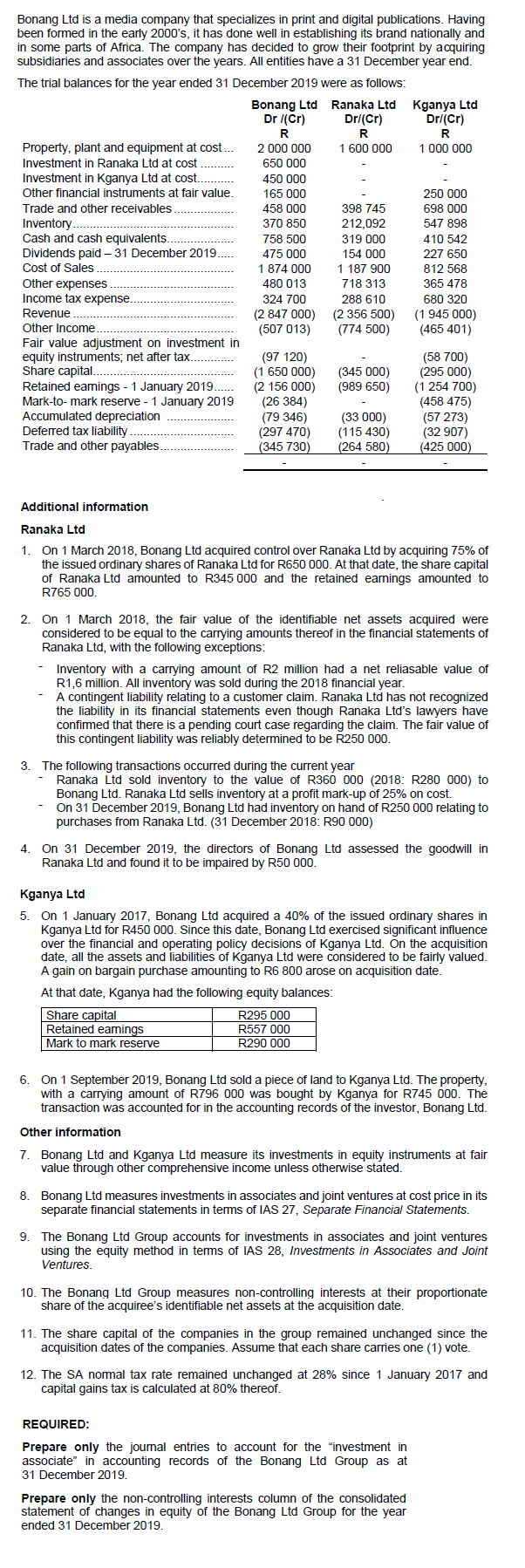

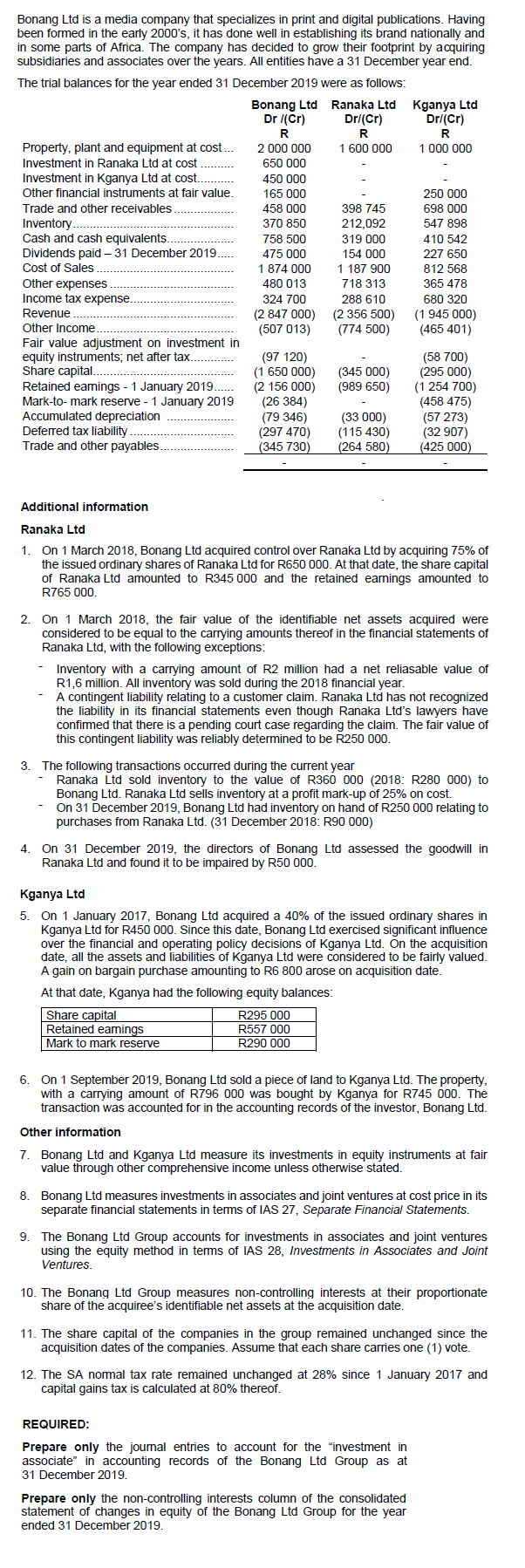

Bonang Ltd is a media company that specializes in print and digital publications. Having been formed in the early 2000's, it has done well in establishing its brand nationally and in some parts of Africa. The company has decided to grow their footprint by acquiring subsidiaries and associates over the years. All entities have a 31 December year end. The trial balances for the year ended 31 December 2019 were as follows: Bonang Ltd Ranaka Ltd Kganya Ltd Dr/(Cr) Drl(Cr) Dr/(Cr) 1 600 000 000 000 .......... 2 000 000 650 000 450 000 165 000 458 000 370 850 758 500 475 000 Property, plant and equipment at cost... Investment in Ranaka Ltd at cost Investment in Kganya Ltd at cost. Other financial instruments at fair value. Trade and other receivables Inventory Cash and cash equivalents. Dividends paid - 31 December 2019... Cost of Sales Other expenses Income tax expense.. Revenue Other Income.. Fair value adjustment on investment in equity instruments, net after tax.. Share capital... Retained earings - 1 January 2019...... Mark-to-mark reserve - 1 January 2019 Accumulated depreciation Deferred tax liability Trade and other payables... 398 745 212,092 319 000 154 000 1 187 900 718 313 288 610 (2 356 500) (774 500) 250 000 698 000 547 898 410 542 227 650 812 568 365 478 680 320 (1 945 000) (465 401) 480 013 324 700 (2 847 000) (507 013) (345 000) (989 650) (97 120) (1 650 000) (2156 000) (26 384) (79 346) (297 470) (345 730) (58 700) (295 000) (1 254 700) (458 475) (57 273) (32 907) (425 000) ..... (33 000) (115 430) (264 580) Additional information Ranaka Ltd 1. On 1 March 2018, Bonang Ltd acquired control over Ranaka Ltd by acquiring 75% of the issued ordinary shares of Ranaka Ltd for R650 000. At that date, the share capital of Ranaka Ltd amounted to R345 000 and the retained earnings amounted to R765 000. 2. On 1 March 2018, the fair value of the identifiable net assets acquired were considered to be equal to the carrying amounts thereof in the financial statements of Ranaka Ltd, with the following exceptions: - Inventory with a carrying amount of R2 million had a net reliasable value of R1,6 million. All inventory was sold during the 2018 financial year. A contingent liability relating to a customer claim. Ranaka Ltd has not recognized the liability in its financial statements even though Ranaka Ltd's lawyers have confirmed that there is a pending court case regarding the claim. The fair value of this contingent liability was reliably determined to be R250 000. 