Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bond and Stock Evaluation. Solve each problem and show your work! 1. A bond with a coupon rate of 7.30% has a price that today

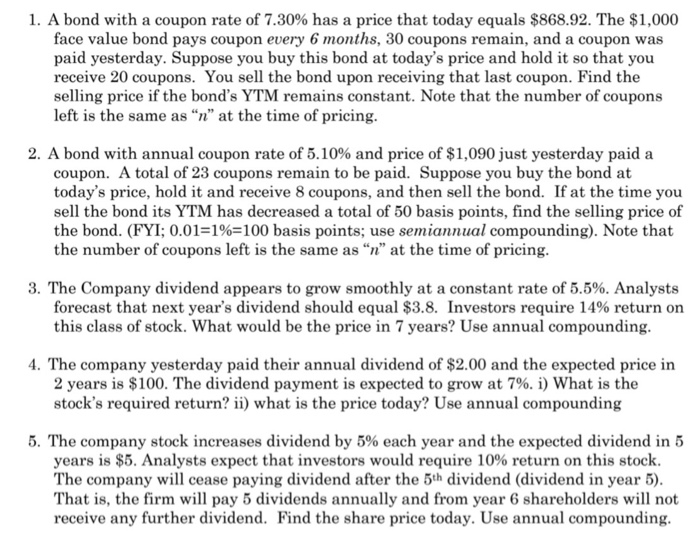

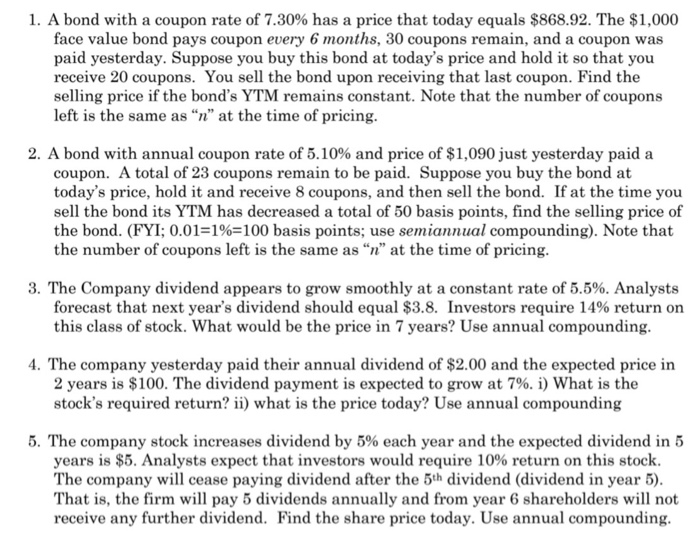

Bond and Stock Evaluation. Solve each problem and show your work!

1. A bond with a coupon rate of 7.30% has a price that today equals $868.92. The $1,000 face value bond pays coupon every 6 months, 30 coupons remain, anda coupon was paid yesterday. Suppose you buy this bond at today's price and hold it so that you receive 20 coupons. You sell the bond upon receiving that last coupon. Find the selling price if the bond's YTM remains constant. Note that the number of coupons left is the same as "n" at the time of pricing 2. A bond with annual coupon rate of 5.10% and price of $1,090 just yesterday paid a coupon. A total of 23 coupons remain to be paid. Suppose you buy the bond at today's price, hold it and receive 8 coupons, and then sell the bond. If at the time you sell the bond its YTM has decreased a total of 50 basis points, find the selling price of the bond. (FYI; 0.01=1%=100 basis points; use semiannual compounding). Note that the number of coupons left is the same as "n" at the time of pricing 3. The Company dividend appears to grow smoothly at a constant rate of 5.5%. Analysts forecast that next year's dividend should equal $3.8. Investors require 14% return on this class of stock. What would be the price in 7 years? Use annual compounding 4. The company yesterday paid their annual dividend of $2.00 and the expected price in 2 years is $100. The dividend payment is expected to grow at 7%. i) What is the stock's required return? ii) what is the price today? Use annual compounding 5. The company stock increases dividend by 5% each year and the expected dividend in 5 years is $5. Analysts expect that investors would require 10% return on this stock The company will cease paying dividend after the 5th dividend (dividend in year 5) That is, the firm will pay 5 dividends annually and from year 6 shareholders will not receive any further dividend. Find the share price today. Use annual compounding

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started