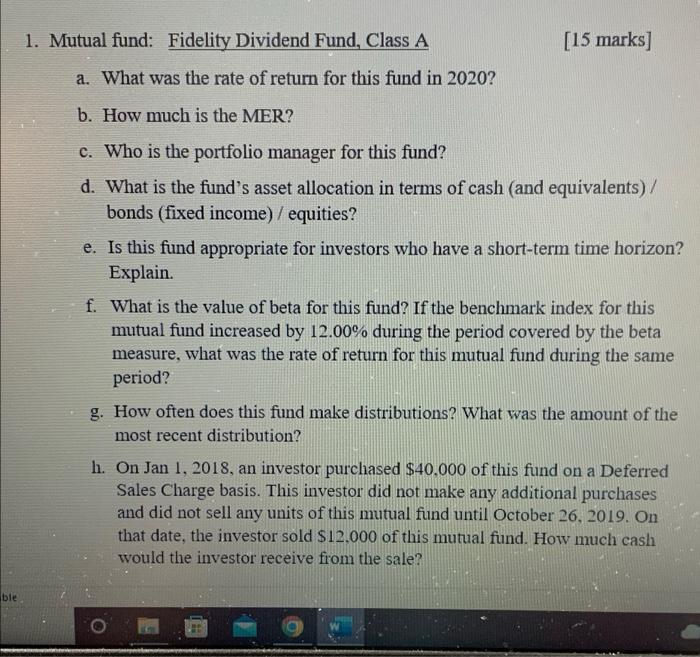

ble [15 marks] a. What was the rate of return for this fund in 2020? b. How much is the MER? c. Who is the portfolio manager for this fund? d. What is the fund's asset allocation in terms of cash (and equivalents) / bonds (fixed income) / equities? e. Is this fund appropriate for investors who have a short-term time horizon? Explain. f. What is the value of beta for this fund? If the benchmark index for this mutual fund increased by 12.00% during the period covered by the beta measure, what was the rate of return for this mutual fund during the same period? g. How often does this fund make distributions? What was the amount of the most recent distribution? h. On Jan 1, 2018, an investor purchased $40,000 of this fund on a Deferred Sales Charge basis. This investor did not make any additional purchases and did not sell any units of this mutual fund until October 26, 2019. On that date, the investor sold $12.000 of this mutual fund. How much cash would the investor receive from the sale? 1. Mutual fund: Fidelity Dividend Fund, Class A ble [15 marks] a. What was the rate of return for this fund in 2020? b. How much is the MER? c. Who is the portfolio manager for this fund? d. What is the fund's asset allocation in terms of cash (and equivalents) / bonds (fixed income) / equities? e. Is this fund appropriate for investors who have a short-term time horizon? Explain. f. What is the value of beta for this fund? If the benchmark index for this mutual fund increased by 12.00% during the period covered by the beta measure, what was the rate of return for this mutual fund during the same period? g. How often does this fund make distributions? What was the amount of the most recent distribution? h. On Jan 1, 2018, an investor purchased $40,000 of this fund on a Deferred Sales Charge basis. This investor did not make any additional purchases and did not sell any units of this mutual fund until October 26, 2019. On that date, the investor sold $12.000 of this mutual fund. How much cash would the investor receive from the sale? 1. Mutual fund: Fidelity Dividend Fund, Class A