Blossom Farms purchased real estate for $1,210,000, which included $6,500 in legal fees. It paid $264,000 cash and incurred a mortgage payable for the

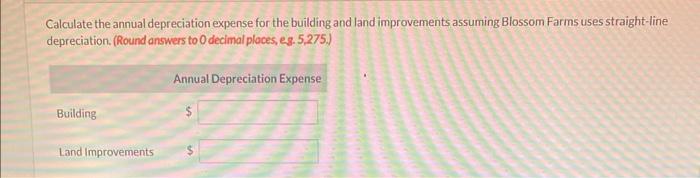

Blossom Farms purchased real estate for $1,210,000, which included $6,500 in legal fees. It paid $264,000 cash and incurred a mortgage payable for the balance. The real estate included land that was appraised at $481,680, a building appraised at $735,900, and fences and other land improvements appraised at $120,420. The building has an estimated useful life of 60 years and a $52,000 residual value. Land improvements have an estimated 15-year useful life and no residual value. Calculate the annual depreciation expense for the building and land improvements assuming Blossom Farms uses straight-line depreciation. (Round answers to 0 decimal places, e.g. 5,275.) Building Land Improvements Annual Depreciation Expense

Step by Step Solution

3.32 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started