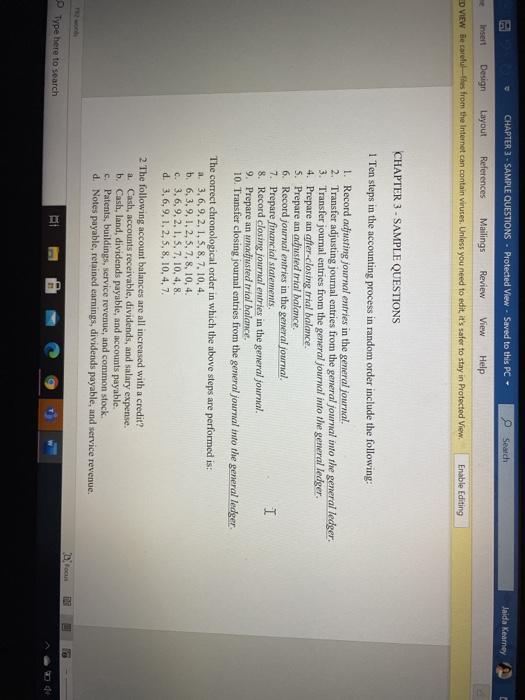

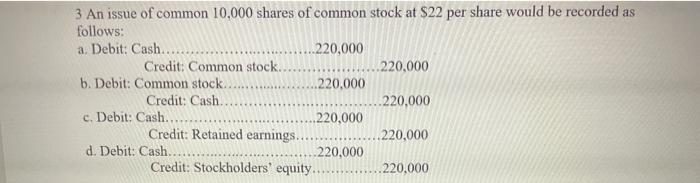

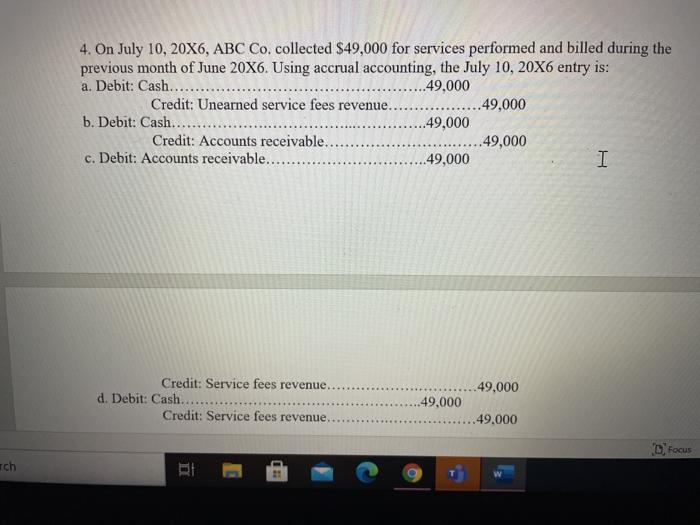

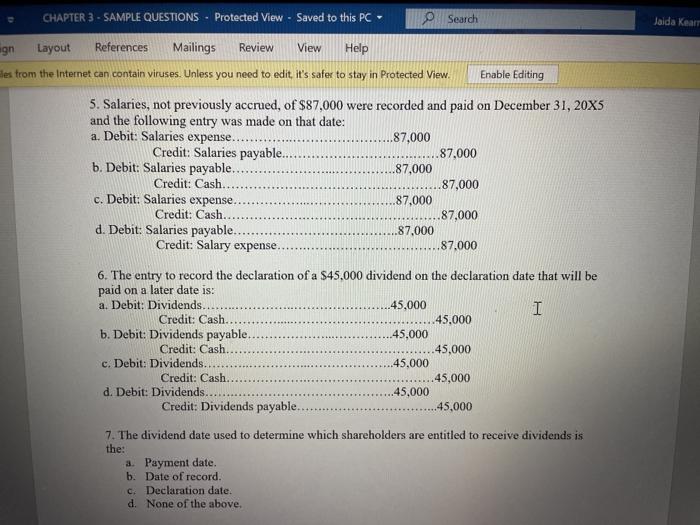

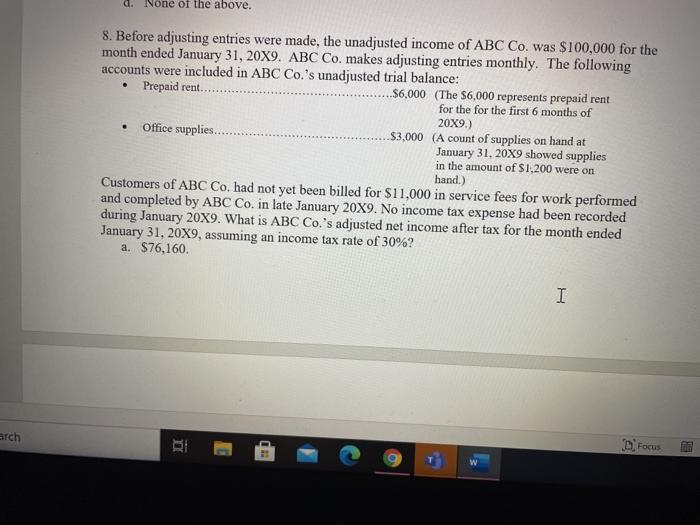

Blo Jaida Kearney CHAPTER 3 - SAMPLE QUESTIONS . Protected View - Saved to this PC- Search Insert Design Layout References Mailings Review View Help ED VIEW Be careles from the Internet can contain viruses. Unless you need to edit it's safe to stay in Protected View Enable Editing CHAPTER 3 - SAMPLE QUESTIONS 1 Ten steps in the accounting process in random order include the following: 1. Record adjusting journal entries in the general journal. 2. Transfer adjusting journal entries from the general journal into the general ledger 3. Transfer journal entries from the general journal into the general ledger 4. Prepare an after-closing trial balance. 5. Prepare an adjusted trial balance. 6. Record journal entries in the general Journal 7. Prepare financial statements I 8. Record closing journal entries in the general journal. 9. Prepare an adjusted trial balance. 10. Transfer closing journal entries from the general journal into the general ledger The correct chronological order in which the above steps are performed is: a 3,6,9.2, 1, 5, 8, 7. 10,4 b. 6.3.9. 1. 2, 5, 7, 8, 10.4. c. 3.6.9.2, 1.5.7. 10.4.8. d. 3, 6, 9, 1, 2, 5, 8, 10, 4.7. 2 The following account balances are all increased with a credit? a. Cash, accounts receivable, dividends, and salary expense. b. Cash, land, dividends payable, and accounts payable. c. Patents, buildings, service revenue, and common stock d Notes payable, retained earings, dividends payable, and service revenue. Do TE Type here to search 3 An issue of common 10,000 shares of common stock at $22 per share would be recorded as follows: a. Debit: Cash .220,000 Credit: Common stock. 220,000 b. Debit: Common stock. .220,000 Credit: Cash .220,000 c. Debit: Cash.. .220,000 Credit: Retained earnings. .220,000 d. Debit: Cash .220,000 Credit: Stockholders' equity. 220,000 4. On July 10, 20X6, ABC Co. collected $49,000 for services performed and billed during the previous month of June 20X6. Using accrual accounting, the July 10, 20X6 entry is: a. Debit: Cash..... 49,000 Credit: Unearned service fees revenue. .49,000 b. Debit: Cash...... .49,000 Credit: Accounts receivable.. ...49,000 c. Debit: Accounts receivable.... ..49,000 I Credit: Service fees revenue. d. Debit: Cash.... Credit: Service fees revenue. ..49,000 49,000 ...49,000 Focus Ich BE CHAPTER 3 - SAMPLE QUESTIONS - Protected View - Saved to this PC Search Jalda Kearr ign Layout References Mailings Review View Help les from the Internet can contain viruses. Unless you need to edit it's safer to stay in Protected View Enable Editing 5. Salaries, not previously accrued, of $87,000 were recorded and paid on December 31, 20X5 and the following entry was made on that date: a. Debit: Salaries expense. .87,000 Credit: Salaries payable. .87.000 b. Debit: Salaries payable.. .87,000 Credit: Cash .87,000 c. Debit: Salaries expense. .87,000 Credit: Cash 87,000 d. Debit: Salaries payable.. .87,000 Credit: Salary expense. 