Question

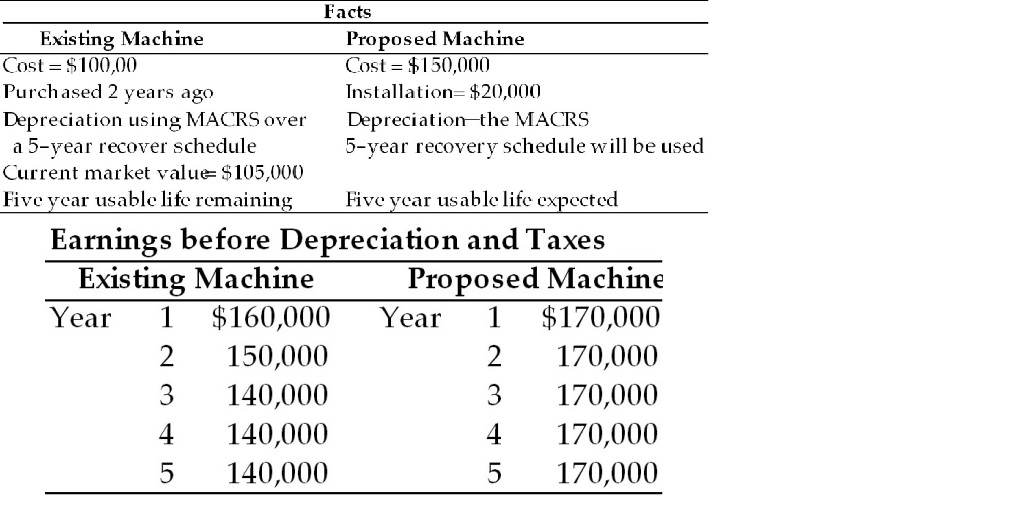

Blazer, Inc., a manufacturer of childrens apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

Blazer, Inc., a manufacturer of childrens apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given. (Look up MACRS percentages at irs.gov) The firm pays 40 percent taxes on both ordinary income and capital gains.

a. Calculate the book value of the existing asset being replaced.

b. Calculate the tax effect from the sale of the existing asset.

c. Calculate the initial investment required for the new asset.

d. Summarize the incremental after-tax cash flow (relevant cash flows) for years t = 0 through t = 5. (You will need the total cash flows from each machine to answer this question.)

Facts Existing Machine Cost 100,00 Purch ased 2 years ago Depreciation using MACRS over Depreciation the MACRS Proposed Machine Cost = 150,000 Installation 20,000 a 5-vear recover schedule Current market value- $105,000 Five vear usable life remainin 5-vear recovery schedule will be used Five vear usabl life expected Earnings before Depreciation and Taxes Proposed Machine Year 1 $160,000 Year $170,000 2 170,000 3 170,000 4170,000 5170,000 Existing Machine 2150,000 3 140,000 4140,000 5140,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started