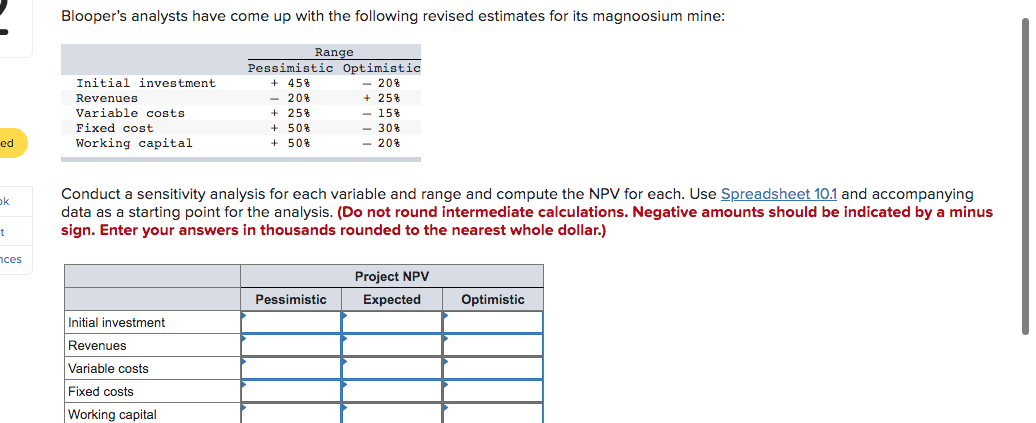

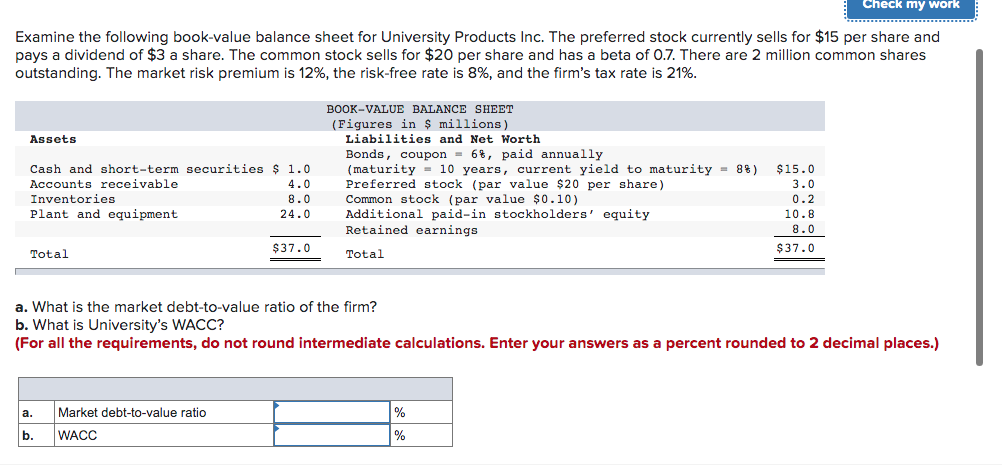

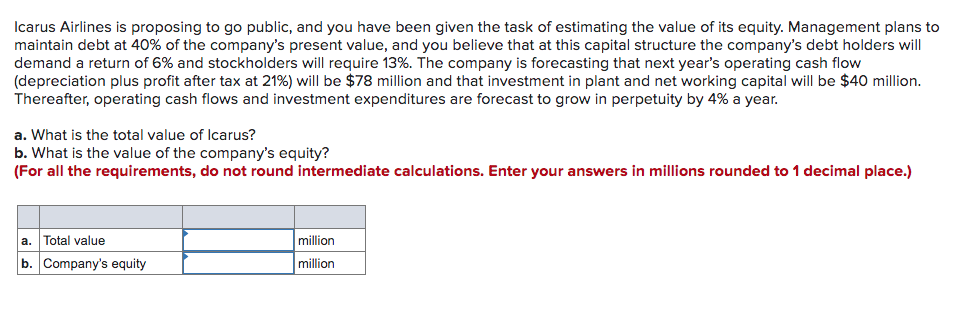

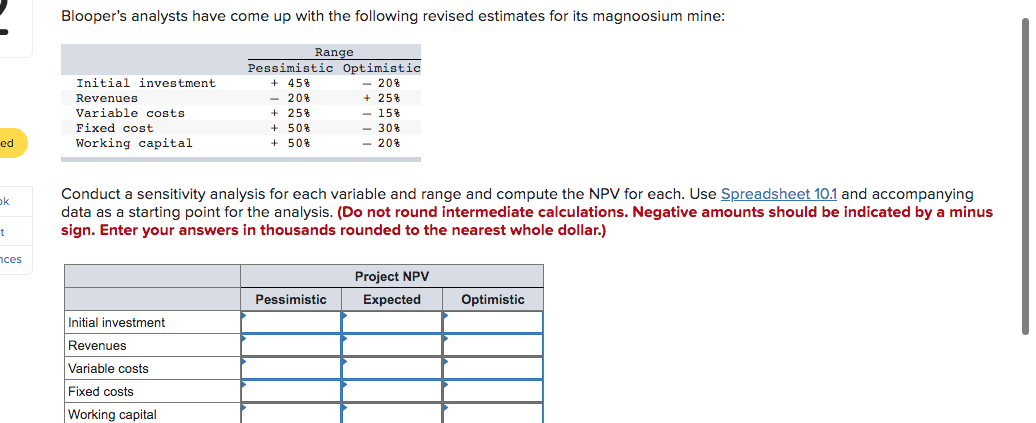

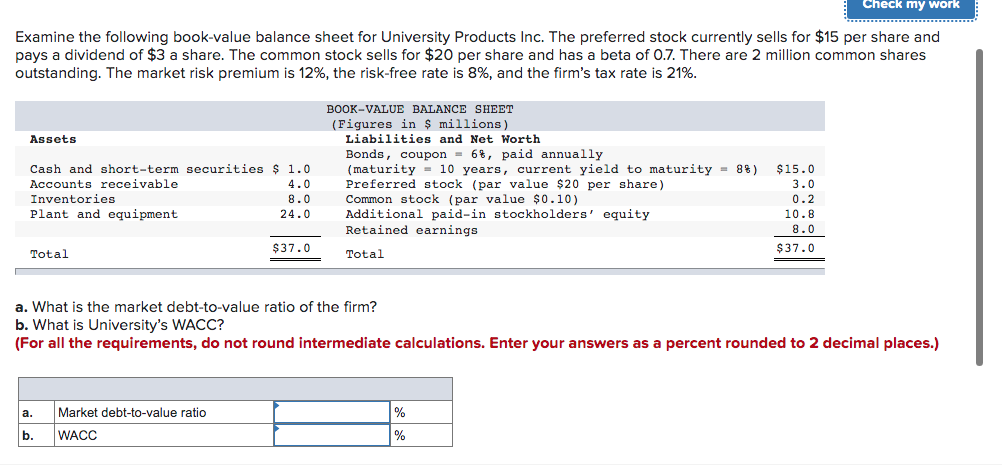

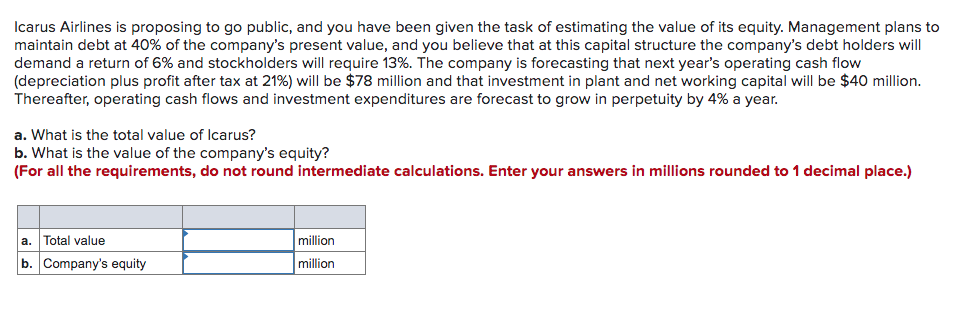

Blooper's analysts have come up with the following revised estimates for its magnoosium mine: Initial investment Revenues Variable costs Fixed cost Working capital Range Pessimistic Optimistic + 45% - 20% 20% + 25% + 25% 157 + 50% -30% + 50% - 20% ed ok Conduct a sensitivity analysis for each variable and range and compute the NPV for each. Use Spreadsheet 10.1 and accompanying data as a starting point for the analysis. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign. Enter your answers in thousands rounded to the nearest whole dollar.) t nces Project NPV Expected Pessimistic Optimistic Initial investment Revenues Variable costs Fixed costs Working capital Check my work Examine the following book-value balance sheet for University Products Inc. The preferred stock currently sells for $15 per share and pays a dividend of $3 a share. The common stock sells for $20 per share and has a beta of 0.7. There are 2 million common shares outstanding. The market risk premium is 12%, the risk-free rate is 8%, and the firm's tax rate is 21%. Assets Cash and short-term securities $ 1.0 Accounts receivable 4.0 Inventories 8.0 Plant and equipment 24.0 BOOK-VALUE BALANCE SHEET (Figures in $ millions Liabilities and Net Worth Bonds, coupon = 6%, paid annually (maturity = 10 years, current yield to maturity = 8%) Preferred stock (par value $20 per share) Common stock (par value $0.10) Additional paid-in stockholders' equity Retained earnings Total $15.0 3.0 0.2 10.8 8.0 Total $ $37.0 $37.0 a. What is the market debt-to-value ratio of