Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Glaxo Plc is listed on the London Stock Exchange. It has 20 million ordinary shares in issue that have a nominal value of 1

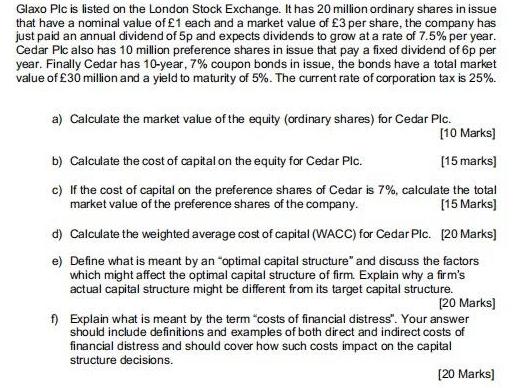

Glaxo Plc is listed on the London Stock Exchange. It has 20 million ordinary shares in issue that have a nominal value of 1 each and a market value of 3 per share, the company has just paid an annual dividend of 5p and expects dividends to grow at a rate of 7.5% per year. Cedar Plc also has 10 million preference shares in issue that pay a fixed dividend of 6p per year. Finally Cedar has 10-year, 7% coupon bonds in issue, the bonds have a total market value of 30 million and a yield to maturity of 5%. The current rate of corporation tax is 25%. a) Calculate the market value of the equity (ordinary shares) for Cedar Plc. [10 Marks] [15 marks] b) Calculate the cost of capital on the equity for Cedar Plc. c) If the cost of capital on the preference shares of Cedar is 7%, calculate the total market value of the preference shares of the company. [15 Marks] d) Calculate the weighted average cost of capital (WACC) for Cedar Plc. [20 Marks] e) Define what is meant by an "optimal capital structure and discuss the factors which might affect the optimal capital structure of firm. Explain why a firm's actual capital structure might be different from its target capital structure. [20 Marks] f) Explain what is meant by the term "costs of financial distress". Your answer should include definitions and examples of both direct and indirect costs of financial distress and should cover how such costs impact on the capital structure decisions. [20 Marks]

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

ID 198 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started