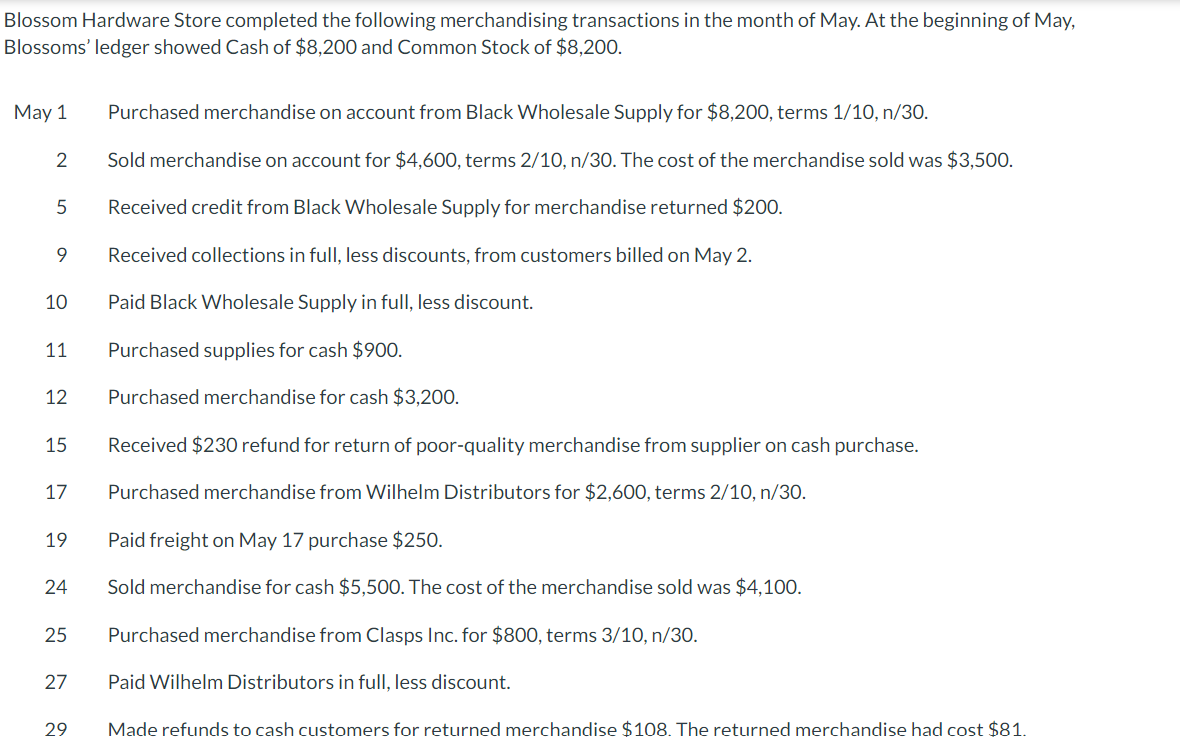

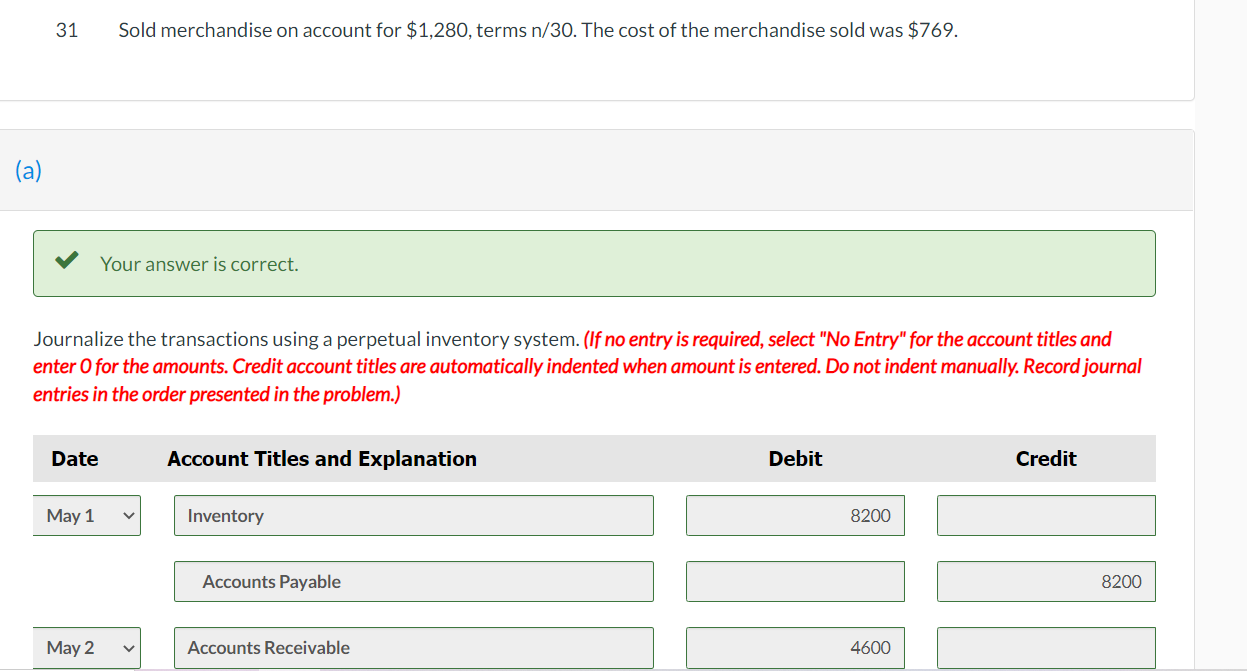

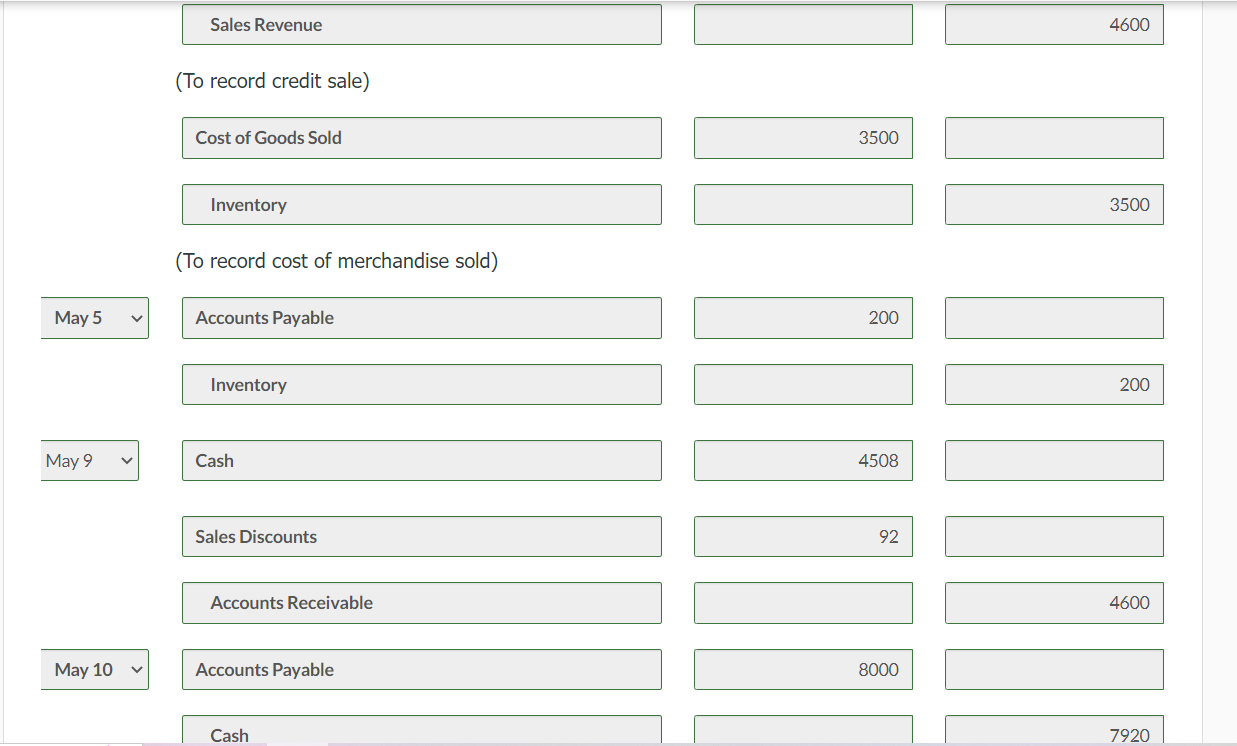

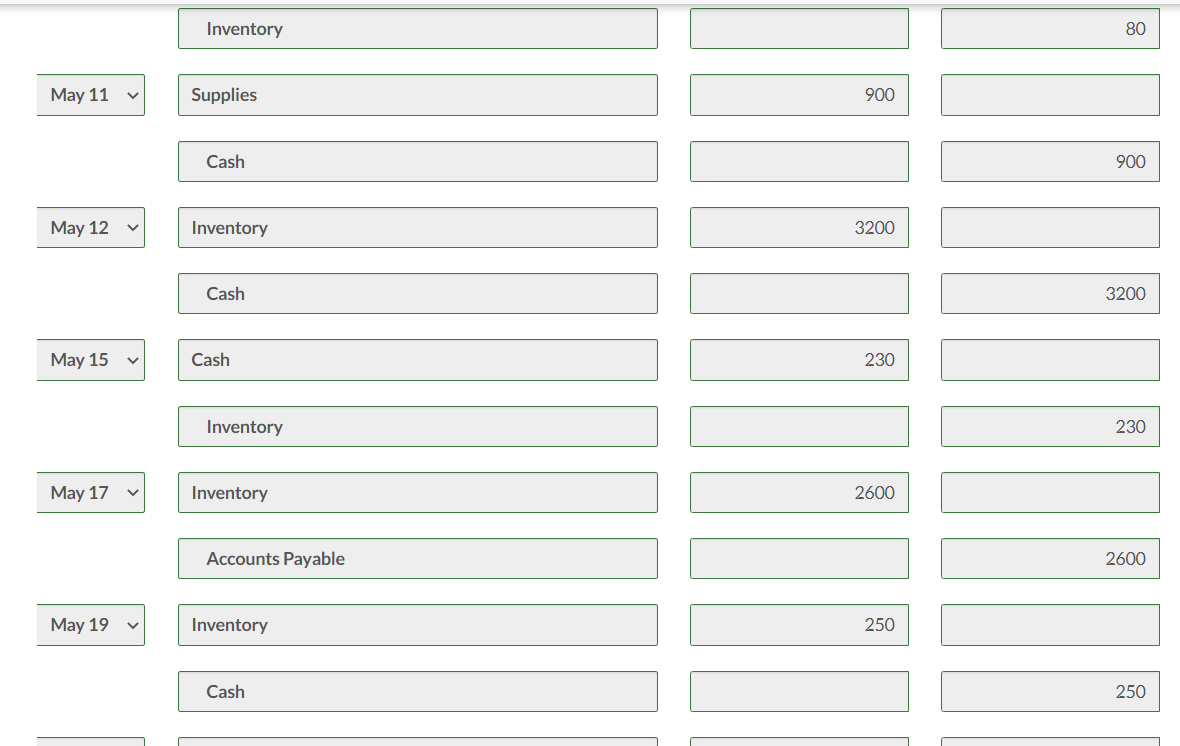

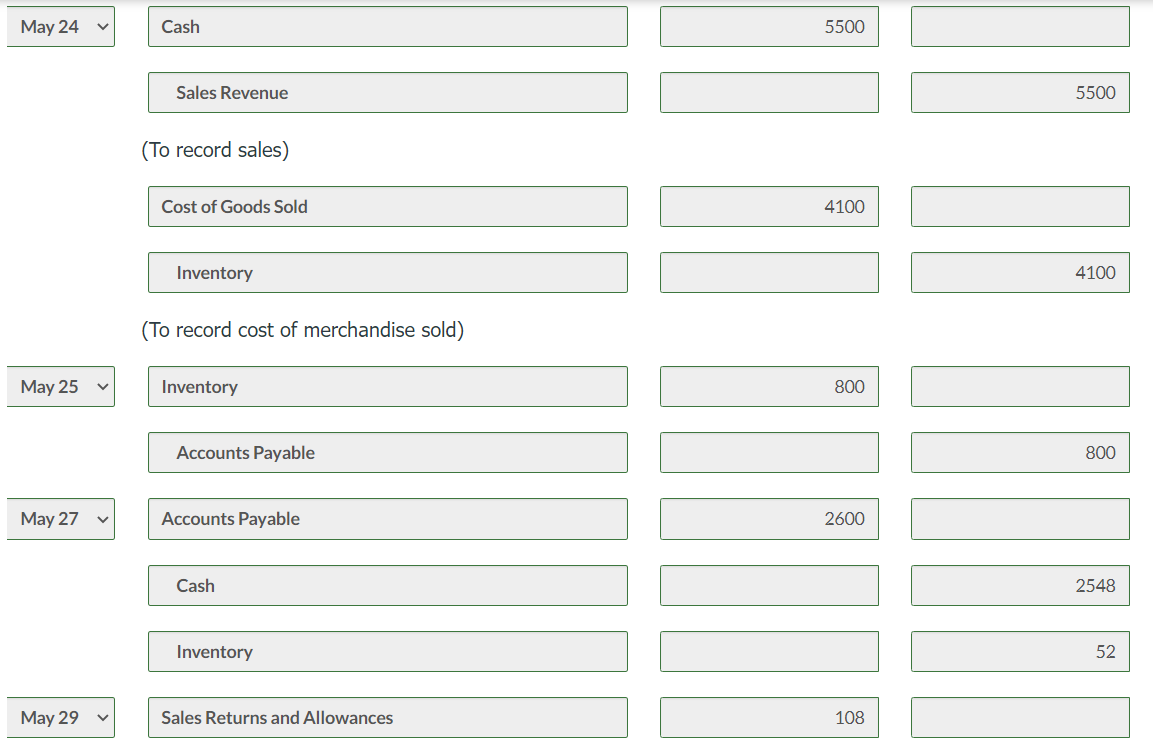

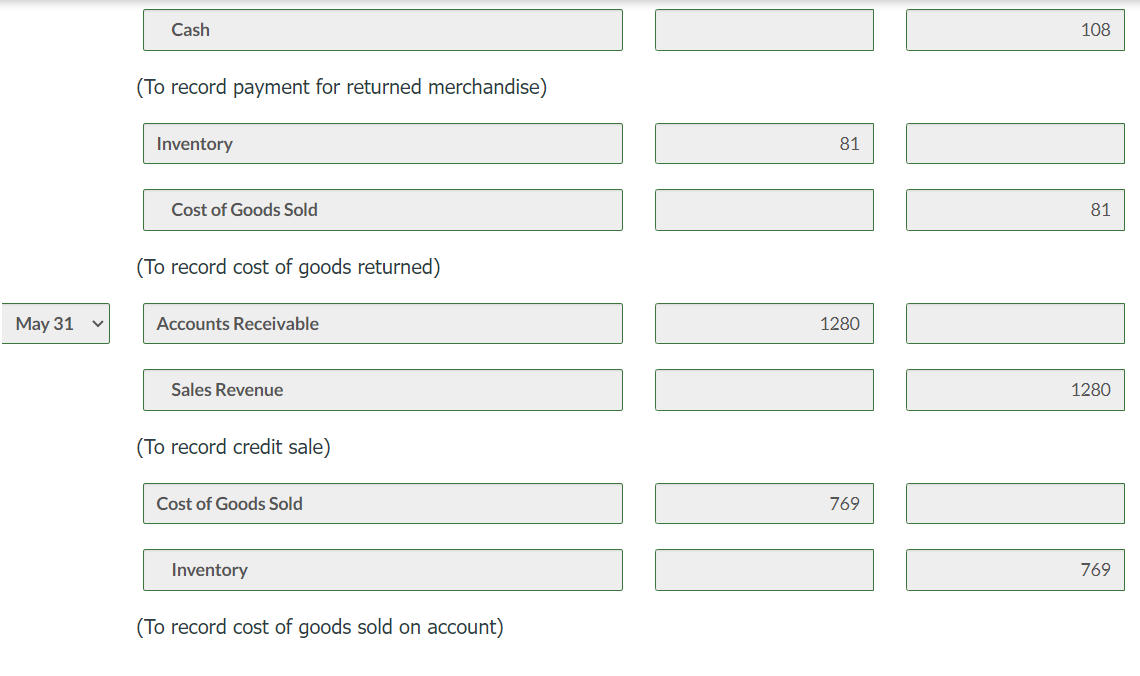

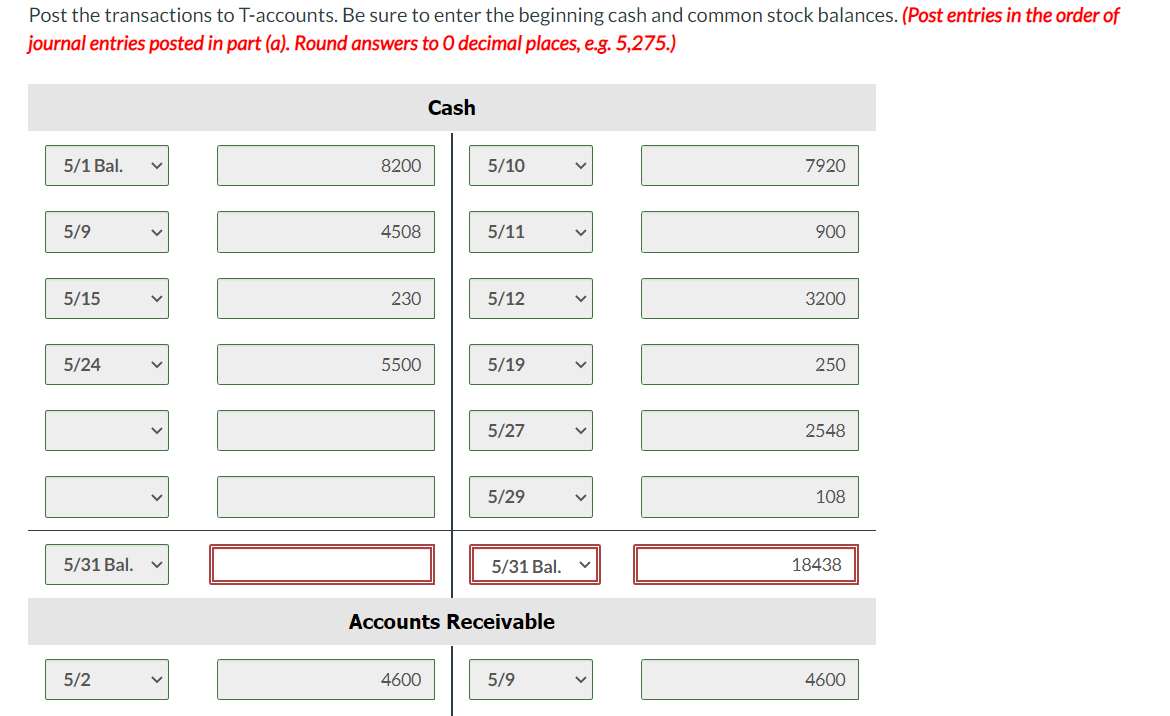

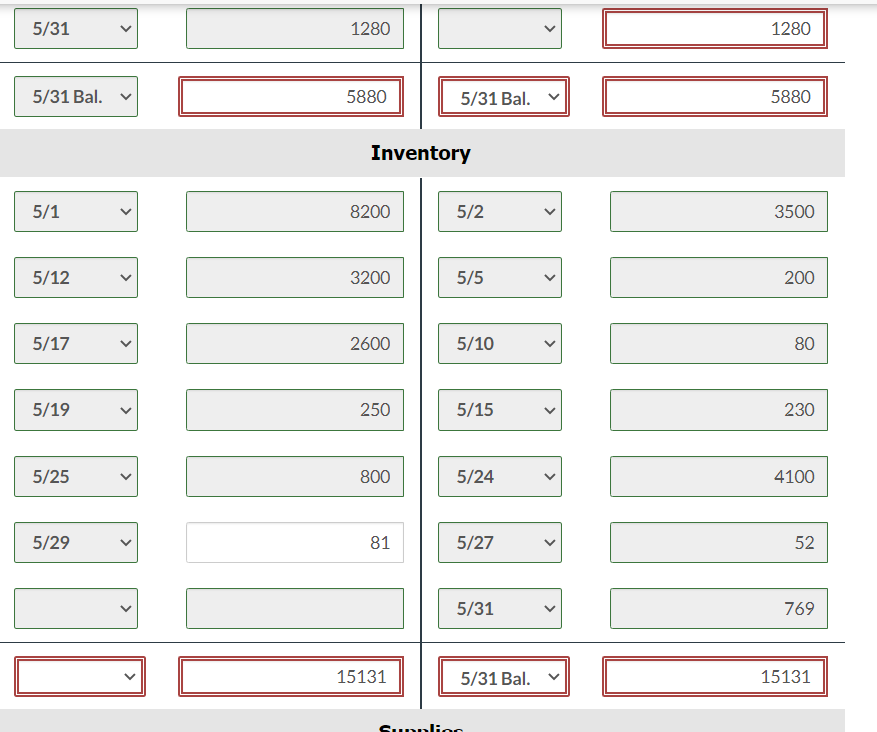

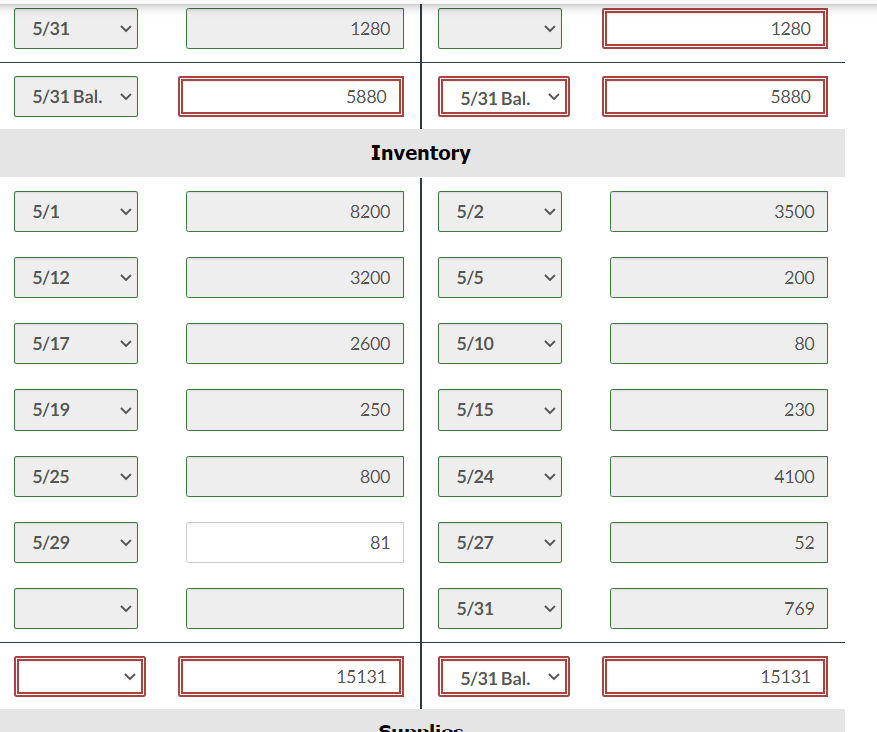

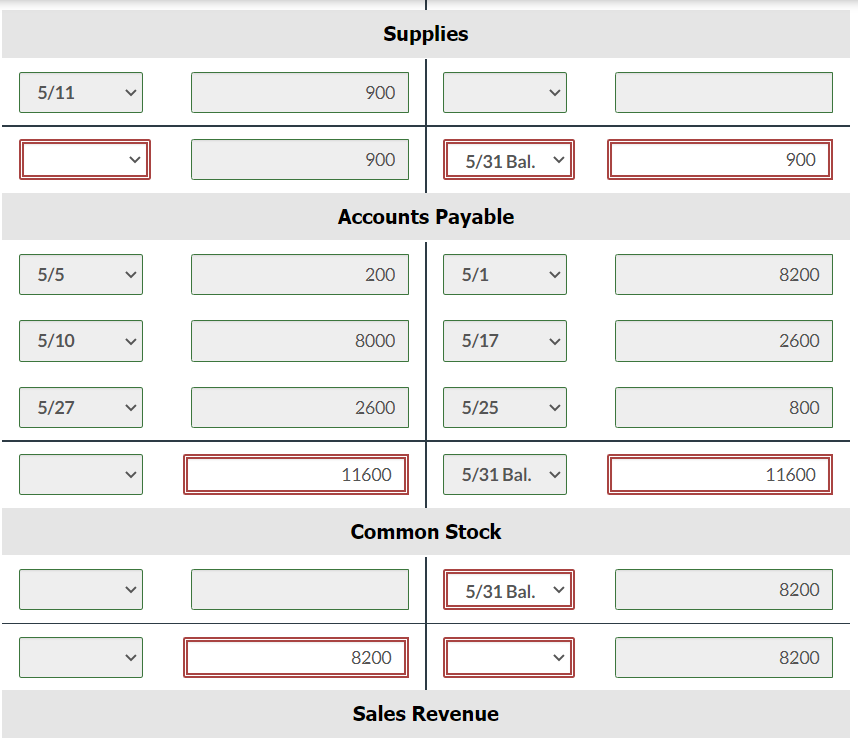

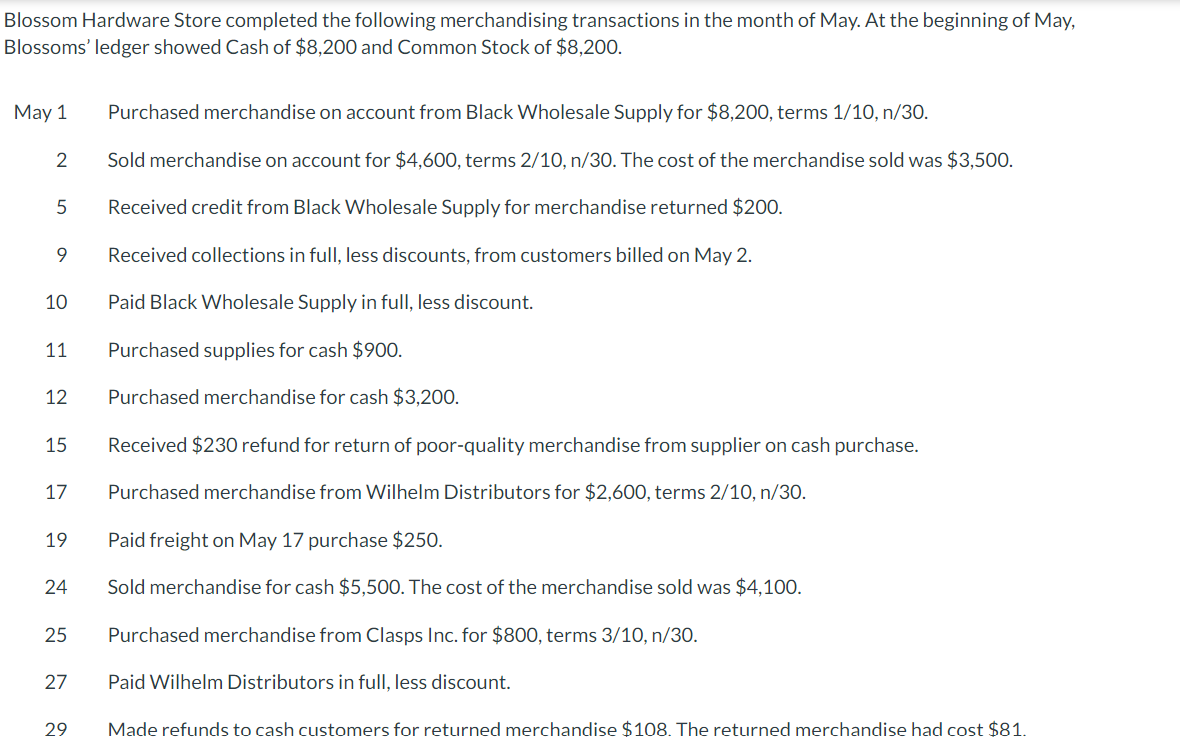

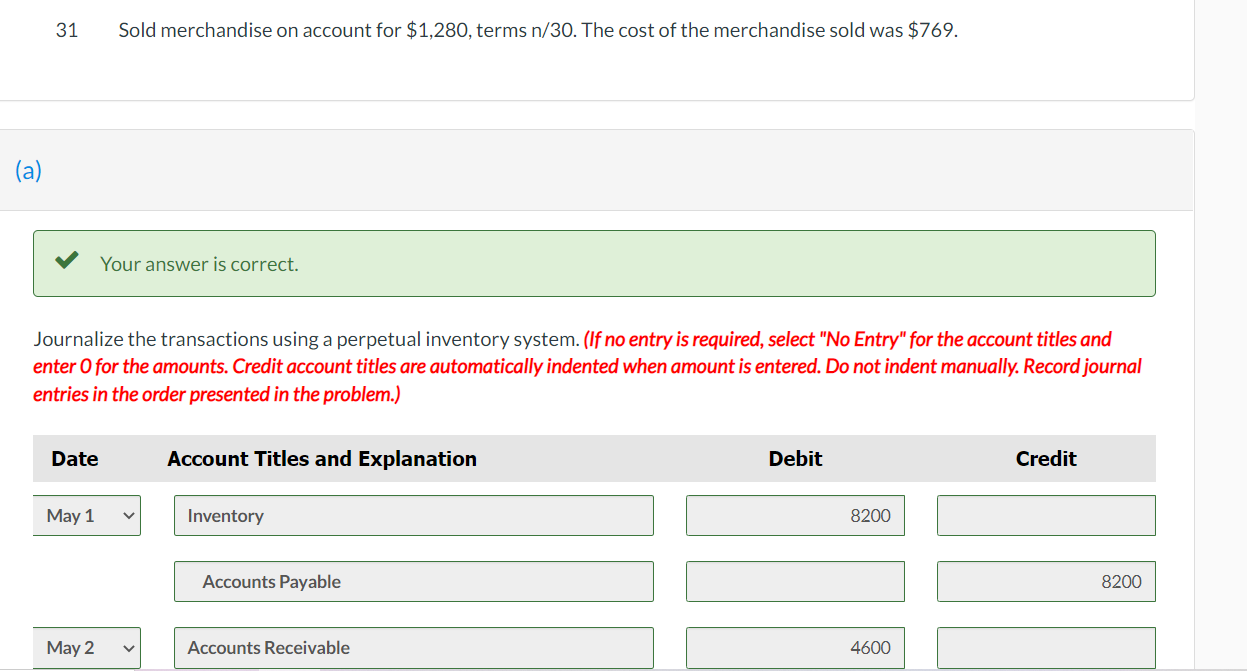

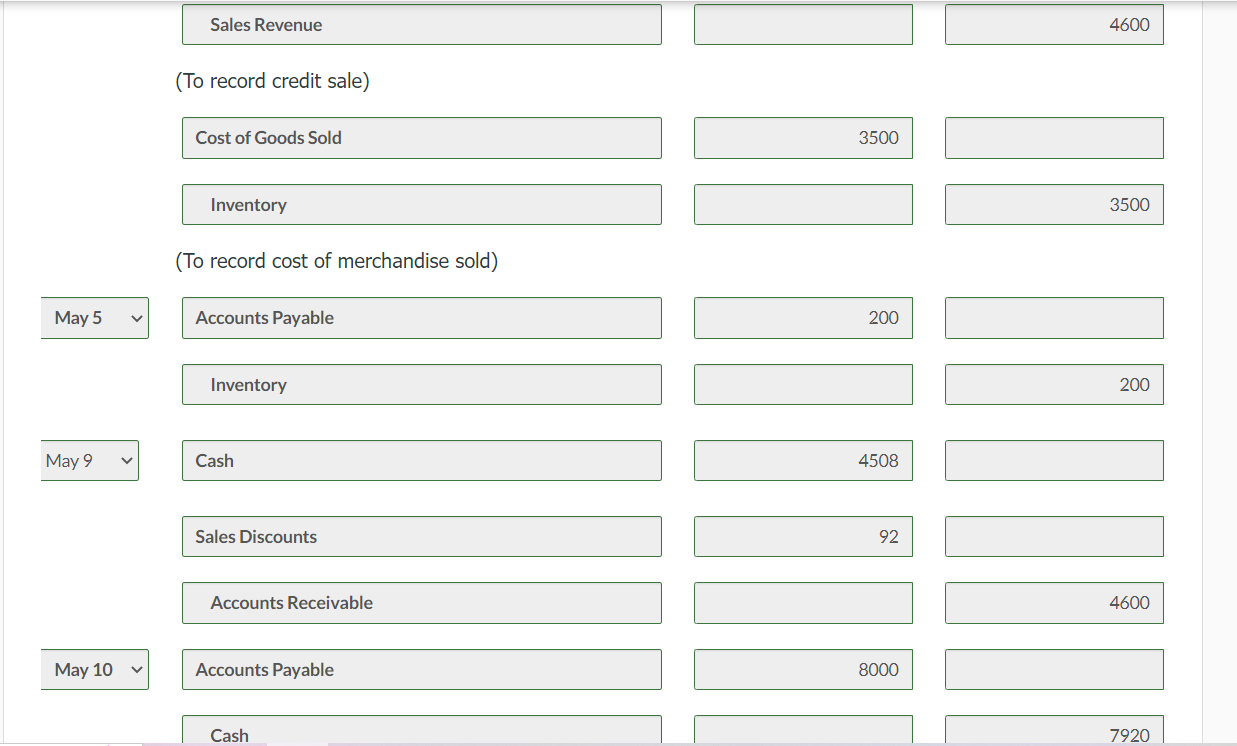

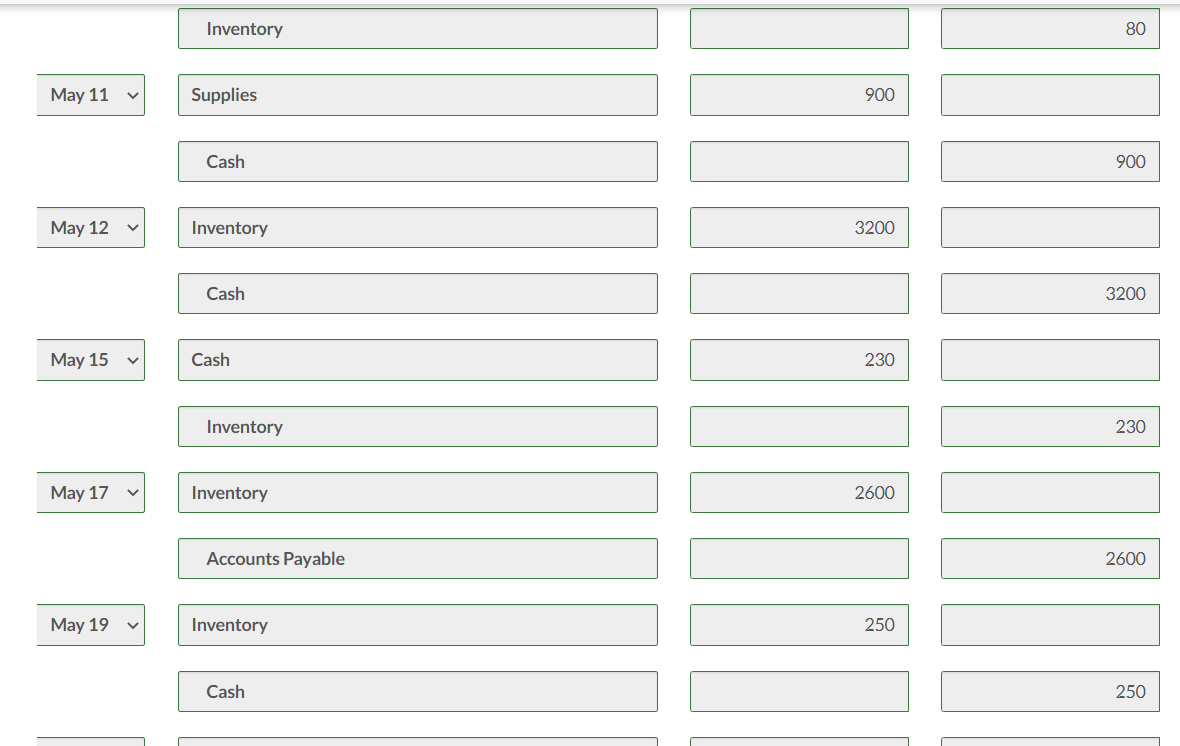

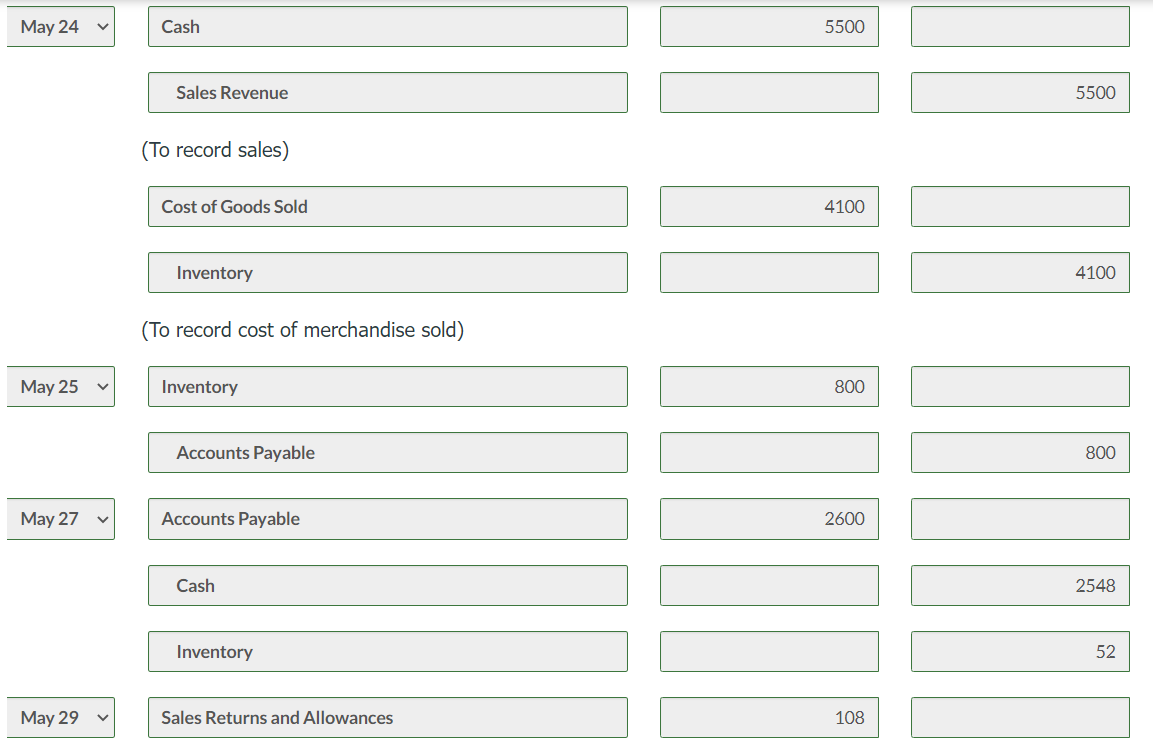

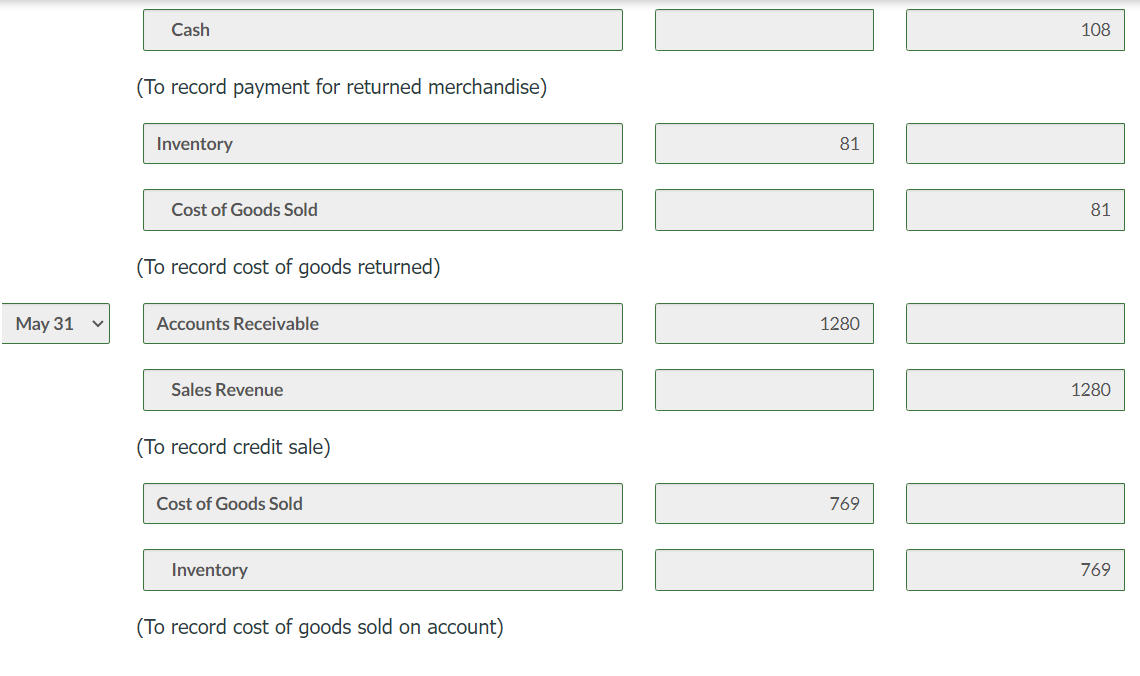

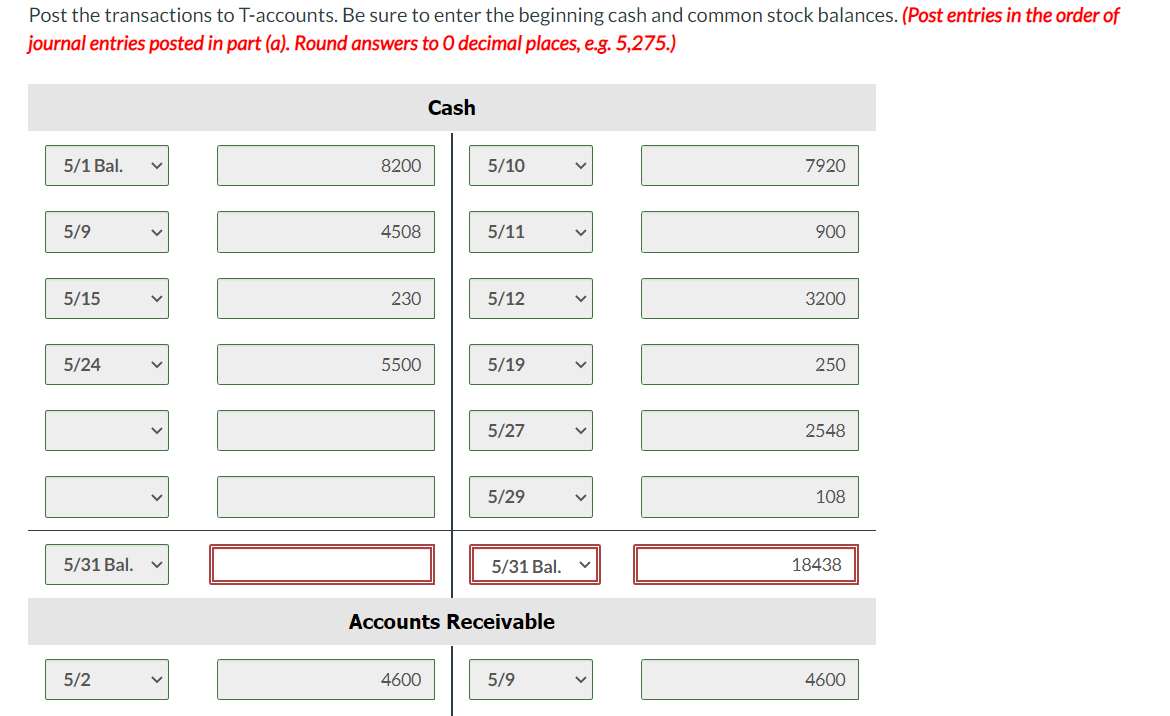

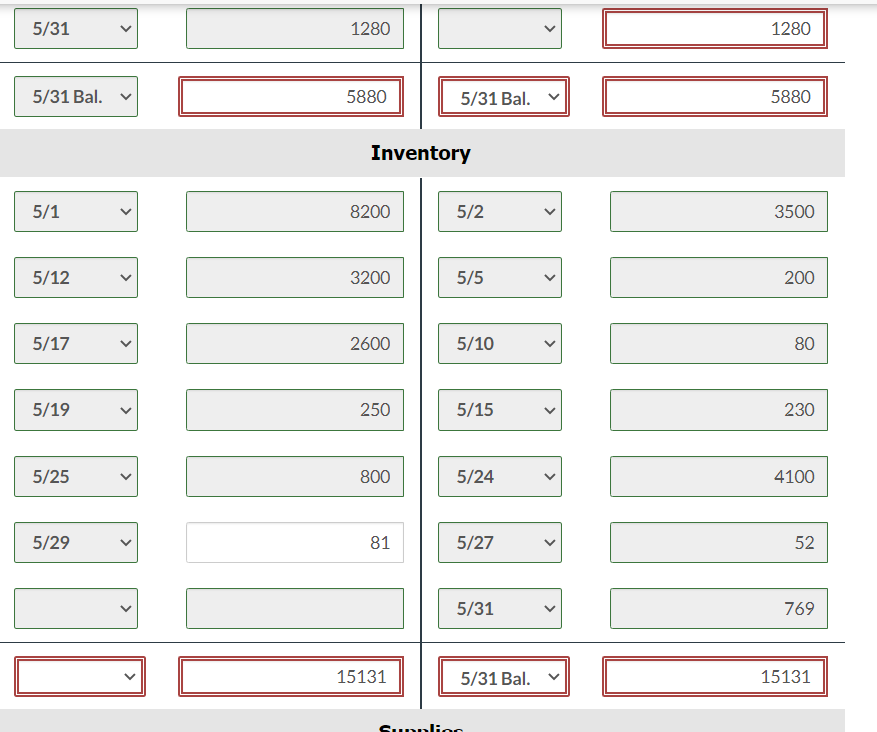

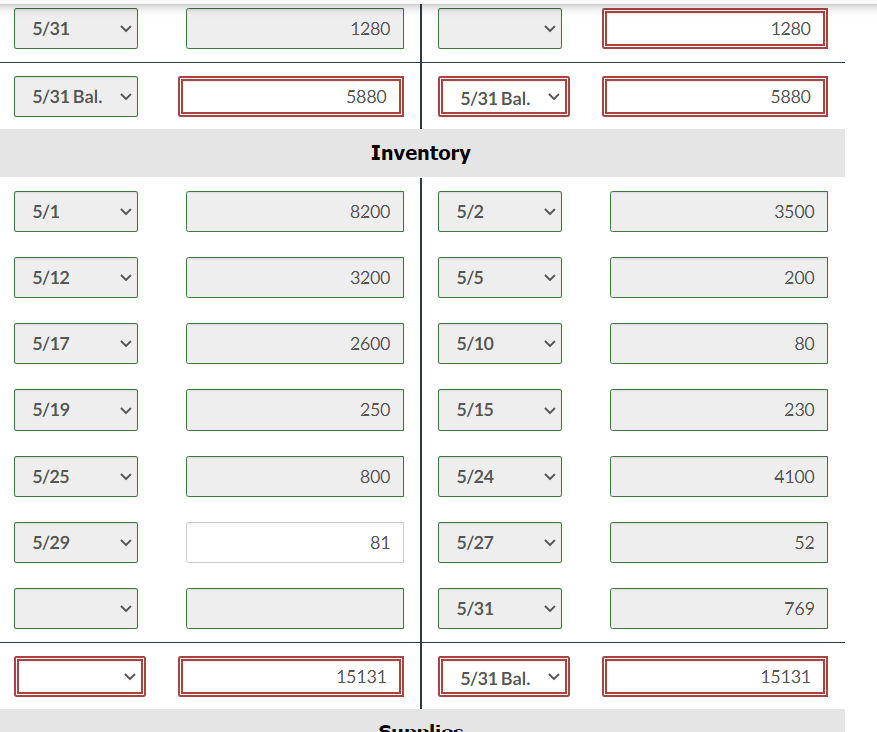

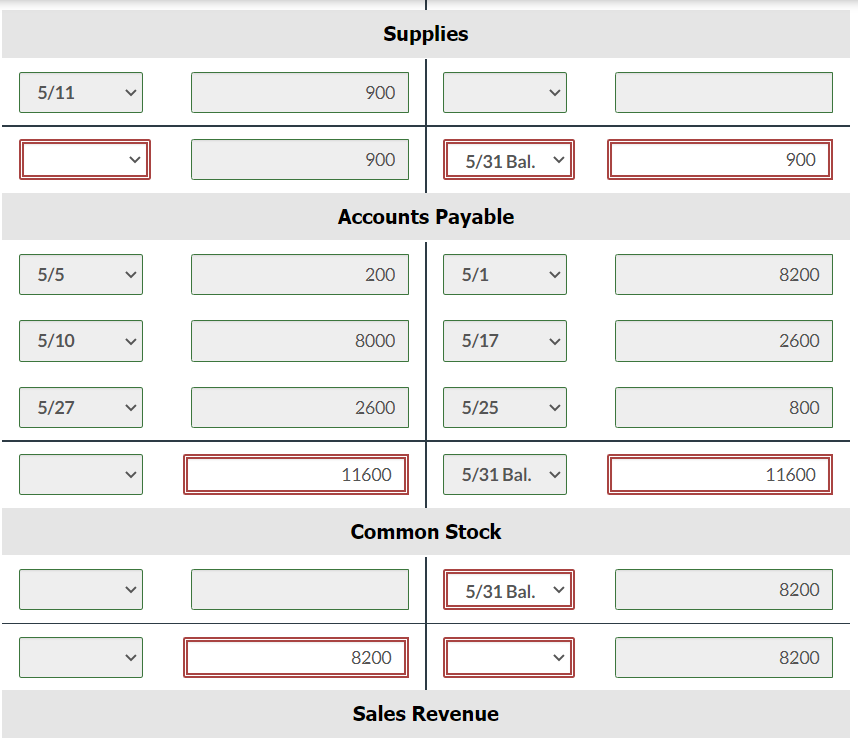

Blossom Hardware Store completed the following merchandising transactions in the month of May. At the beginning of May, Blossoms' ledger showed Cash of $8,200 and Common Stock of $8,200. May 1 Purchased merchandise on account from Black Wholesale Supply for $8,200, terms 1/10, n/30. 