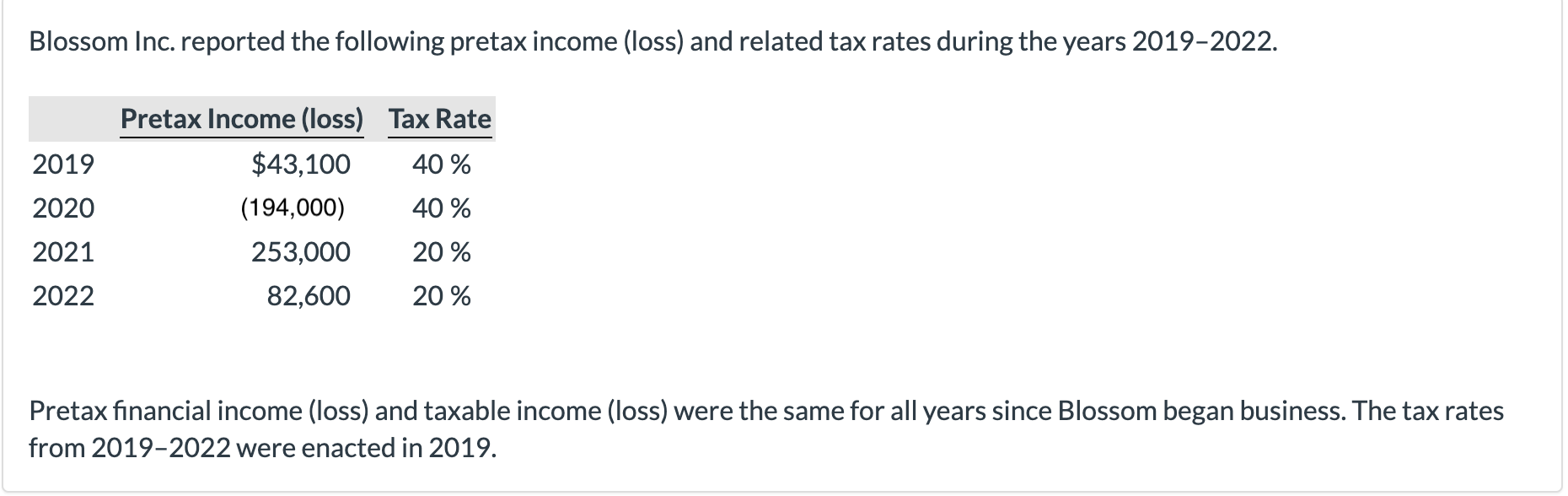

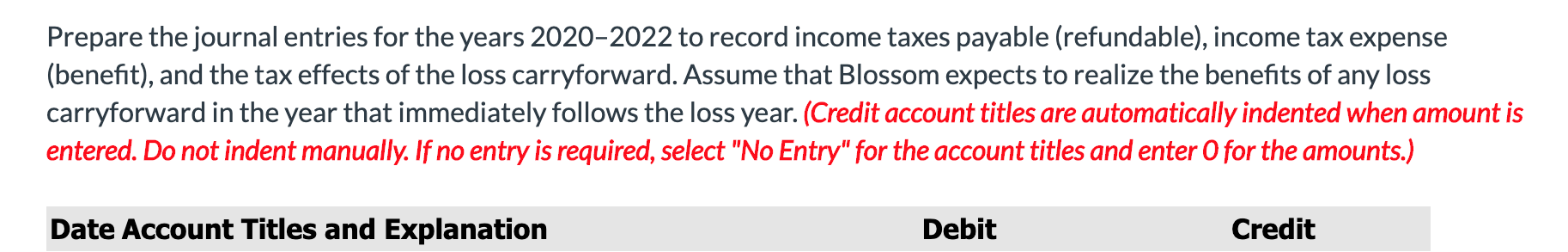

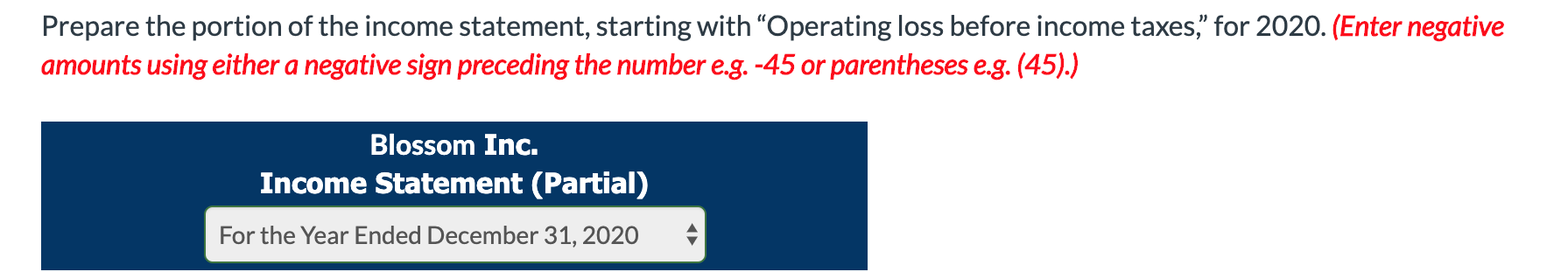

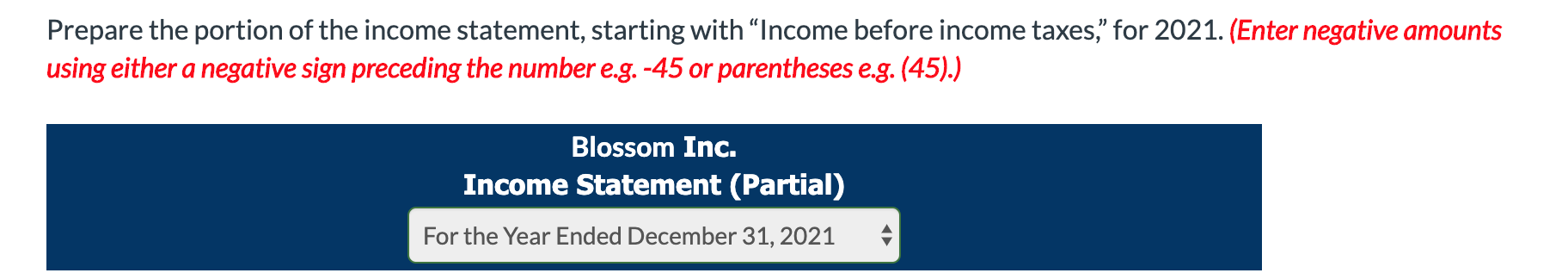

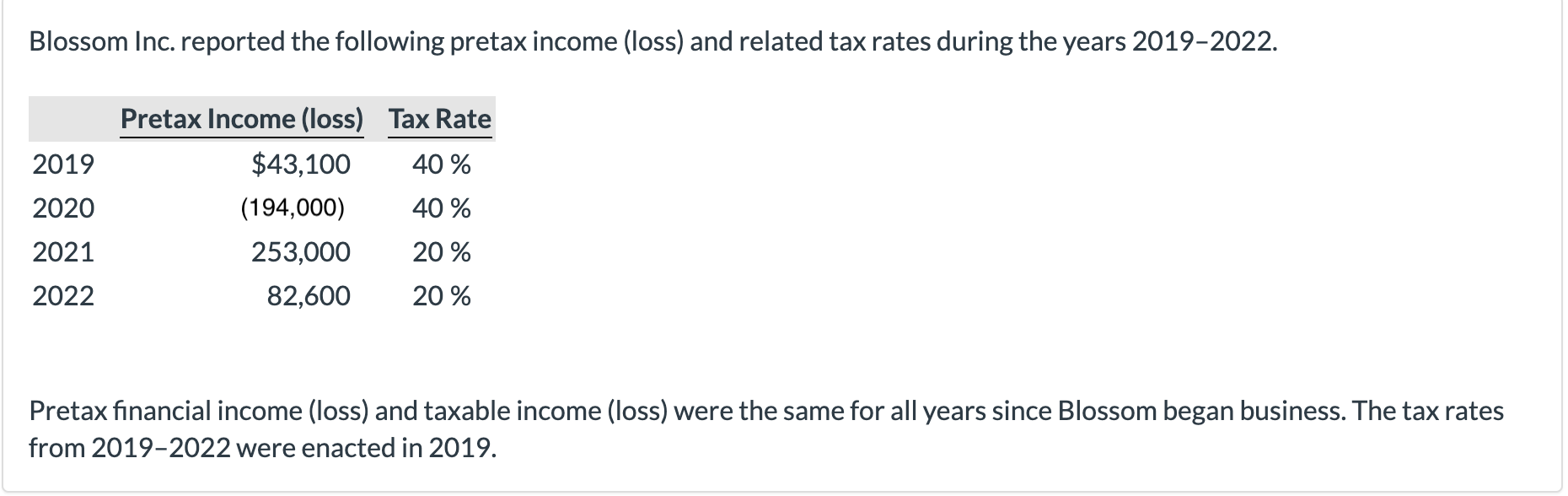

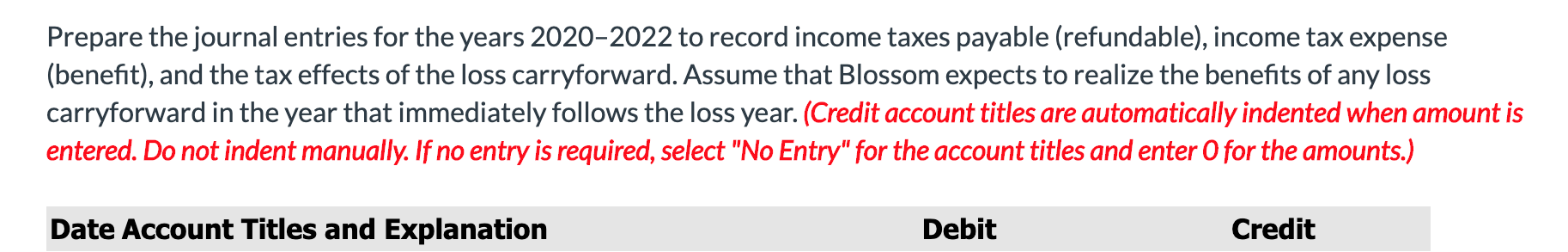

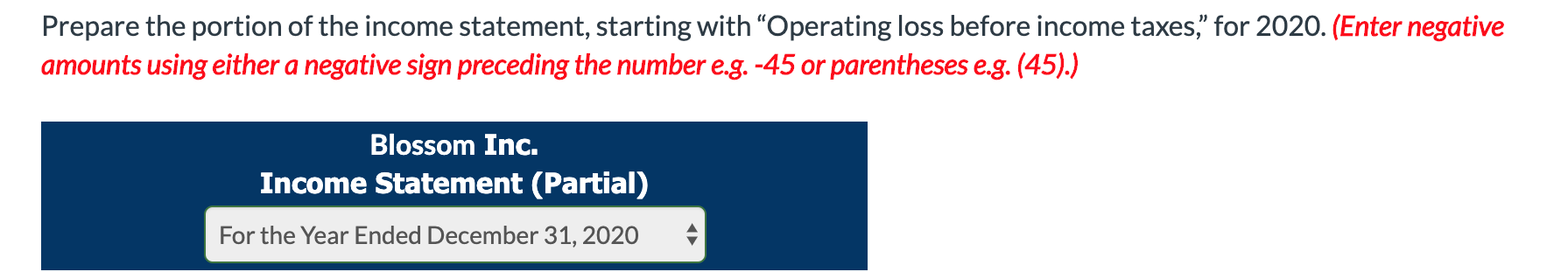

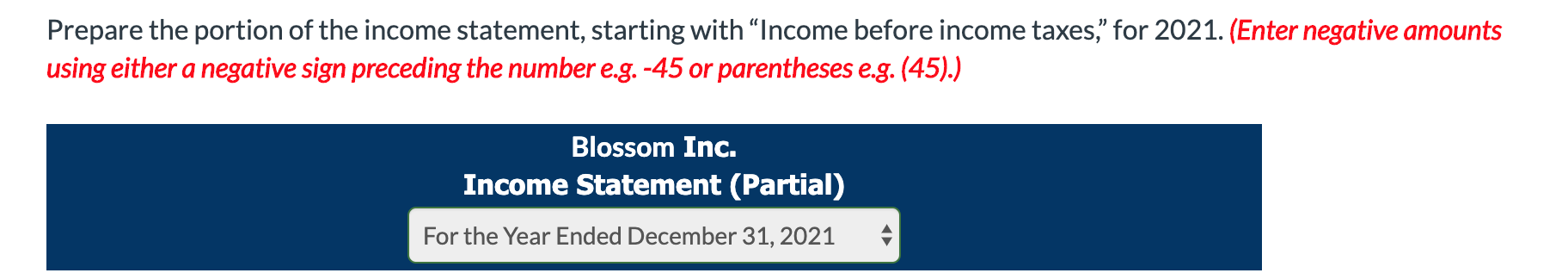

Blossom Inc. reported the following pretax income (loss) and related tax rates during the years 2019-2022. 2019 2020 Pretax Income (loss) Tax Rate $43,100 40 % (194,000) 40 % 253,000 20% 82,600 20 % 2021 2022 Pretax financial income (loss) and taxable income (loss) were the same for all years since Blossom began business. The tax rates from 2019-2022 were enacted in 2019. Prepare the journal entries for the years 2020-2022 to record income taxes payable (refundable), income tax expense (benefit), and the tax effects of the loss carryforward. Assume that Blossom expects to realize the benefits of any loss carryforward in the year that immediately follows the loss year. