Answered step by step

Verified Expert Solution

Question

1 Approved Answer

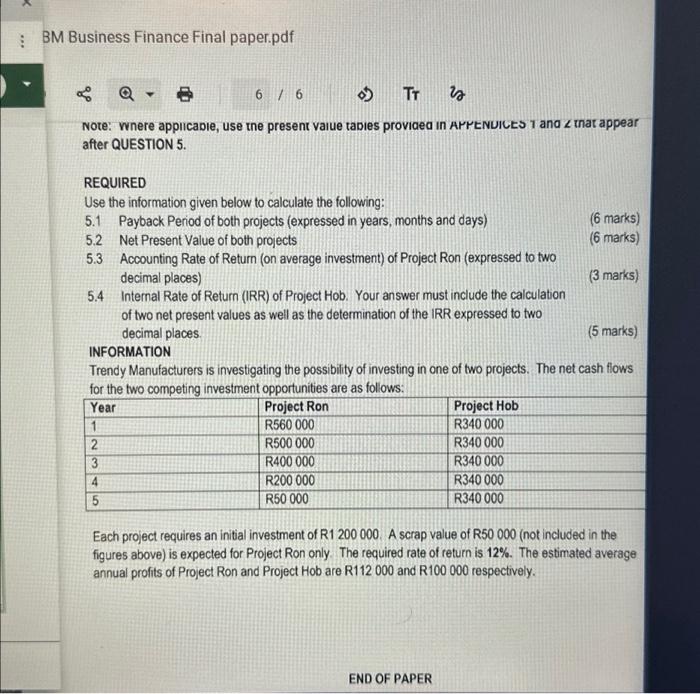

BM Business Finance Final paper.pdf 8 Note: Where applicable, use the present value tapies provided in APPENDICES 1 and 2 that appear after QUESTION 5.

BM Business Finance Final paper.pdf 8 Note: Where applicable, use the present value tapies provided in APPENDICES 1 and 2 that appear after QUESTION 5. B TT 5.2 5.3 REQUIRED Use the information given below to calculate the following: 5.1 Payback Period of both projects (expressed in years, months and days) 5.4 1 Net Present Value of both projects Accounting Rate of Return (on average investment) of Project Ron (expressed to two decimal places) Internal Rate of Return (IRR) of Project Hob. Your answer must include the calculation of two net present values as well as the determination of the IRR expressed to two decimal places. INFORMATION 6 / 6 1 2 3 4 5 22 (5 marks) Trendy Manufacturers is investigating the possibility of investing in one of two projects. The net cash flows for the two competing investment opportunities are as follows: Year Project Ron R560 000 R500 000 R400 000 R200 000 R50 000 END OF PAPER (6 marks) (6 marks) Project Hob R340 000 R340 000 R340 000 R340 000 R340 000 (3 marks) Each project requires an initial investment of R1 200 000. A scrap value of R50 000 (not included in the figures above) is expected for Project Ron only. The required rate of return is 12%. The estimated average annual profits of Project Ron and Project Hob are R112 000 and R100 000 respectively.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started