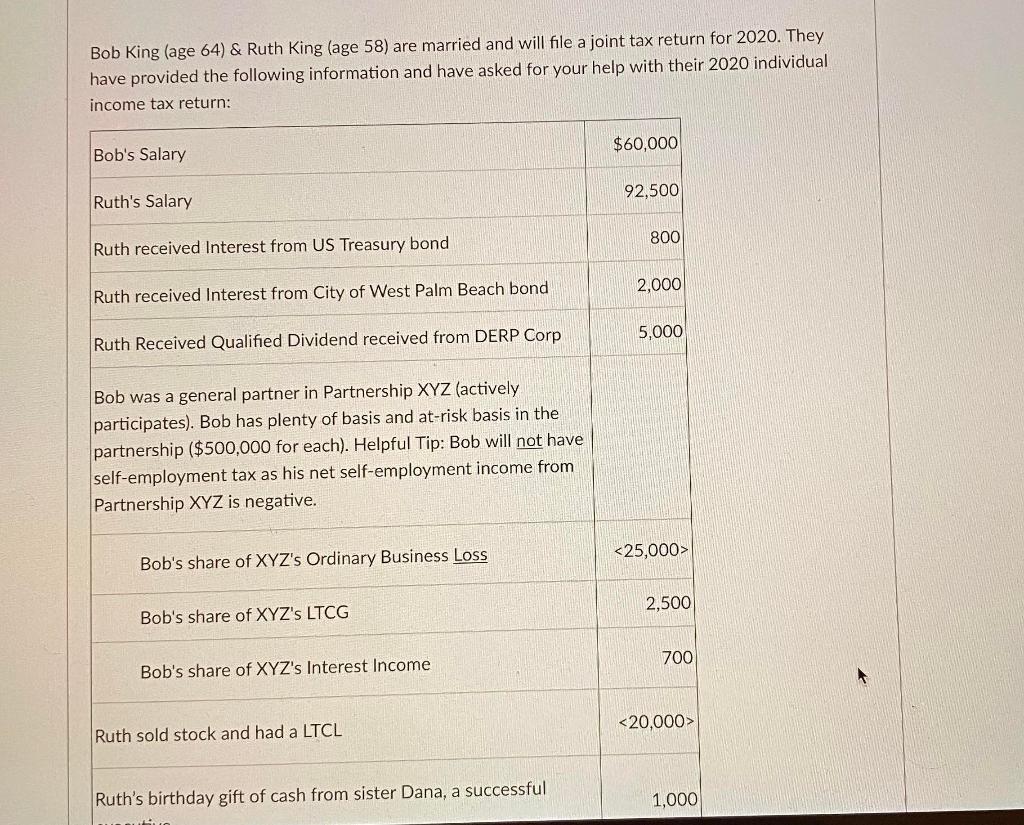

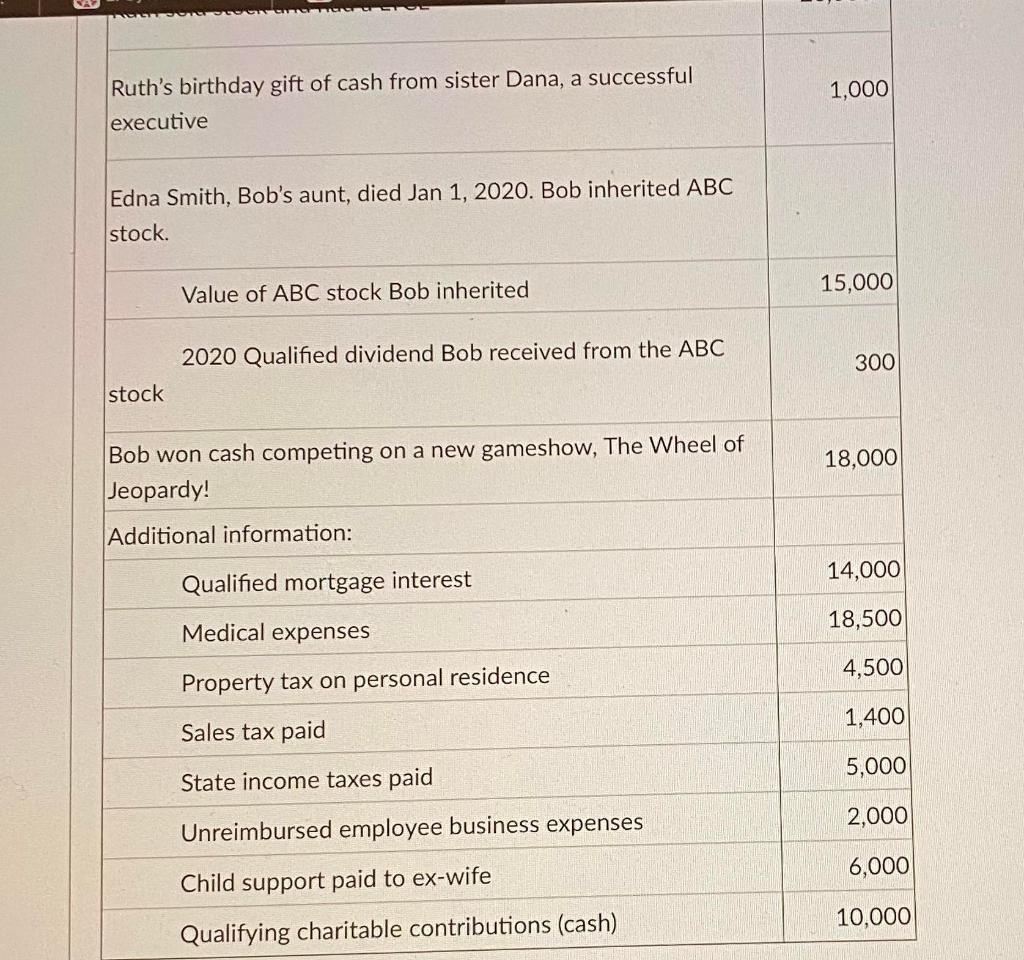

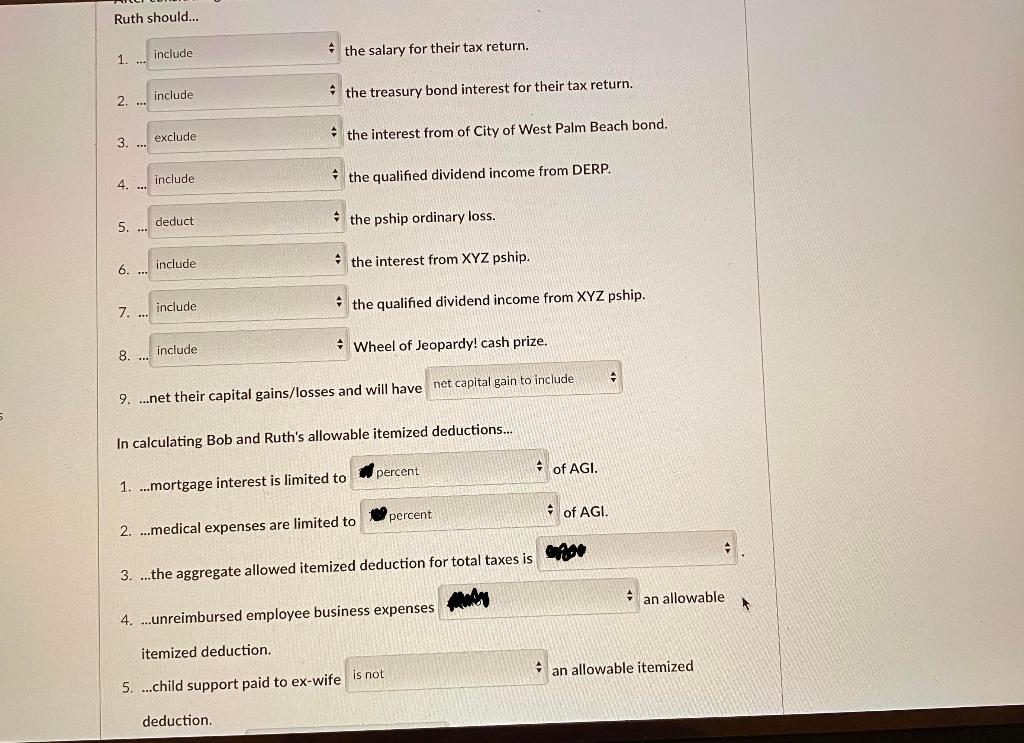

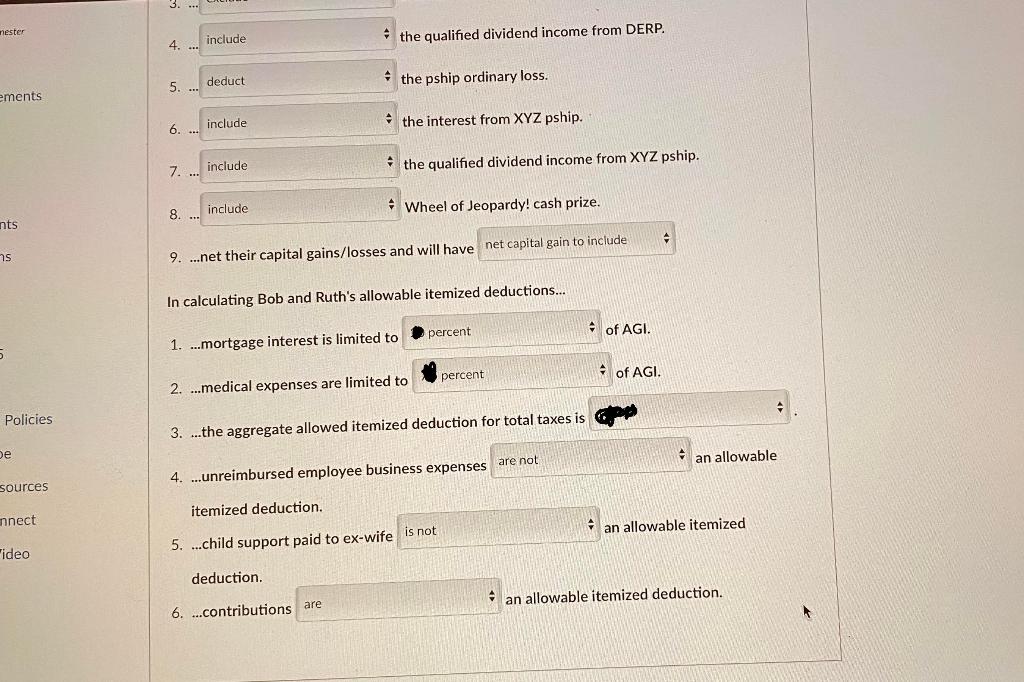

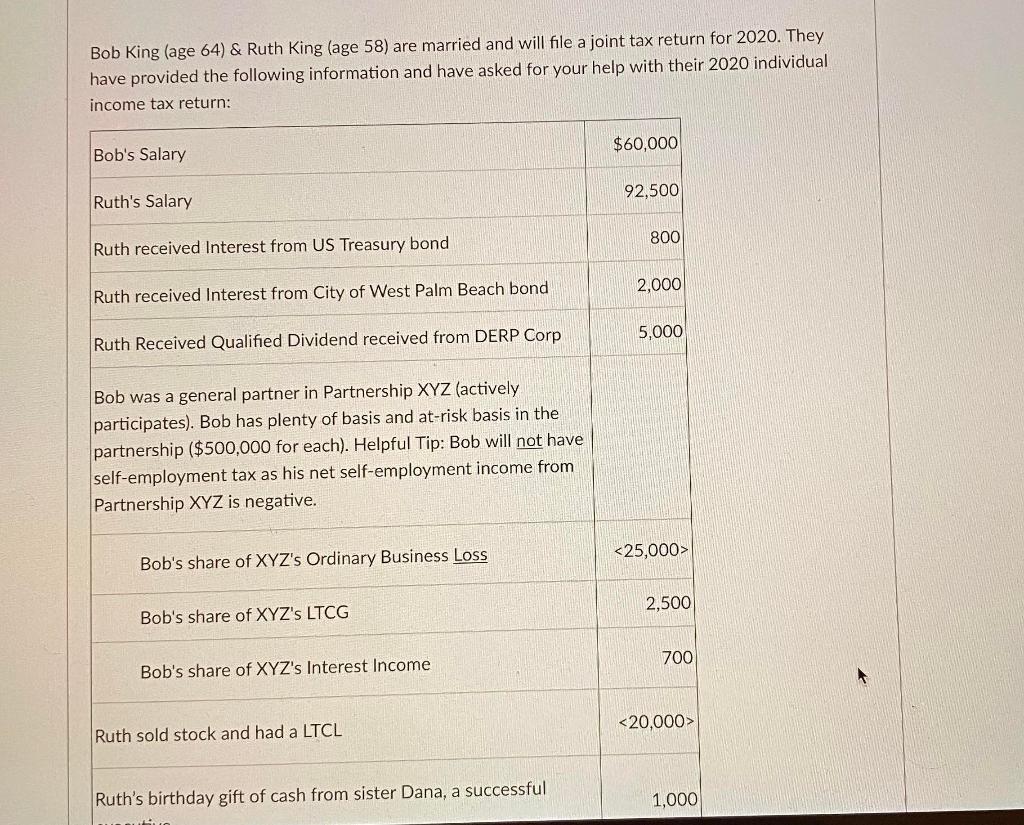

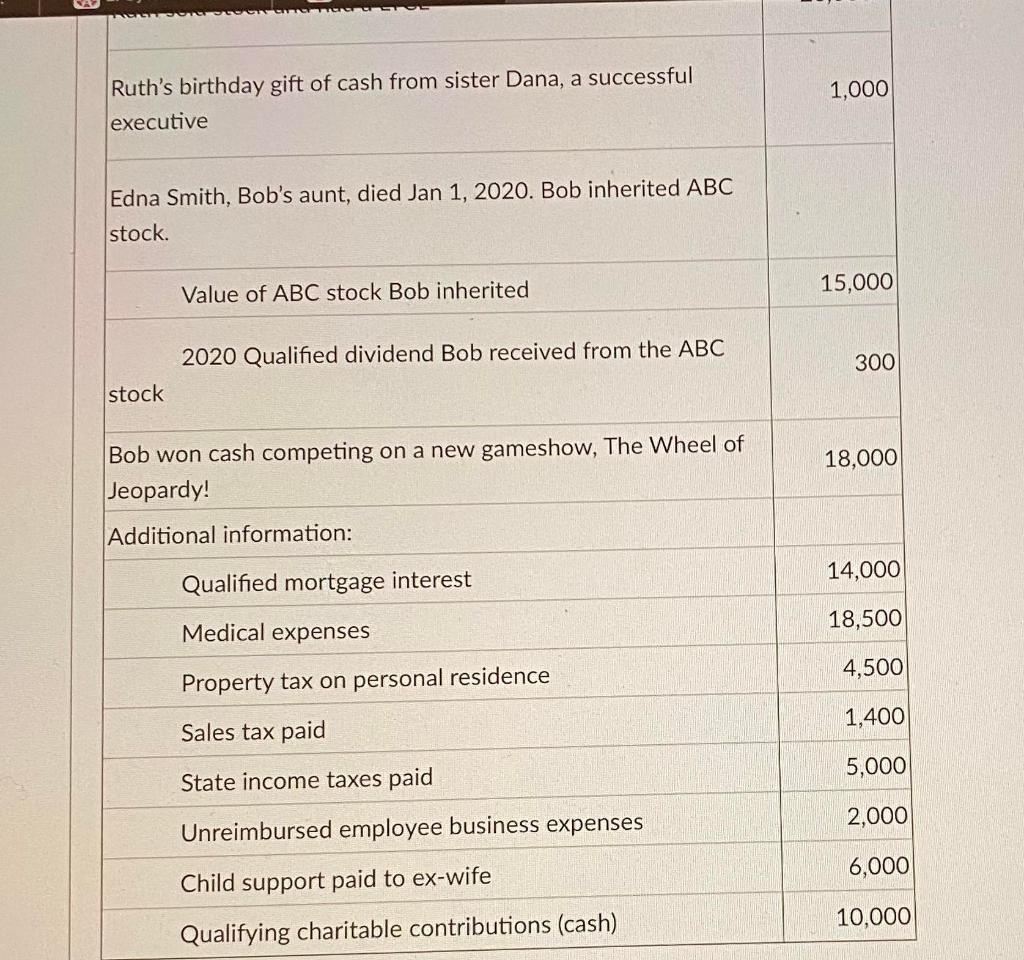

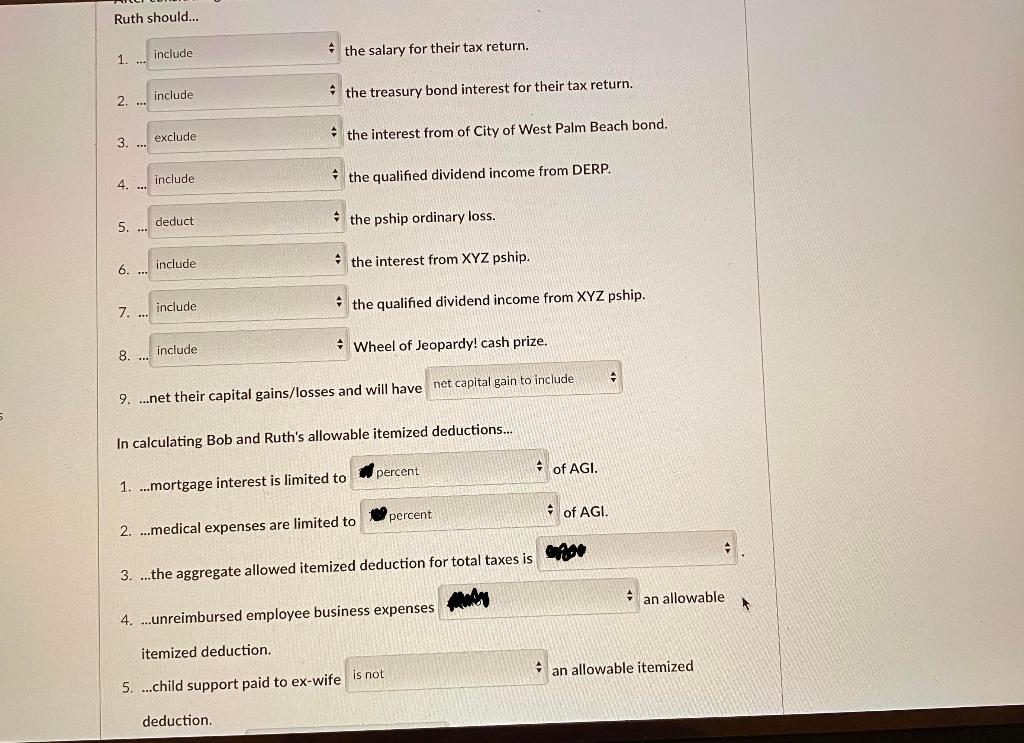

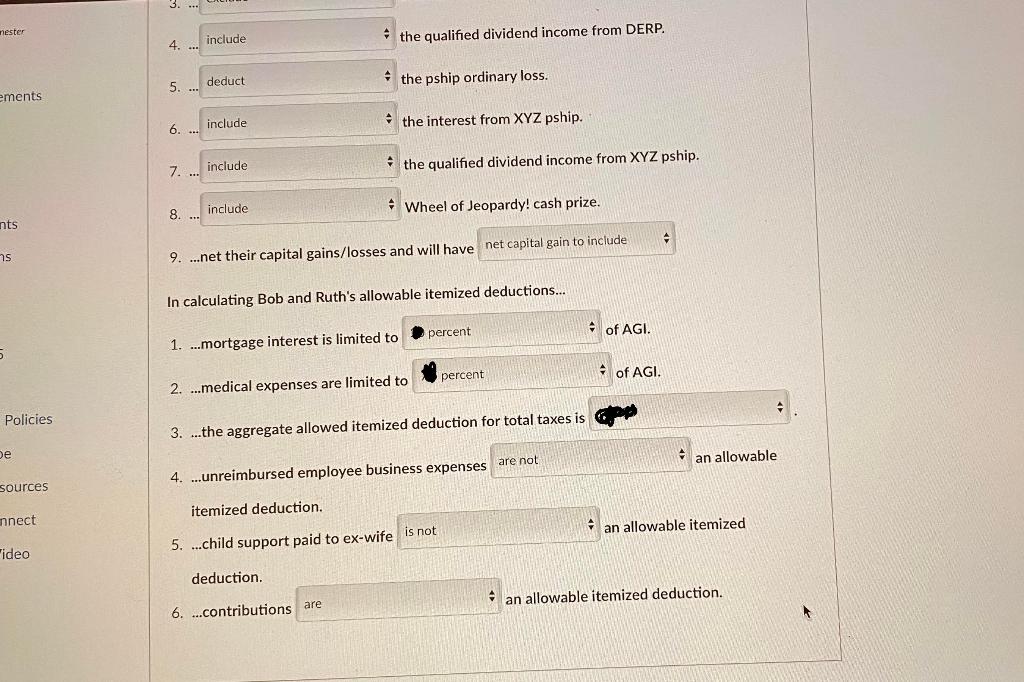

Bob King (age 64) & Ruth King (age 58) are married and will file a joint tax return for 2020. They have provided the following information and have asked for your help with their 2020 individual income tax return: $60,000 Bob's Salary 92,500 Ruth's Salary 800 