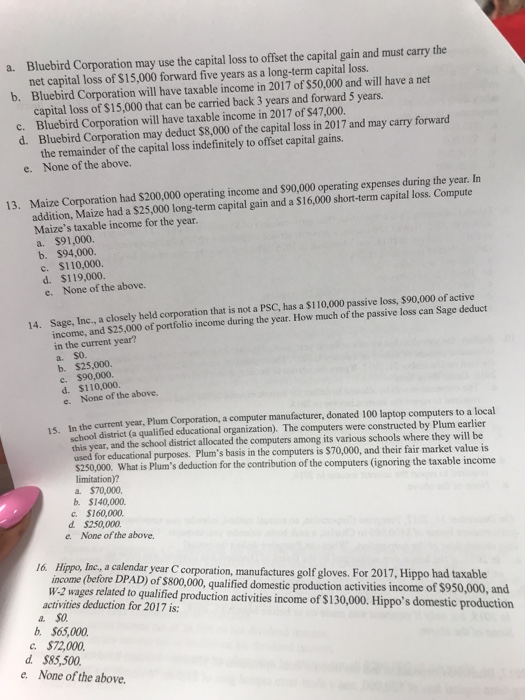

Bluebird Corporation may use the capital loss to offset the capital gain and must carry the net capital loss of $15,000 forward five years as a long-term capital loss. Bluebird Corporation will have taxable income in 2017 of $50,000 and will have a net capital loss of $15,000 that can be carried back 3 years and forward 5 years. a. b. Bluebird Corporation will have taxable income in 2017 of $47,000. Bluebird Corporation may deduct $8,000 of the capital loss in 2017 and may carry forward c. d. the remainder of the capital loss indefinitely to offset capital gains. None of the above. e. 13. Maize Corporation had $200,000 operating income and $90,000 operating expenses during the year. In addition, Maize had a $25,000 long-term capital gain and a $16,000 short-term capital loss. Compute Maize's taxable income for the year. $91,000. a. b. $94,000. c. $110,000 d. $119,000. e. None of the above. 14. Sage, Inc., a closely held corporation that is not a PSC, has a $110,000 passive loss, $90,000 of active income, and $25,000 of portfolio income during the year. How much of the passive loss can Sage deduct in the current year? a. $O. b. $25,000. c. $90,000. d. $110,000. e. None of the above. 15. In the current year, Plum Corporation, a computer manufacturer, donated 100 laptop computers to a local school district (a qualified educational organization). The computers were constructed by Plum earlier this year, and the school district a used for educational purposes. Plum's basis in the computers is $70,000, and their fair market value is the computers among its various schools where they will be 250,000. What is Plum's deduction for the contribution of the computers (ignoring the taxable income limitation)? a. $70,000. b. $140,000 c. $160,000. d $250,000 e. None ofthe above l6. Hippo, Inc, a calendar year C corporation, manufactures golf gloves. For 2017, Hippo had taxable income (before DPAD) of $800,000, qualified domestic production activities income of $950,000, and W.-2 wages related talfied production activities income of $130,000. Hippo's domestic production activities deduction for 2017 is: a. b. $65,000 c. $72,000 d $85,500 e. None of the above