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Prepare the portion of the income statement, starting with "Operating loss before income taxes," for 2020. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Blossom Inc. Income Statement (Partial) For the Year Ended December 31, 2020 Prepare the portion of the income statement, starting with Income before income taxes," for 2021. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Blossom Inc. Income Statement (Partial) For the Year Ended December 31, 2021 Blossom Inc. reported the following pretax income (loss) and related tax rates during the years 2019-2022. 2019 2020 Pretax Income (loss) Tax Rate $43,100 40 % (194,000) 40 % 253,000 20% 82,600 20 % 2021 2022 Pretax financial income (loss) and taxable income (loss) were the same for all years since Blossom began business. The tax rates from 2019-2022 were enacted in 2019. Prepare the journal entries for the years 2020-2022 to record income taxes payable (refundable), income tax expense (benefit), and the tax effects of the loss carryforward. Assume that Blossom expects to realize the benefits of any loss carryforward in the year that immediately follows the loss year. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Prepare the portion of the income statement, starting with "Operating loss before income taxes," for 2020. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Blossom Inc. Income Statement (Partial) For the Year Ended December 31, 2020 Prepare the portion of the income statement, starting with Income before income taxes," for 2021. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Blossom Inc. Income Statement (Partial) For the Year Ended December 31, 2021