Ruth received Interest from US Treasury bond 2,000 Ruth received Interest from City of West Palm Beach bond 5,000 Ruth Received Qualified Dividend received from DERP Corp Bob was a general partner in Partnership XYZ (actively participates). Bob has plenty of basis and at-risk basis in the partnership ($500,000 for each). Helpful Tip: Bob will not have self-employment tax as his net self-employment income from Partnership XYZ is negative. Bob's share of XYZ's Ordinary Business Loss 2,500 Bob's share of XYZ's LTCG 700 Bob's share of XYZ's Interest Income Ruth sold stock and had a LTCL Ruth's birthday gift of cash from sister Dana, a successful 1,000 1,000 Ruth's birthday gift of cash from sister Dana, a successful executive Edna Smith, Bob's aunt, died Jan 1, 2020. Bob inherited ABC stock. 15,000 Value of ABC stock Bob inherited 2020 Qualified dividend Bob received from the ABC 300 stock 18,000 Bob won cash competing on a new gameshow, The Wheel of Jeopardy! Additional information: 14,000 Qualified mortgage interest 18,500 Medical expenses 4,500 Property tax on personal residence 1,400 Sales tax paid 5,000 State income taxes paid 2,000 Unreimbursed employee business expenses 6,000 Child support paid to ex-wife 10,000 Qualifying charitable contributions (cash) Ruth should... 1. the salary for their tax return. include 2. include the treasury bond interest for their tax return. exclude the interest from of City of West Palm Beach bond. 3. 4. include the qualified dividend income from DERP. *** 5. the pship ordinary loss. deduct ... 6. ... the interest from XYZ pship. include 7. ... include the qualified dividend income from XYZ pship. 8. include Wheel of Jeopardy! cash prize. 9. ...net their capital gains/losses and will have net capital gain to include In calculating Bob and Ruth's allowable itemized deductions... percent of AGI. 1. ...mortgage interest is limited to Hof AGI. percent 2. ...medical expenses are limited to CA 3. ...the aggregate allowed itemized deduction for total taxes is an allowable 4. ...unreimbursed employee business expenses itemized deduction. an allowable itemized 5. ...child support paid to ex-wife is not deduction 3. .. nester 4. include the qualified dividend income from DERP. 5. deduct the pship ordinary loss. ements include 6. the interest from XYZ pship. 7. include the qualified dividend income from XYZ pship. 8. include Wheel of Jeopardy! cash prize. nts ns 9. ...net their capital gains/losses and will have net capital gain to include In calculating Bob and Ruth's allowable itemized deductions... percent of AGI. 1. ...mortgage interest is limited to 5 percent of AGI. 2. ...medical expenses are limited to Policies 3. ...the aggregate allowed itemized deduction for total taxes is an allowable 4. ...unreimbursed employee business expenses are not sources itemized deduction. nnect an allowable itemized "ideo 5. ...child support paid to ex-wife is not deduction. an allowable itemized deduction. 6. ...contributions are