Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blue Sky Corporation, a U.S.-based company, invested 11 million Polish zloty in Green Mountain Company in Lodz, Poland, on January 1, Year 2, when

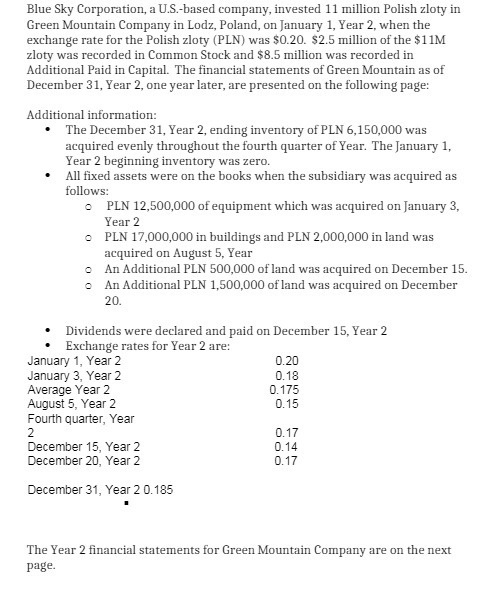

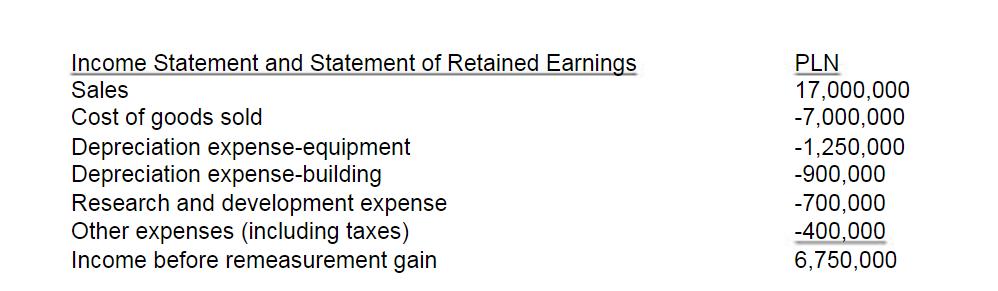

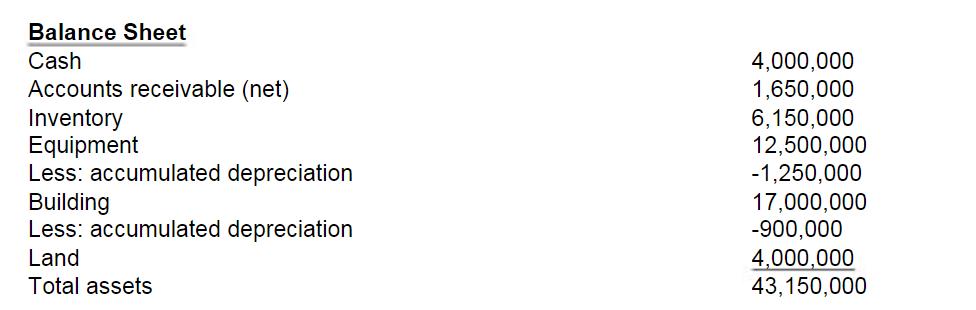

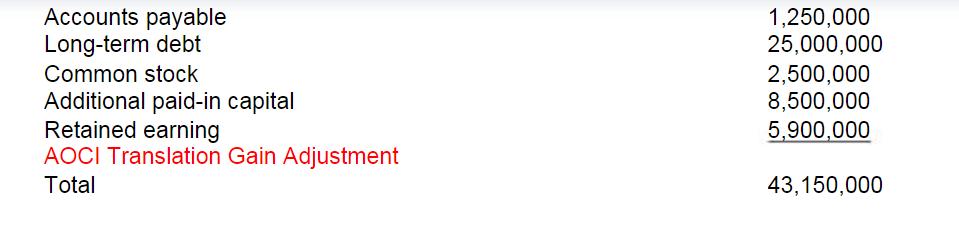

Blue Sky Corporation, a U.S.-based company, invested 11 million Polish zloty in Green Mountain Company in Lodz, Poland, on January 1, Year 2, when the exchange rate for the Polish zloty (PLN) was $0.20. $2.5 million of the $11M zloty was recorded in Common Stock and $8.5 million was recorded in Additional Paid in Capital. The financial statements of Green Mountain as of December 31, Year 2, one year later, are presented on the following page: Additional information: . The December 31, Year 2, ending inventory of PLN 6,150,000 was acquired evenly throughout the fourth quarter of Year. The January 1, Year 2 beginning inventory was zero. All fixed assets were on the books when the subsidiary was acquired as follows: PLN 12,500,000 of equipment which was acquired on January 3, Year 2 PLN 17,000,000 in buildings and PLN 2,000,000 in land was acquired on August 5, Year An Additional PLN 500,000 of land was acquired on December 15. An Additional PLN 1,500,000 of land was acquired on December 20. Dividends were declared and paid on December 15, Year 2 Exchange rates for Year 2 are: January 1, Year 2 January 3, Year 2 Average Year 2 August 5, Year 2 Fourth quarter, Year 2 December 15, Year 2 December 20, Year 2 December 31, Year 2 0.185 0.20 0.18 0.175 0.15 0.17 0.14 0.17 The Year 2 financial statements for Green Mountain Company are on the next page. Income Statement and Statement of Retained Earnings Sales Cost of goods sold Depreciation expense-equipment Depreciation expense-building Research and development expense Other expenses (including taxes) Income before remeasurement gain PLN 17,000,000 -7,000,000 -1,250,000 -900,000 -700,000 -400,000 6,750,000 Remeasurement gain/loss, Year 2 Net income Plus: Retained earnings, 1/1/Y2 Less: Dividends paid Retained earnings, 12/31/Y2 6,750,000 0 -850,000 5,900,000 Balance Sheet Cash Accounts receivable (net) Inventory Equipment Less: accumulated depreciation Building Less: accumulated depreciation Land Total assets 4,000,000 1,650,000 6,150,000 12,500,000 -1,250,000 17,000,000 -900,000 4,000,000 43,150,000 Accounts payable Long-term debt Common stock Additional paid-in capital Retained earning AOCI Translation Gain Adjustment Total 1,250,000 25,000,000 2,500,000 8,500,000 5,900,000 43,150,000 Required 1. Translate Green Mountain's financial statements into U.S. dollars in accordance with U.S. GAAP at December 31, Year 2 and prove out the Foreign Exchange gain or loss through a reconciliation schedule: a. Assuming the Polish zloty is the functional currency. b. Assuming the U.S. dollar is the functional currency. Please provide schedules for any calculations for any account that is a mix rate (i.e., cost of goods sold).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Assumption USD is the functional currency 1 Translate equity investments at inception 11Y2 Equity in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started