2 Sold merchandise on account for $4,600, terms 2/10,n/30. The cost of the merchandise sold was $3,500. 5 Received credit from Black Wholesale Supply for merchandise returned $200. 9 Received collections in full, less discounts, from customers billed on May 2. 10 Paid Black Wholesale Supply in full, less discount. 11 Purchased supplies for cash \$900. 12 Purchased merchandise for cash $3,200. 15 Received $230 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Wilhelm Distributors for $2,600, terms 2/10,n/30. 19 Paid freight on May 17 purchase $250. 24 Sold merchandise for cash $5,500. The cost of the merchandise sold was $4,100. 25 Purchased merchandise from Clasps Inc. for $800, terms 3/10,n/30. 27 Paid Wilhelm Distributors in full, less discount. 31 Sold merchandise on account for $1,280, terms n/30. The cost of the merchandise sold was $769. Your answer is correct. Journalize the transactions using a perpetual inventory system. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Sales Revenue (To record credit sale) Cost of Goods Sold 3500 Inventory (To record cost of merchandise sold) May 5 Accounts Payable 200 Inventory 200 May 9 Cash 4508 Sales Discounts 92 Accounts Receivable 4600 May 10 Accounts Payable 8000 Cash Inventory 80 May 11 Supplies 900 Cash May 12 Inventory 3200 Cash 3200 May 15 Cash 230 Inventory May 17 Inventory 2600 Accounts Payable 2600 May 19 Inventory 250 Cash 250 May 24V Cash 5500 Sales Revenue (To record sales) Cost of Goods Sold 4100 Inventory (To record cost of merchandise sold) May 25 Inventory 800 Accounts Payable May 27 Accounts Payable 2600 Cash 2548 Inventory May 29 Sales Returns and Allowances 52 Cash (To record payment for returned merchandise) Inventory 81 Cost of Goods Sold (To record cost of goods returned) May 31 Accounts Receivable 1280 Sales Revenue (To record credit sale) Cost of Goods Sold 769 