the firm? b. What is University's WACC? (For all the requirements, do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) a. % Market debt-to-value ratio WACC b. % Icarus Airlines is proposing to go public, and you have been given the task of estimating the value of its equity. Management plans to maintain debt at 40% of the company's present value, and you believe that at this capital structure the company's debt holders will demand a return of 6% and stockholders will require 13%. The company is forecasting that next year's operating cash flow (depreciation plus profit after tax at 21%) will be $78 million and that investment in plant and net working capital will be $40 million. Thereafter, operating cash flows and investment expenditures are forecast to grow in perpetuity by 4% a year. a. What is the total value of Icarus? b. What is the value of the company's equity? (For all the requirements, do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place.) a. Total value b. Company's equity million million Blooper's analysts have come up with the following revised estimates for its magnoosium mine: Initial investment Revenues Variable costs Fixed cost Working capital Range Pessimistic Optimistic + 45% - 20% 20% + 25% + 25% 157 + 50% -30% + 50% - 20% ed ok Conduct a sensitivity analysis for each variable and range and compute the NPV for each. Use Spreadsheet 10.1 and accompanying data as a starting point for the analysis. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign. Enter your answers in thousands rounded to the nearest whole dollar.) t nces Project NPV Expected Pessimistic Optimistic Initial investment Revenues Variable costs Fixed costs Working capital Check my work Examine the following book-value balance sheet for University Products Inc. The preferred