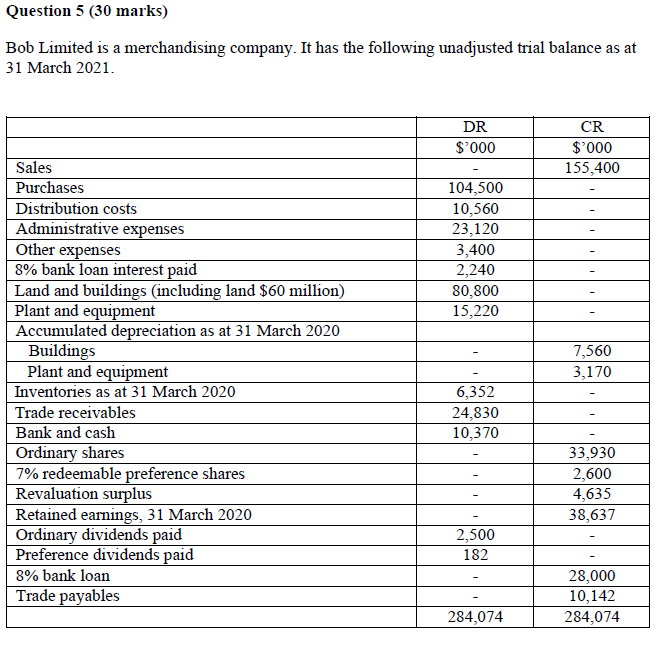

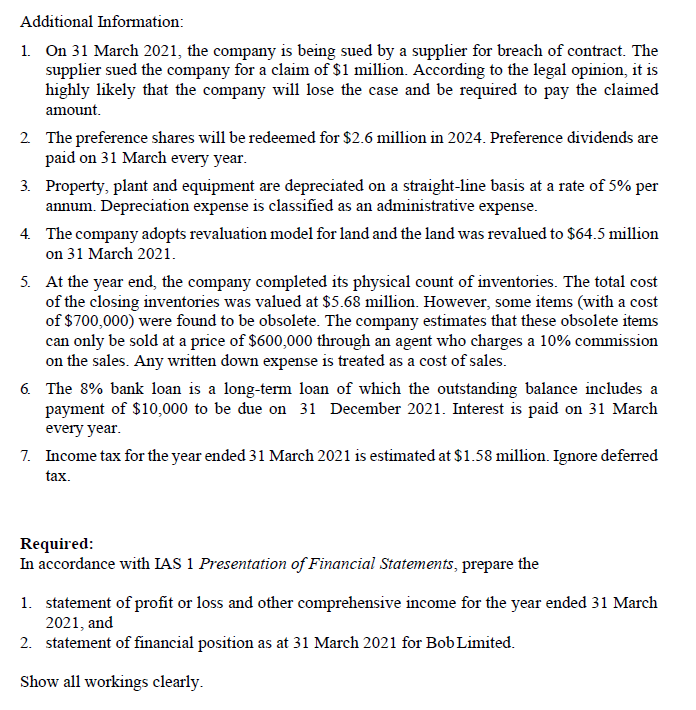

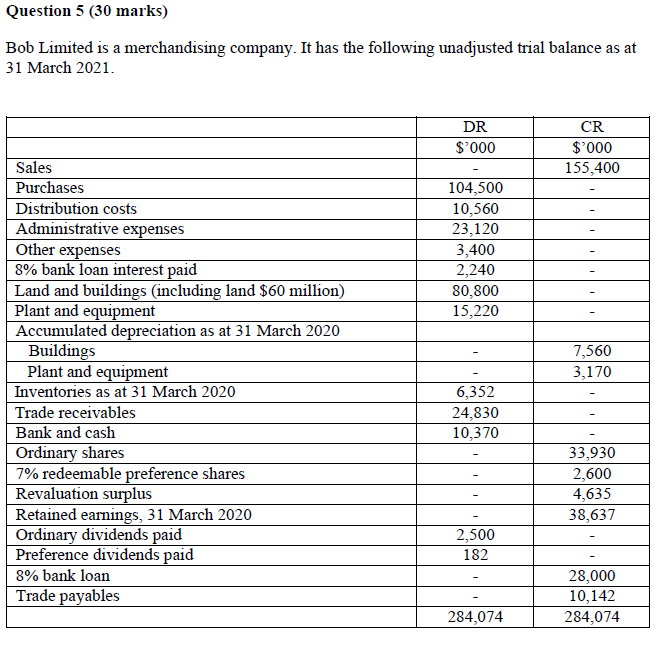

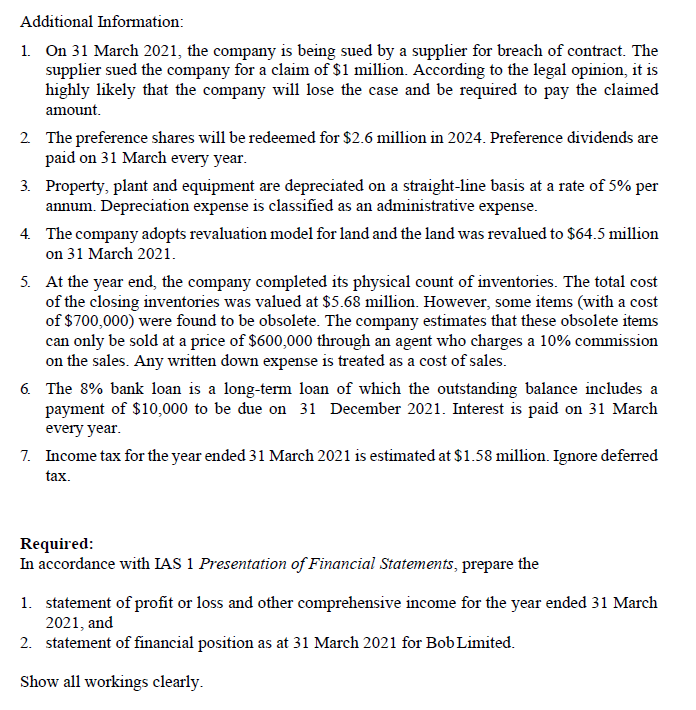

Bob Limited is a merchandising company. It has the following unadjusted trial balance as at 31 March 2021. Additional Information: 1. On 31 March 2021 , the company is being sued by a supplier for breach of contract. The supplier sued the company for a claim of $1 million. According to the legal opinion, it is highly likely that the company will lose the case and be required to pay the claimed amount. 2. The preference shares will be redeemed for $2.6 million in 2024 . Preference dividends are paid on 31 March every year. 3. Property, plant and equipment are depreciated on a straight-line basis at a rate of 5% per annum. Depreciation expense is classified as an administrative expense. 4. The company adopts revaluation model for land and the land was revalued to $64.5 million on 31 March 2021. 5. At the year end, the company completed its physical count of inventories. The total cost of the closing inventories was valued at $5.68 million. However, some items (with a cost of $700,000 ) were found to be obsolete. The company estimates that these obsolete items can only be sold at a price of $600,000 through an agent who charges a 10% commission on the sales. Any written down expense is treated as a cost of sales. 6. The 8% bank loan is a long-term loan of which the outstanding balance includes a payment of $10,000 to be due on 31 December 2021. Interest is paid on 31 March every year. 7. Income tax for the year ended 31 March 2021 is estimated at $1.58 million. Ignore deferred tax. Required: In accordance with IAS 1 Presentation of Financial Statements, prepare the 1. statement of profit or loss and other comprehensive income for the year ended 31 March 2021, and 2. statement