1280 Inventory (To record cost of goods sold on account) Post the transactions to T-accounts. Be sure to enter the beginning cash and common stock balances. (Post entries in the order of journal entries posted in part (a). Round answers to 0 decimal places, e.g. 5,275.) \begin{tabular}{|l|} \hline \\ \hline \hline \\ \hline \end{tabular} \begin{tabular}{||c|} \hline \hline \\ \hline \hline \end{tabular} Inventory \begin{tabular}{|ll|} \hline 5/1 & \\ \hline & \\ \hline 5/12 & \\ \hline \end{tabular} \begin{tabular}{|} \hline 8200 \\ \hline 3200 \\ \hline \end{tabular} 5/2 \begin{tabular}{|l|} \hline 3500 \\ \hline \end{tabular} \begin{tabular}{|ll|} \hline 5/19 & \\ \hline 5/25 & \\ \hline \end{tabular} 5/5 200 5/292 5/10 80 230 4100 \begin{tabular}{|l|} \hline \\ \hline \hline \\ \hline \end{tabular} \begin{tabular}{||c|} \hline \hline \\ \hline \hline \end{tabular} Inventory \begin{tabular}{|ll|} \hline 5/1 & \\ \hline & \\ \hline 5/12 & \\ \hline \end{tabular} \begin{tabular}{|} \hline 