Answered step by step

Verified Expert Solution

Question

1 Approved Answer

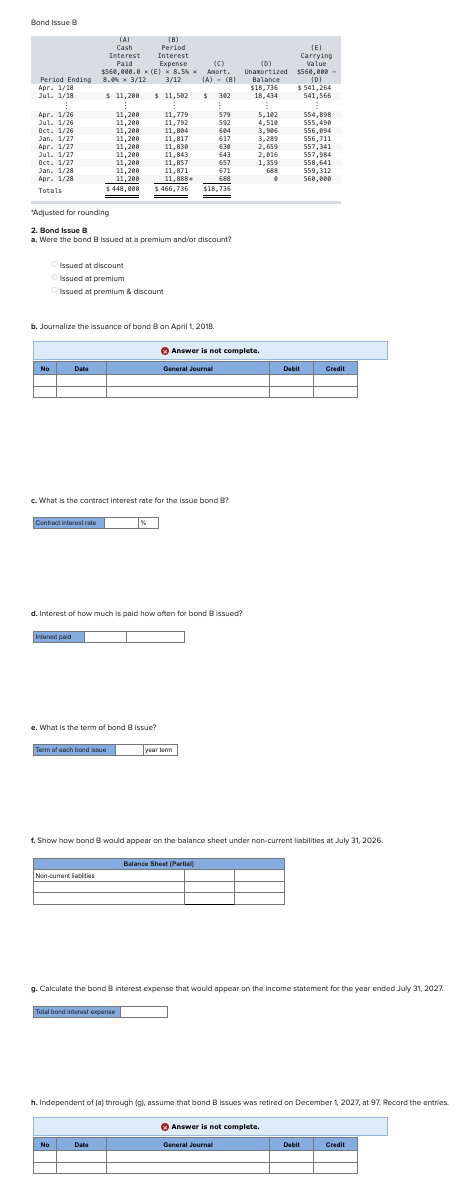

Bond Issue B [A] (B) Period Cash Interest Interest Expense (C) (D) (E) Carrying Value Period Ending $560,000.0 8.0% x 3/12 (E) x 8.5%

Bond Issue B [A] (B) Period Cash Interest Interest Expense (C) (D) (E) Carrying Value Period Ending $560,000.0 8.0% x 3/12 (E) x 8.5% x Amort. Unamortized $560,000 - (A) - (B) Balance (D) Apr. 1/18 $18,736 $541,264 Jul. 1/18 $ 11,200 $ 11,582 $ 302 18,434 541,566 Apr. 1/26 11,288 11,779 579 5,102 554,898 Jul. 1/26 11,200 11,792 592 Oct. 1/26 11,280 4,510 555,498 11,884 604 3,906 556,094 Jan. 1/27 11,200 11,817 617 3,289 556,711 Apr. 1/27 11,200 11,838 630 2,659 557,341 Jul. 1/27 11,200 11,843 643 2,016 557,984 Oct. 1/27 11,288 11,857 657 1,359 558,641 Jan. 1/28 11,200 11,871 671 688 559,312 Apr. 1/28 11,200 11,888 688 568,000 Totals $ 448,000 $466,736 $18,736 *Adjusted for rounding 2. Bond Issue B a. Were the bond B issued at a premium and/or discount? Issued at discount Issued at premium Issued at premium & discount b. Journalize the issuance of bond B on April 1, 2018. No Answer is not complete. General Journal Debit c. What is the contract interest rate for the issue bond B? Contract interest rate d. Interest of how much is paid how often for bond B issued? Interest paid e. What is the term of bond B issue? Term of each bond issue year term f. Show how bond B would appear on the balance sheet under non-current liabilities at July 31, 2026. Non-cument labities Balance Sheet (Partial) g. Calculate the bond B interest expense that would appear on the income statement for the year ended July 31, 2027. Total band interest expense h. Independent of (a) through (g), assume that bond B issues was retired on December 1, 2027, at 97. Record the entries. Answer is not complete. General Journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started