Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blaze Scooters is considering expanding into a new college town and has the following operating data: Initial Investment in scooters (year 0): $101515 Cost

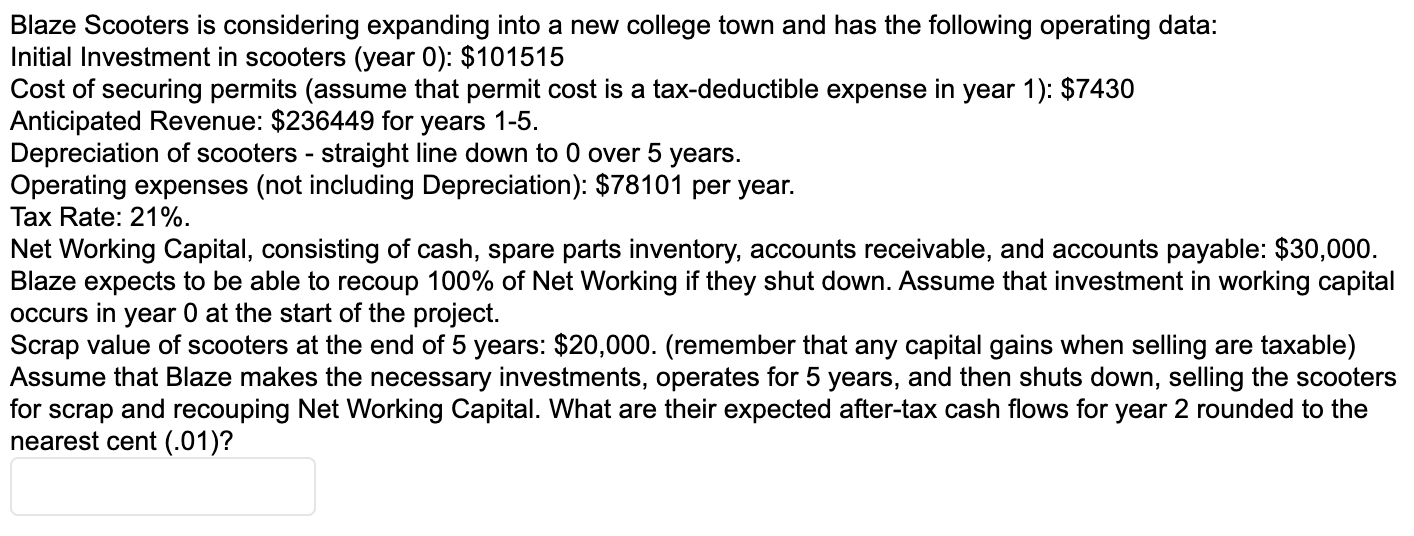

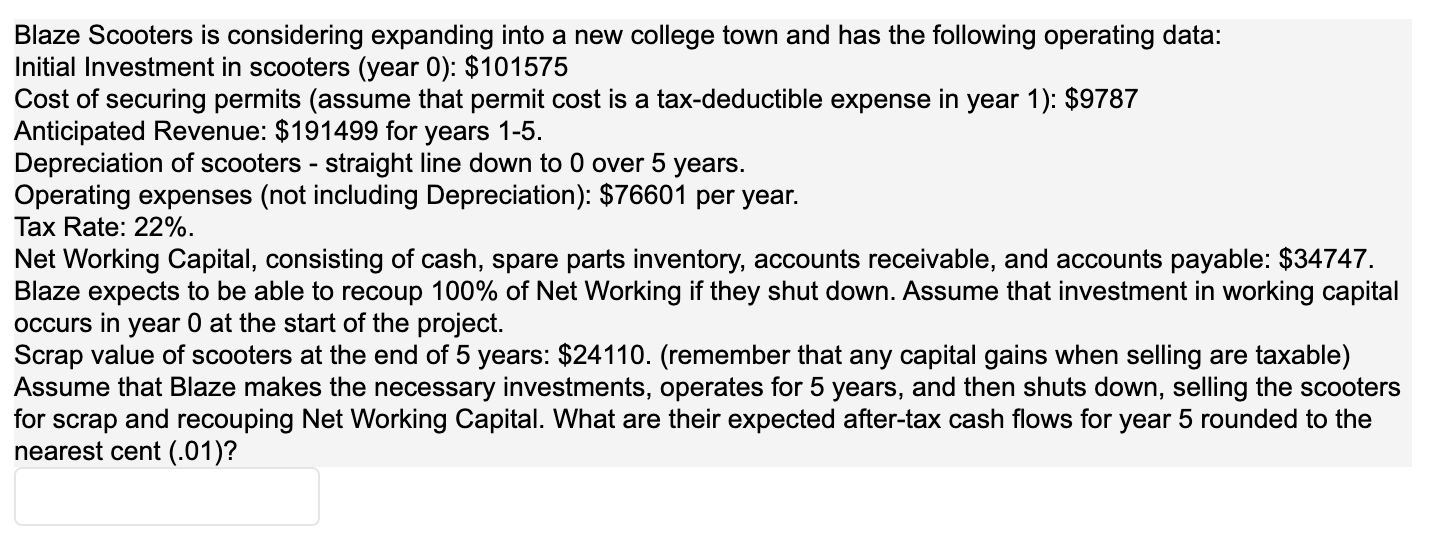

Blaze Scooters is considering expanding into a new college town and has the following operating data: Initial Investment in scooters (year 0): $101515 Cost of securing permits (assume that permit cost is a tax-deductible expense in year 1): $7430 Anticipated Revenue: $236449 for years 1-5. Depreciation of scooters - straight line down to 0 over 5 years. Operating expenses (not including Depreciation): $78101 per year. Tax Rate: 21%. Net Working Capital, consisting of cash, spare parts inventory, accounts receivable, and accounts payable: $30,000. Blaze expects to be able to recoup 100% of Net Working if they shut down. Assume that investment in working capital occurs in year 0 at the start of the project. Scrap value of scooters at the end of 5 years: $20,000. (remember that any capital gains when selling are taxable) Assume that Blaze makes the necessary investments, operates for 5 years, and then shuts down, selling the scooters for scrap and recouping Net Working Capital. What are their expected after-tax cash flows for year 2 rounded to the nearest cent (.01)? Blaze Scooters is considering expanding into a new college town and has the following operating data: Initial Investment in scooters (year 0): $101575 Cost of securing permits (assume that permit cost is a tax-deductible expense in year 1): $9787 Anticipated Revenue: $191499 for years 1-5. Depreciation of scooters - straight line down to 0 over 5 years. Operating expenses (not including Depreciation): $76601 per year. Tax Rate: 22%. Net Working Capital, consisting of cash, spare parts inventory, accounts receivable, and accounts payable: $34747. Blaze expects to be able to recoup 100% of Net Working if they shut down. Assume that investment in working capital occurs in year 0 at the start of the project. Scrap value of scooters at the end of 5 years: $24110. (remember that any capital gains when selling are taxable) Assume that Blaze makes the necessary investments, operates for 5 years, and then shuts down, selling the scooters for scrap and recouping Net Working Capital. What are their expected after-tax cash flows for year 5 rounded to the nearest cent (.01)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started