8200 \\ \hline 3200 \\ \hline \end{tabular} 5/2 \begin{tabular}{|l|} \hline 3500 \\ \hline \end{tabular} \begin{tabular}{|ll|} \hline 5/19 & \\ \hline 5/25 & \\ \hline \end{tabular} 5/5 200 5/292 5/10 80 230 4100 Supplies Accounts Payable \begin{tabular}{|lll|} \hline 5/1 & & 8200 \\ \hline 5/17 & & 2600 \\ \hline & & \\ \hline 5/25 & & \\ \hline 5/31 Bal. & & \\ \hline \end{tabular} Common Stock Sales Revenue Blossom Hardware Store completed the following merchandising transactions in the month of May. At the beginning of May, Blossoms' ledger showed Cash of $8,200 and Common Stock of $8,200. May 1 Purchased merchandise on account from Black Wholesale Supply for $8,200, terms 1/10, n/30. 2 Sold merchandise on account for $4,600, terms 2/10,n/30. The cost of the merchandise sold was $3,500. 5 Received credit from Black Wholesale Supply for merchandise returned $200. 9 Received collections in full, less discounts, from customers billed on May 2. 10 Paid Black Wholesale Supply in full, less discount. 11 Purchased supplies for cash \$900. 12 Purchased merchandise for cash $3,200. 15 Received $230 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Wilhelm Distributors for $2,600, terms 2/10,n/30. 19 Paid freight on May 17 purchase $250. 24 Sold merchandise for cash $5,500. The cost of the merchandise sold was $4,100. 25 Purchased merchandise from Clasps Inc. for $800, terms 3/10,n/30. 27 Paid Wilhelm Distributors in full, less discount. 31 Sold merchandise on account for $1,280, terms n/30. The cost of the merchandise sold was $769. Your answer is correct. Journalize the transactions using a perpetual inventory system. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Sales Revenue (To record credit sale) Cost of Goods Sold 3500 Inventory (To record cost of merchandise sold) May 5 Accounts Payable 200 Inventory 200 May 9 Cash 4508 Sales Discounts 92 Accounts Receivable 4600 May 10 Accounts Payable 8000 Cash Inventory 80 May 11 Supplies 900 Cash May 12 