87.000 6. The entry to record the declaration of a $45.000 dividend on the declaration date that will be paid on a later date is: a. Debit: Dividends 45,000 I Credit: Cash 45,000 b. Debit: Dividends payable. .45.000 Credit: Cash 45,000 c. Debit: Dividends. 45,000 Credit: Cash.. 45,000 d. Debit: Dividends.. .45,000 Credit: Dividends payable.. 7. The dividend date used to determine which shareholders are entitled to receive dividends is the: a. Payment date. b. Date of record. c. Declaration date. d. None of the above. 45,000 d. None of the above. 8. Before adjusting entries were made, the unadjusted income of ABC Co. was $100,000 for the month ended January 31, 20X9. ABC Co. makes adjusting entries monthly. The following accounts were included in ABC Co.'s unadjusted trial balance: Prepaid rent. $6,000 (The S6,000 represents prepaid rent for the for the first 6 months of 20X9.) Office supplies....... $3,000 (A count of supplies on hand at January 31, 20X9 showed supplies in the amount of $1,200 were on hand.) Customers of ABC Co. had not yet been billed for $11,000 in service fees for work performed and completed by ABC Co. in late January 20X9. No income tax expense had been recorded during January 20X9. What is ABC Co.'s adjusted net income after tax for the month ended January 31, 20X9, assuming an income tax rate of 30%? a. $76,160 I arch Focus EB @ Blo Jaida Kearney CHAPTER 3 - SAMPLE QUESTIONS . Protected View - Saved to this PC- Search Insert Design Layout References Mailings Review View Help ED VIEW Be careles from the Internet can contain viruses. Unless you need to edit it's safe to stay in Protected View Enable Editing CHAPTER 3 - SAMPLE QUESTIONS 1 Ten steps in the accounting process in random order include the following: 1. Record adjusting journal entries in the general journal. 2. Transfer adjusting journal entries from the general journal into the general ledger 3. Transfer journal entries from the general journal into the general ledger 4. Prepare an after-closing trial balance. 5. Prepare an adjusted trial balance. 6. Record journal entries in the general Journal 7. Prepare financial statements I 8. Record closing journal entries in the general journal. 9. Prepare an adjusted trial balance. 10. Transfer closing journal entries from the general journal into the general ledger The correct chronological order in which the above steps are performed is: a 3,6,9.2, 1, 5, 8, 7. 10,4 b. 6.3.9. 1. 2, 5, 7, 8, 10.4. c. 3.6.9.2, 1.5.7. 10.4.8. d. 3, 6, 9, 1, 2, 5, 8, 10, 4.7. 