were made as follows: FICA-OASDI, FICA-HIP, 1.45%; federal income taxes, 20%; group health insurance, $569 (All wages were subject to OASDI.) Labor charged to production: direct, $24,900; indirect, $9,200 Paid for repairs, $300 a. b. c. 6, 2%; d. e. f. Recorded depreciation as follows: building, $850; equipment, $630 g. Recorded employer payroll taxes on June wages: FICA-OASDI, FUTA, 6, 2%; FICA-HIP, 1.45%; 0.8%; SUTA, 2.7% h. Factory insurance expired, $195 i. Accrued property taxes, $225 j. Paid for various factory overhead cost, $1,200 k. Factory overhead applied to production at 80% of direct labor cost I. Cost of jobs completed during the months, $71,300 m. Goods costing $65,400 to manufacture were sold on account for $81,750 Required 1. Opengen eral ledger accounts for Raw Materials Inventory 121, Work in Process Inventory 122, Finished Goods Inventory 123, Sales 411, Cost of Goods Sold 415, Factory Payroll Clearing 500, and Factory Overhead Control, 511. 2. Enter the balances of the manufacturing accounts given at the beginning of the problem. 3. Record Blankenship's June transactions. 4. Post to selected accounts opened in number 1. 5. Prepare a statement of cost of goods manufactured. 6. Prepare a schedule of factory overhead costs. 7. Prepare an income statement for the month, assuming selling expenses of $12,400, genera expenses of $11,800, and an income tax rate of 34%. Blankenship Company's ledger contained the following account balances on June 1, 19X1: Raw Materials Inventory Work in Process Inventory Finished Goods Inventory $25,600 18,200 21,640 June transactions Purchased materials on account, $30,200 Materials requisitioned to production as follows: direct, $26,400; indirect, $4,800 Factory wages totaled $34,000, deductions were made as follows: FICA-OASDI, FICA-HIP, 1.45%; federal income taxes, 20%; group health insurance, $569 (All wages were subject to OASDI.) Labor charged to production: direct, $24,900; indirect, $9,200 Paid for repairs, $300 a. b. c. 6, 2%; d. e. f. Recorded depreciation as follows: building, $850; equipment, $630 g. Recorded employer payroll taxes on June wages: FICA-OASDI, FUTA, 6, 2%; FICA-HIP, 1.45%; 0.8%; SUTA, 2.7% h. Factory insurance expired, $195 i. Accrued property taxes, $225 j. Paid for various factory overhead cost, $1,200 k. Factory overhead applied to production at 80% of direct labor cost I. Cost of jobs completed during the months, $71,300 m. Goods costing $65,400 to manufacture were sold on account for $81,750 Required 1. Opengen eral ledger accounts for Raw Materials Inventory 121, Work in Process Inventory 122, Finished Goods Inventory 123, Sales 411, Cost of Goods Sold 415, Factory Payroll Clearing 500, and Factory Overhead Control, 511. 2. Enter the balances of the manufacturing accounts given at the beginning of the problem. 3. Record Blankenship's June transactions. 4. Post to selected accounts opened in number 1. 5. Prepare a statement of cost of goods manufactured. 6. Prepare a schedule of factory overhead costs. 7. Prepare an income statement for the month, assuming selling expenses of $12,400, genera expenses of $11,800, and an income tax rate of 34%