Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bob Reckonwith, a famed fund manager, is pondering three strategies: a large-cap stock fund, a hedge fund, and a T-bill money market fund. He estimates

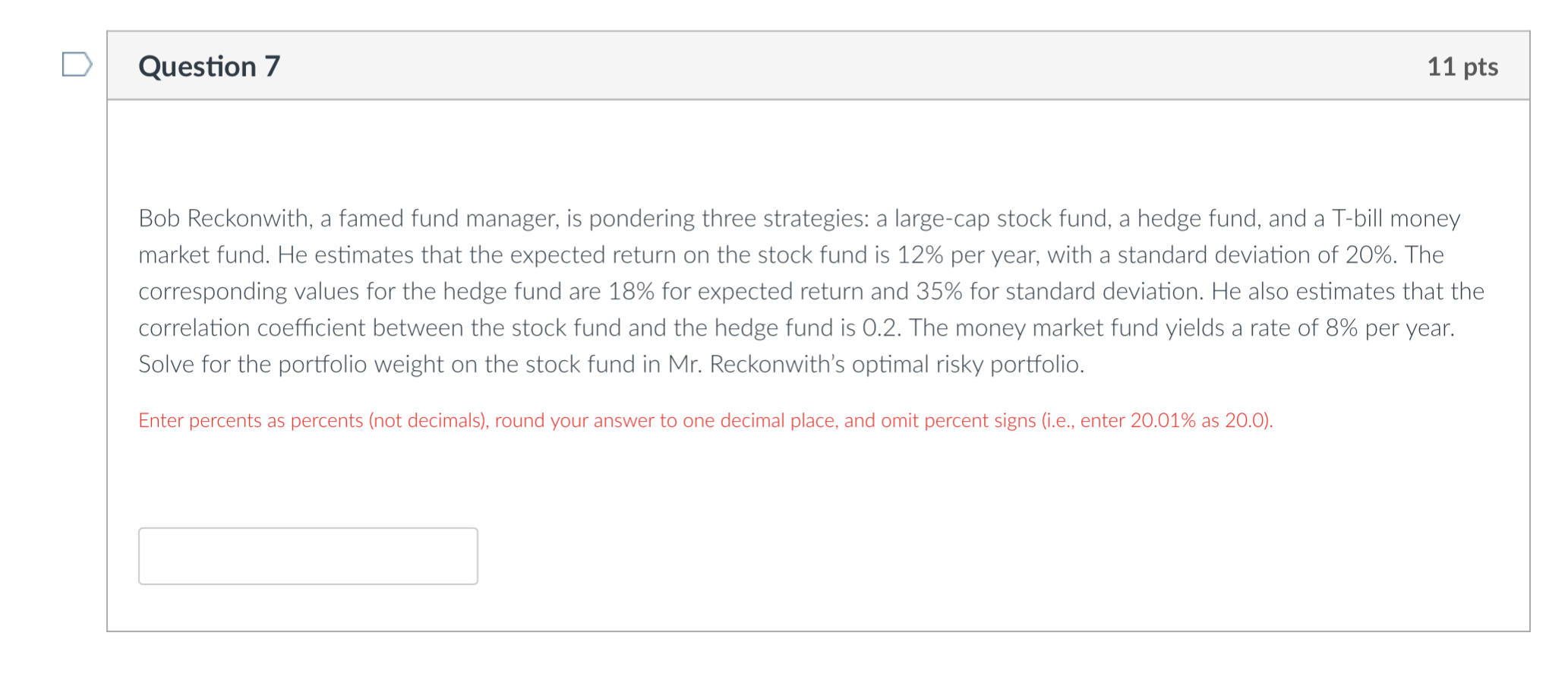

Bob Reckonwith, a famed fund manager, is pondering three strategies: a large-cap stock fund, a hedge fund, and a T-bill money market fund. He estimates that the expected return on the stock fund is 12% per year, with a standard deviation of 20%. The corresponding values for the hedge fund are 18\% for expected return and 35\% for standard deviation. He also estimates that the correlation coefficient between the stock fund and the hedge fund is 0.2 . The money market fund yields a rate of 8% per year. Solve for the portfolio weight on the stock fund in Mr. Reckonwith's optimal risky portfolio. Enter percents as percents (not decimals), round your answer to one decimal place, and omit percent signs (i.e., enter 20.01\% as 20.0)

Bob Reckonwith, a famed fund manager, is pondering three strategies: a large-cap stock fund, a hedge fund, and a T-bill money market fund. He estimates that the expected return on the stock fund is 12% per year, with a standard deviation of 20%. The corresponding values for the hedge fund are 18\% for expected return and 35\% for standard deviation. He also estimates that the correlation coefficient between the stock fund and the hedge fund is 0.2 . The money market fund yields a rate of 8% per year. Solve for the portfolio weight on the stock fund in Mr. Reckonwith's optimal risky portfolio. Enter percents as percents (not decimals), round your answer to one decimal place, and omit percent signs (i.e., enter 20.01\% as 20.0) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started