2 The following account balances are all increased with a credit? a. Cash, accounts receivable, dividends, and salary expense. b. Cash, land, dividends payable, and accounts payable. c. Patents, buildings, service revenue, and common stock d Notes payable, retained earings, dividends payable, and service revenue. Do TE Type here to search 3 An issue of common 10,000 shares of common stock at $22 per share would be recorded as follows: a. Debit: Cash .220,000 Credit: Common stock. 220,000 b. Debit: Common stock. .220,000 Credit: Cash .220,000 c. Debit: Cash.. .220,000 Credit: Retained earnings. .220,000 d. Debit: Cash .220,000 Credit: Stockholders' equity. 220,000 4. On July 10, 20X6, ABC Co. collected $49,000 for services performed and billed during the previous month of June 20X6. Using accrual accounting, the July 10, 20X6 entry is: a. Debit: Cash..... 49,000 Credit: Unearned service fees revenue. .49,000 b. Debit: Cash...... .49,000 Credit: Accounts receivable.. ...49,000 c. Debit: Accounts receivable.... ..49,000 I Credit: Service fees revenue. d. Debit: Cash.... Credit: Service fees revenue. ..49,000 49,000 ...49,000 Focus Ich BE CHAPTER 3 - SAMPLE QUESTIONS - Protected View - Saved to this PC Search Jalda Kearr ign Layout References Mailings Review View Help les from the Internet can contain viruses. Unless you need to edit it's safer to stay in Protected View Enable Editing 5. Salaries, not previously accrued, of $87,000 were recorded and paid on December 31, 20X5 and the following entry was made on that date: a. Debit: Salaries expense. .87,000 Credit: Salaries payable. .87.000 b. Debit: Salaries payable.. .87,000 Credit: Cash .87,000 c. Debit: Salaries expense. .87,000 Credit: Cash 87,000 d. Debit: Salaries payable.. .87,000 Credit: Salary expense. 87.000 6. The entry to record the declaration of a $45.000 dividend on the declaration date that will be paid on a later date is: a. Debit: Dividends 45,000 I Credit: Cash 45,000 b. Debit: Dividends payable. .45.000 Credit: Cash 45,000 c. Debit: Dividends. 45,000 Credit: Cash.. 45,000 d. Debit: Dividends.. .45,000 Credit: Dividends payable.. 7. The dividend date used to determine which shareholders are entitled to receive dividends is the: a. Payment date. b. Date of record. c. Declaration date. d. None of the above. 45,000 d. None of the above. 8. Before adjusting entries were made, the unadjusted income of ABC Co. was $100,000 for the month ended January 31, 20X9. ABC Co. makes adjusting entries monthly. The following accounts were included in ABC Co.'s unadjusted trial balance: Prepaid rent. $6,000 (The S6,000 represents prepaid rent for the for the first 6 months of 20X9.) Office supplies....... $3,000 (A count of supplies on hand at January 31, 20X9 showed supplies in the amount of $1,200 were on hand.) Customers of ABC Co. had not yet been billed for $11,000 in service fees for work performed and completed by ABC Co. in late January 20X9. No income tax expense had been recorded during January 20X9. What is ABC Co.'s adjusted net income after tax for the month ended January 31, 20X9, assuming an income tax rate of 30%? a. $76,160 I arch Focus EB @