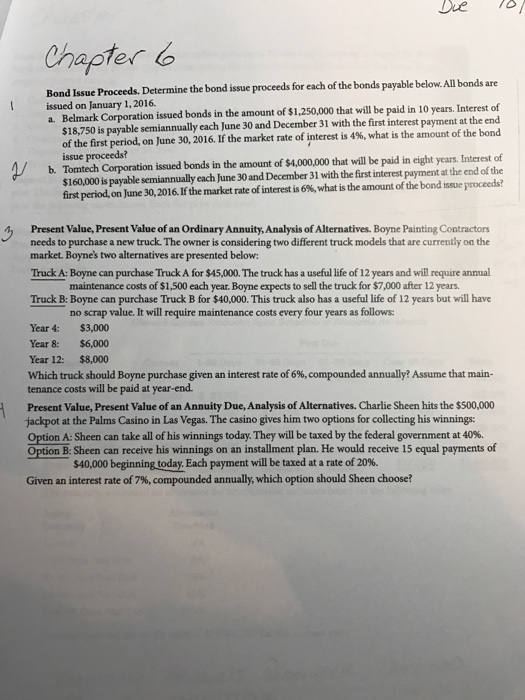

Bond Issue Proceeds, Determine the bond issue proceeds for each of the bonds payable below. All bonds are issued on January 1, 2016. Belmark Corporation issued bonds in the amount of $1, 250,000 that will be paid in 10 years. Interest of $18, 750 is payable semiannually each June 30 and December 31 with the first interest payment at the end of the first period, on June 30, 2016. If the market rate of interest is 4%, what is the amount of the bond issue proceeds? Tomtech Corporation issued bonds in the amount of $4,000,000 that will be paid in eight years. Interest of $ 160.000 is payable semiannually each June 30 and December 31 with the first interest payment at the end of the first period, on June 30, 2016. If the market rate of interest is 6%, what is the amount of the bond issue proceeds? Present Value, Present Value of an Ordinary Annuity, Analysis of Alternatives. Boyne Painting Contractors needs to purchase a new truck. The owner is considering two different truck models that are currently on the market. Boyne's two alternatives are presented below: Truck A: Boyne can purchase Truck A for $45,000. The truck has a useful life of 12 years and will require annual maintenance costs of $1, 500 each year. Boyne expects to sell the truck for $7,000 after 12 years. Truck B: Boyne can purchase Truck B for $40,000. This truck also has a useful life of 12 years but will have no scrap value. It will require maintenance costs every four years as follows: Which truck should Boyne purchase given an interest rate of 6%, compounded annually? Assume that maintenance costs will be paid at year-end. Present Value, Present Value of an Annuity Due, Analysis of Alternatives. Charlie Sheen hits the $500,000 jackpot at the Palms Casino in Las Vegas. The casino gives him two options for collecting his winnings: Option A: Sheen can take all of his winnings today. They will be taxed by the federal government at 40%. Option B: Sheen can receive his winnings on an installment plan. He would receive 15 equal payments of $40,000 beginning today. Each payment will be taxed at a rate of 20%. Given an interest rate of 7%, compounded annually, which option should Sheen choose