of financial position as at 31 March 2021 for Bob Limited. Show all workings clearly. Bob Limited is a merchandising company. It has the following unadjusted trial balance as at 31 March 2021. Additional Information: 1. On 31 March 2021 , the company is being sued by a supplier for breach of contract. The supplier sued the company for a claim of $1 million. According to the legal opinion, it is highly likely that the company will lose the case and be required to pay the claimed amount. 2. The preference shares will be redeemed for $2.6 million in 2024 . Preference dividends are paid on 31 March every year. 3. Property, plant and equipment are depreciated on a straight-line basis at a rate of 5% per annum. Depreciation expense is classified as an administrative expense. 4. The company adopts revaluation model for land and the land was revalued to $64.5 million on 31 March 2021. 5. At the year end, the company completed its physical count of inventories. The total cost of the closing inventories was valued at $5.68 million. However, some items (with a cost of $700,000 ) were found to be obsolete. The company estimates that these obsolete items can only be sold at a price of $600,000 through an agent who charges a 10% commission on the sales. Any written down expense is treated as a cost of sales. 6. The 8% bank loan is a long-term loan of which the outstanding balance includes a payment of $10,000 to be due on 31 December 2021. Interest is paid on 31 March every year. 7. Income tax for the year ended 31 March 2021 is estimated at $1.58 million. Ignore deferred tax. Required: In accordance with IAS 1 Presentation of Financial Statements, prepare the 1. statement of profit or loss and other comprehensive income for the year ended 31 March 2021, and 2. statement of financial position as at 31 March 2021 for Bob Limited. Show all workings clearly