Answered step by step

Verified Expert Solution

Question

1 Approved Answer

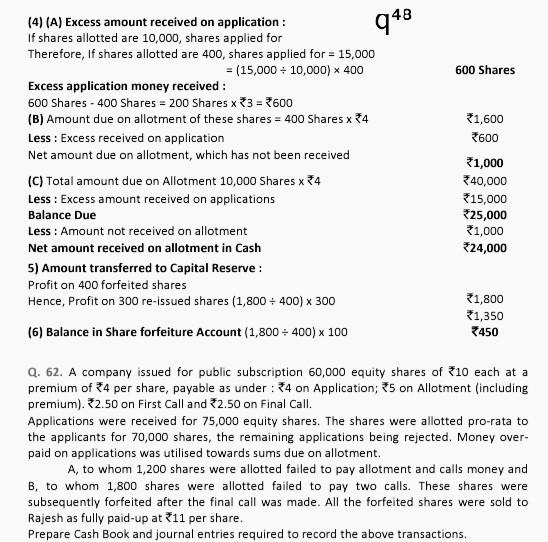

bn 948 600 Shares (4) (A) Excess amount received on application : If shares allotted are 10,000, shares applied for Therefore, If shares allotted are

bn

948 600 Shares (4) (A) Excess amount received on application : If shares allotted are 10,000, shares applied for Therefore, If shares allotted are 400, shares applied for = 15,000 = (15,000 - 10,000) x 400 Excess application money received: 600 Shares - 400 Shares = 200 Shares x 3 = 3600 (B) Amount due on allotment of these shares = 400 Shares x 34 Less: Excess received on application Net amount due on allotment, which has not been received (C) Total amount due on Allotment 10,000 Shares x4 Less : Excess amount received on applications Balance Due Less : Amount not received on allotment Net amount received on allotment in Cash 5) Amount transferred to Capital Reserve : Profit on 400 forfeited shares Hence, Profit on 300 re-issued shares (1,800 + 400) 300 31,600 3600 31,000 +40,000 315,000 325,000 1,000 24,000 31,800 1,350 3450 (6) Balance in Share forfeiture Account (1,800 - 400) x 100 Q. 62. A company issued for public subscription 60,000 equity shares of 10 each at a premium of 34 per share, payable as under : 34 on Application; 5 on Allotment (including premium). 72.50 on First Call and 2.50 on Final Call. Applications were received for 75,000 equity shares. The shares were allotted pro-rata to the applicants for 70,000 shares, the remaining applications being rejected. Money over- paid on applications was utilised towards sums due on allotment. A, to whom 1,200 shares were allotted failed to pay allotment and calls money and B, to whom 1,800 shares were allotted failed to pay two calls. These shares were subsequently forfeited after the final call was made. All the forfeited shares were sold to Rajesh as fully paid-up at 11 per share. Prepare Cash Book and journal entries required to record the above transactionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started