Inventory 3200 Cash 3200 May 15 Cash 230 Inventory May 17 Inventory 2600 Accounts Payable 2600 May 19 Inventory 250 Cash 250 May 24V Cash 5500 Sales Revenue (To record sales) Cost of Goods Sold 4100 Inventory (To record cost of merchandise sold) May 25 Inventory 800 Accounts Payable May 27 Accounts Payable 2600 Cash 2548 Inventory May 29 Sales Returns and Allowances 52 Cash (To record payment for returned merchandise) Inventory 81 Cost of Goods Sold (To record cost of goods returned) May 31 Accounts Receivable 1280 Sales Revenue (To record credit sale) Cost of Goods Sold 769 1280 Inventory (To record cost of goods sold on account) Post the transactions to T-accounts. Be sure to enter the beginning cash and common stock balances. (Post entries in the order of journal entries posted in part (a). Round answers to 0 decimal places, e.g. 5,275.) \begin{tabular}{|l|} \hline \\ \hline \hline \\ \hline \end{tabular} \begin{tabular}{||c|} \hline \hline \\ \hline \hline \end{tabular} Inventory \begin{tabular}{|ll|} \hline 5/1 & \\ \hline & \\ \hline 5/12 & \\ \hline \end{tabular} \begin{tabular}{|} \hline 8200 \\ \hline 3200 \\ \hline \end{tabular} 5/2 \begin{tabular}{|l|} \hline 3500 \\ \hline \end{tabular} \begin{tabular}{|ll|} \hline 5/19 & \\ \hline 5/25 & \\ \hline \end{tabular} 5/5 200 5/292 5/10 80 230 4100 \begin{tabular}{|l|} \hline \\ \hline \hline \\ \hline \end{tabular} \begin{tabular}{||c|} \hline \hline \\ \hline \hline \end{tabular} Inventory \begin{tabular}{|ll|} \hline 5/1 & \\ \hline & \\ \hline 5/12 & \\ \hline \end{tabular} \begin{tabular}{|} \hline 8200 \\ \hline 3200 \\ \hline \end{tabular} 5/2 \begin{tabular}{|l|} \hline 3500 \\ \hline \end{tabular} \begin{tabular}{|ll|} \hline 5/19 & \\ \hline 5/25 & \\ \hline \end{tabular} 5/5 200 5/292 5/10 80 230 4100 Supplies Accounts Payable \begin{tabular}{|lll|} \hline 5/1 & & 8200 \\ \hline 5/17 & & 2600 \\ \hline & & \\ \hline 5/25 & & \\ \hline 5/31 Bal. & & \\ \hline \end{tabular} Common Stock Sales Revenue