Answered step by step

Verified Expert Solution

Question

1 Approved Answer

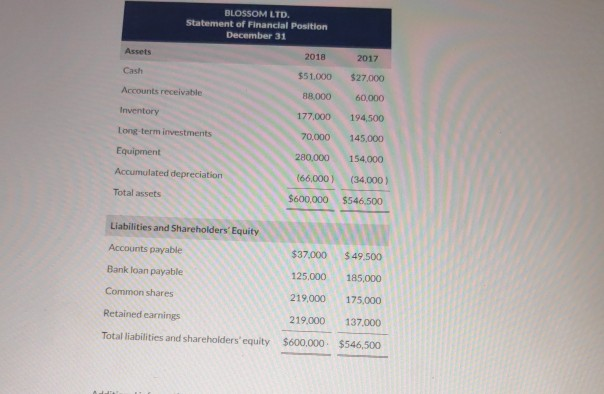

BLOSSOM LTD. Statement of Financial Position December 31 Assets 2018 2017 Cash $51.000 $27.000 Accounts receivable 818.000 60,000 Inventory 177.000 194,500 Long-term investments 70.000 145.000

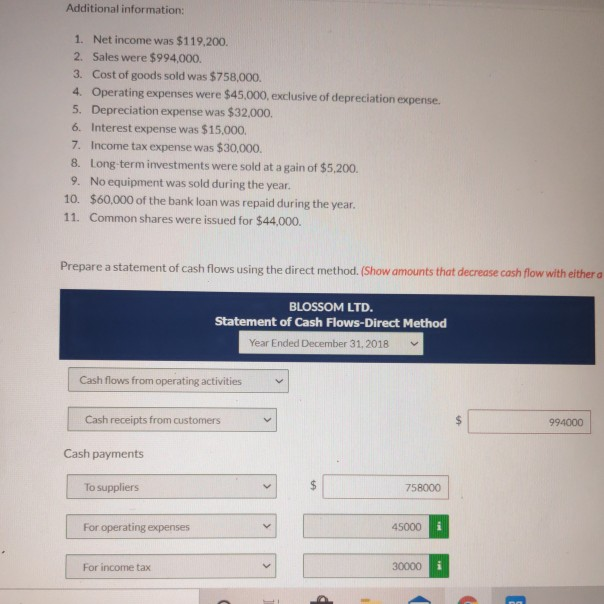

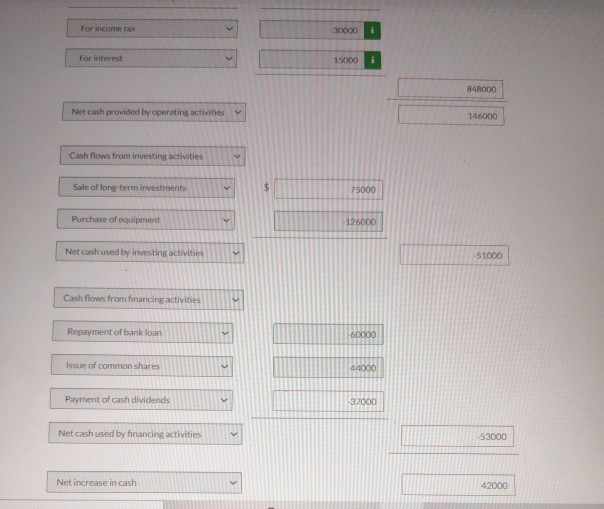

BLOSSOM LTD. Statement of Financial Position December 31 Assets 2018 2017 Cash $51.000 $27.000 Accounts receivable 818.000 60,000 Inventory 177.000 194,500 Long-term investments 70.000 145.000 Equipment Accumulated depreciation 280,000 154.000 (66,000) (34,000) Total assets $600,000 $546,500 Liabilities and Shareholders' Equity Accounts payable $37.000 $49.500 Bank loan payable 125.000 185.000 Common shares 219,000 175.000 Retained earnings 219.000 137.000 Total liabilities and shareholders' equity $600.000 $546,500 Additional information: 1. Net income was $119.200. 2. Sales were $994,000. 3. Cost of goods sold was $758,000. 4. Operating expenses were $45,000, exclusive of depreciation expense. 5. Depreciation expense was $32,000. 6. Interest expense was $15,000. 7. Income tax expense was $30,000 8. Long-term investments were sold at a gain of $5,200. 9. No equipment was sold during the year. 10. $60,000 of the bank loan was repaid during the year. 11. Common shares were issued for $44,000. Prepare a statement of cash flows using the direct method. (Show amounts that decrease cash flow with either a BLOSSOM LTD. Statement of Cash Flows-Direct Method Year Ended December 31, 2018 Cash flows from operating activities Cash receipts from customers $ 994000 Cash payments To suppliers 758000 For operating expenses 45000 For income tax 30000 i For income tax 30000 For interest 15000 848000 Net cash provided by operating activities 146000 Cash flows from investing activities Sale of long term investments 75000 Purchase of equipment 126000 Net cash used by investing activities -51000 Cash flows from financing activities Repayment of bank loan -60000 Issue of common shares 44000 Payment of cash dividends -37000 Net cash used by financing activities -53000 Net increase in cash 42000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started