3. The following transactions occurred during the current year - Ranaka Ltd sold inventory to the value of R360 000 (2018: R280 000) to Bonang Ltd. Ranaka Ltd sells inventory at a profit mark-up of 25% on cost. - On 31 December 2019, Bonang Ltd had inventory on hand of R250 000 relating to purchases from Ranaka Ltd. (31 December 2018: R90 000) 4. On 31 December 2019, the directors of Bonang Ltd assessed the goodwill in Ranaka Ltd and found it to be impaired by R50 000. Kganya Ltd 5. On 1 January 2017, Bonang Ltd acquired a 40% of the issued ordinary shares in Kganya Ltd for R450 000. Since this date, Bonang Ltd exercised significant influence over the financial and operating policy decisions of Kganya Ltd. On the acquisition date, all the assets and liabilities of Kganya Ltd were considered to be fairly valued. A gain on bargain purchase amounting to R6 800 arose on acquisition date. At that date, Kganya had the following equity balances: Share capital R295 000 Retained earnings R557 000 Mark to mark reserve R290 000 6. On 1 September 2019, Bonang Ltd sold a piece of land to Kganya Ltd. The property, with a carrying amount of R796 000 was bought by Kganya for R745 000. The transaction was accounted for in the accounting records of the investor, Bonang Ltd. Other information 7. Bonang Ltd and Kganya Ltd measure its investments in equity instruments at fair value through other comprehensive income unless otherwise stated. 8. Bonang Ltd measures investments in associates and joint ventures at cost price in its separate financial statements in terms of IAS 27, Separate Financial Statements. 9. The Bonang Ltd Group accounts for investments in associates and joint ventures using the equity method in terms of IAS 28, Investments in Associates and Joint Ventures 10. The Bonang Ltd Group measures non-controlling interests at their proportionate share of the acquiree's identifiable net assets at the acquisition date. 11. The share capital of the companies in the group remained unchanged since the acquisition dates of the companies. Assume that each share carries one (1) vote. 12. The SA normal tax rate remained unchanged at 28% since 1 January 2017 and capital gains tax is calculated at 80% thereof. REQUIRED: Prepare only the journal entries to account for the "investment in associate" in accounting records of the Bonang Ltd Group as at 31 December 2019. Prepare only the non-controlling interests column of the consolidated statement of changes in equity of the Bonang Ltd Group for the year ended 31 December 2019