Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blue Angel, Inc., a private firm in the holiday gift Industry is considering a new project The company currently has a target debt equity ratio

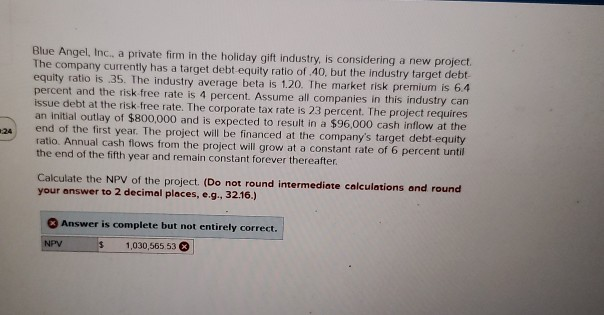

Blue Angel, Inc., a private firm in the holiday gift Industry is considering a new project The company currently has a target debt equity ratio of 40, but the industry target debt equity ratio is 35. The industry average beta is 1.20. The market risk premium is 64 percent and the risk free rate is 4 percent. Assume all companies in this industry can issue debt at the risk free rate. The corporate tax rate is 23 percent. The project requires an initial outlay of $800,000 and is expected to result in a $96.000 cash inflow at the end of the first year. The project will be financed at the company's target debt equity ratio. Annual cash flows from the project will grow at a constant rate of 6 percent until the end of the fifth year and remain constant forever thereafter. Calculate the NPV of the project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. NPV 3 1,030,565 53

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started