stock currently sells for $15 per share and pays a dividend of $3 a share. The common stock sells for $20 per share and has a beta of 0.7. There are 2 million common shares outstanding. The market risk premium is 12%, the risk-free rate is 8%, and the firm's tax rate is 21%. Assets Cash and short-term securities $ 1.0 Accounts receivable 4.0 Inventories 8.0 Plant and equipment 24.0 BOOK-VALUE BALANCE SHEET (Figures in $ millions Liabilities and Net Worth Bonds, coupon = 6%, paid annually (maturity = 10 years, current yield to maturity = 8%) Preferred stock (par value $20 per share) Common stock (par value $0.10) Additional paid-in stockholders' equity Retained earnings Total $15.0 3.0 0.2 10.8 8.0 Total $ $37.0 $37.0 a. What is the market debt-to-value ratio of the firm? b. What is University's WACC? (For all the requirements, do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) a. % Market debt-to-value ratio WACC b. % Icarus Airlines is proposing to go public, and you have been given the task of estimating the value of its equity. Management plans to maintain debt at 40% of the company's present value, and you believe that at this capital structure the company's debt holders will demand a return of 6% and stockholders will require 13%. The company is forecasting that next year's operating cash flow (depreciation plus profit after tax at 21%) will be $78 million and that investment in plant and net working capital will be $40 million. Thereafter, operating cash flows and investment expenditures are forecast to grow in perpetuity by 4% a year. a. What is the total value of Icarus? b. What is the value of the company's equity? (For all the requirements, do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place.) a. Total value b. Company's equity million million