Question

Bluebird Inc. shows a balance of $1,500 in its checking account in its general ledger at October 31. The bank statement for the same account

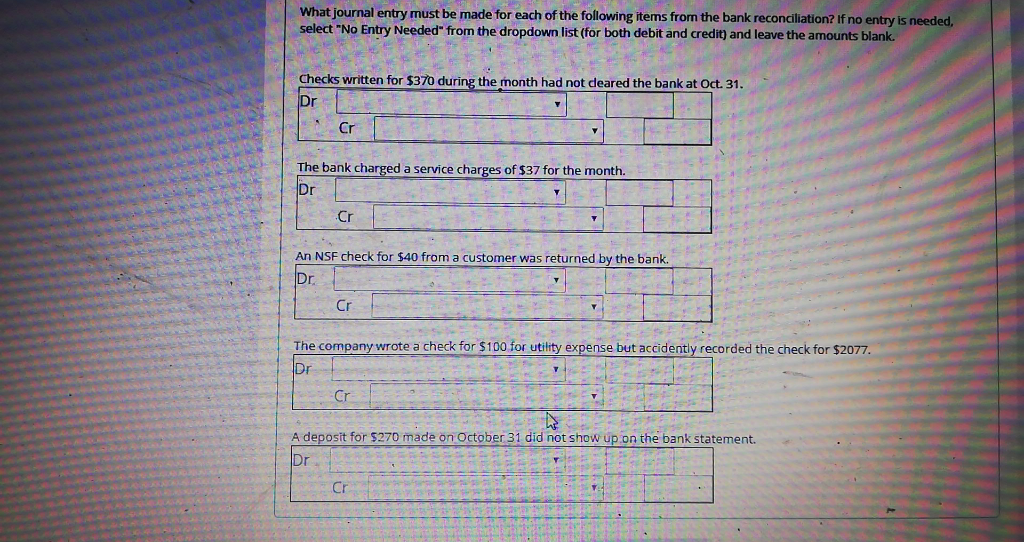

Bluebird Inc. shows a balance of $1,500 in its checking account in its general ledger at October 31. The bank statement for the same account shows a balance of $3,500 at October 31. The following additional information is available: * Checks written for $370 during the month had not cleared the bank at October 31 * The bank charged service charges of $37 for the month. * An NSF check for $40 from a customer was returned by the bank. * The company wrote a check for $100 for utility expense but accidently recorded the check for only $2,077. * A deposit for $270 made on October 31 did not show up on the bank statement. Balance per Bank: $3500 Subtract: Outstanding Checks (-)$370 Add: Deposits In Transit $270 True Balance: $3400 Balance per Books: $1500 Subtract: Bank Charges (-)$37 Subtract: NSF Check (-)$40 Add: Book Error $1977 True Balance: $3400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started