Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blue Plc has 150 million ordinary shares in issue that have a nominal value of 1 each and a market value of 1.06 each.

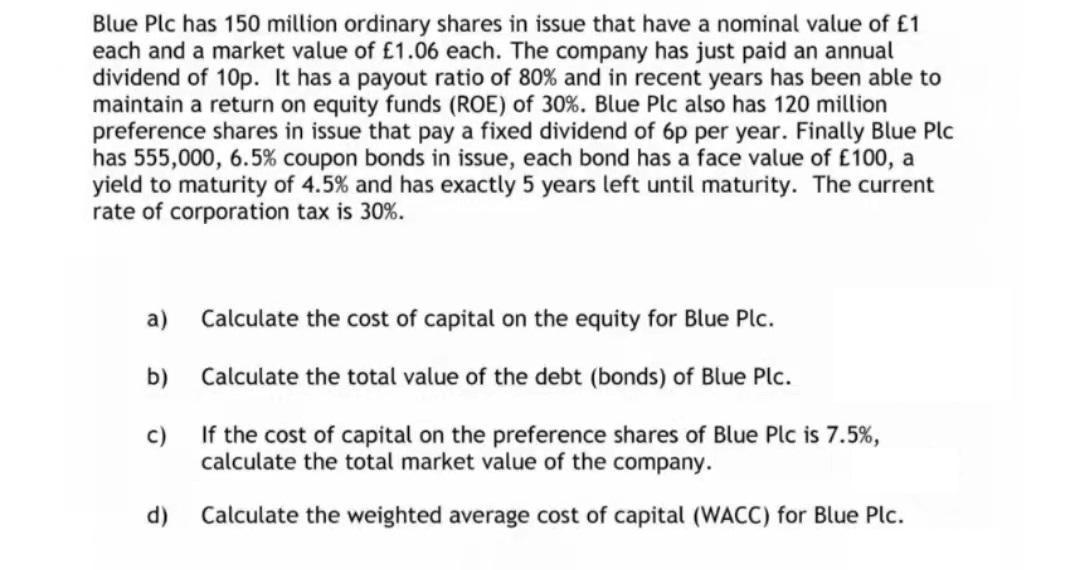

Blue Plc has 150 million ordinary shares in issue that have a nominal value of 1 each and a market value of 1.06 each. The company has just paid an annual dividend of 10p. It has a payout ratio of 80% and in recent years has been able to maintain a return on equity funds (ROE) of 30%. Blue Plc also has 120 million preference shares in issue that pay a fixed dividend of 6p per year. Finally Blue Plc has 555,000, 6.5% coupon bonds in issue, each bond has a face value of 100, a yield to maturity of 4.5% and has exactly 5 years left until maturity. The current rate of corporation tax is 30%. Calculate the cost of capital on the equity for Blue Plc. Calculate the total value of the debt (bonds) of Blue Plc. C) If the cost of capital on the preference shares of Blue Plc is 7.5%, calculate the total market value of the company. Calculate the weighted average cost of capital (WACC) for Blue Plc. a) b) d)

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Growth ROE1Pay out Ratio 30180 6 Cost of Equity Dividend1growthPrice growth01...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started