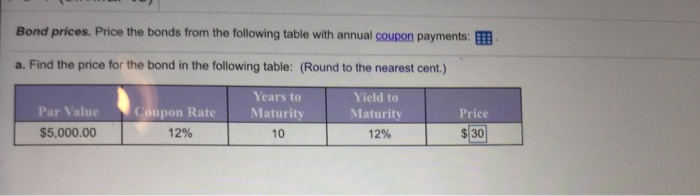

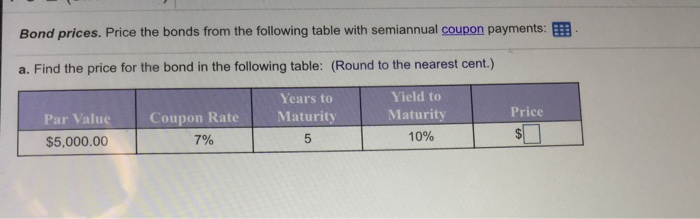

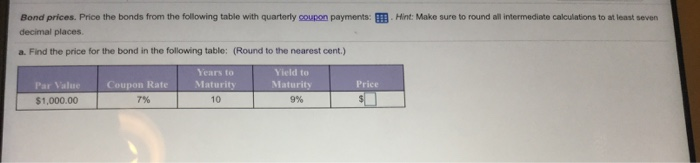

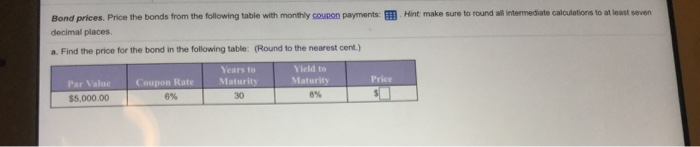

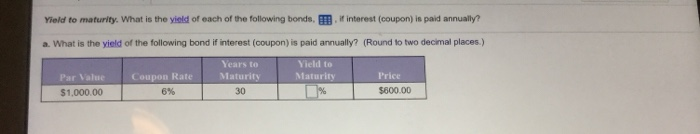

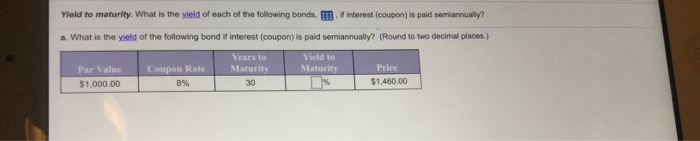

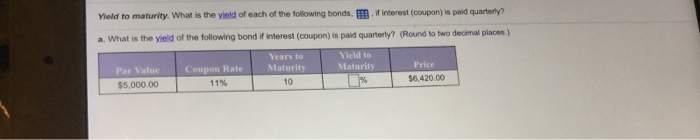

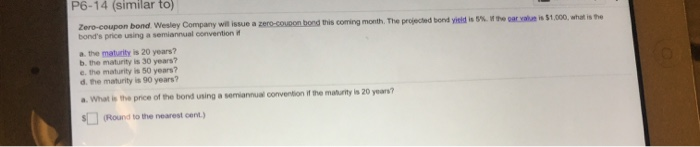

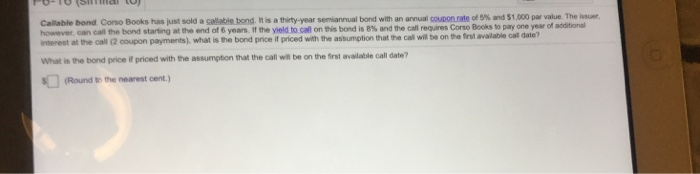

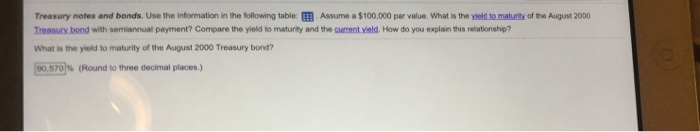

Bond prices. Price the bonds from the following table with annual coupon payments: a. Find the price for the bond in the following table: (Round to the nearest cent.) Par Value $5,000.00 Coupon Rate 12% Years to Maturity 10 Yield to Maturity 12% Price $30 T T Bond prices. Price the bonds from the following table with semiannual coupon payments: a. Find the price for the bond in the following table: (Round to the nearest cent.) Par Value $5,000.00 1 Coupon Rate 7 % Years to Maturity 5 Yield to Maturity 10% Price $ Bond prices. Price the bonds from the following table with quarterly coupon payments: !! Hint: Make sure to round all intermediate calculations to at least seven decimal places a. Find the price for the bond in the following table: (Round to the nearest cent.) Par Value $1,000.00 Price Coupon Rate 7% Tears to Maturity Maturity 109% Hint make sure to round all intermediate calculations to least seven Bond prices. Price the bonds from the following table with monthly Coupon payments: decimal places a. Find the price for the bond in the following table: (Round to the nearest cent) Years to Maturity held to Natur Pele Par Value $5,000.00 Coupon Rate 6% 8% Yield to maturity. What is the yield of each of the following bonds. If interest (coupon) is paid annually? a. What is the yield of the following bond if interest (coupon) is paid annually? (Round to two decimal places) Years to Maturity Sield to Maturity Par Value $1,000.00 Coupon Rate 6% Price $600.00 Yield to maturity. What is the yield of each of the following bonds, interest (coupon) is paid semiannually? a. What is the yield of the following bond if interest (coupon) is paid semiannually? (Round to two decimal places.) Coupon Rate Years to Maturity Par Value $1,000.00 Yield to Maturity % Price $1.460.00 Yield to maturity. What is the yield of each of the following bonds, interest (coupon) is paid quarterly? a. What is the yield of the following bond if interest (coupon) is paid quarterly? (Round to two decimal places) Par Value $5,000.00 Sears to Maturity 10 Coupon Rate 11% Price Sield to Maturity % $6.420 00 FOSH ) the gar value is $1,000, what is the Zero-coupon bond Wesley Company will issue a zero-coupon bord this coming month. The projected bond yield is band's price using a semiannual convention Tematy 20 years? b. the mattis 30 years? e the maturity is 50 years? d. the maturity 50 years? What is the pace of the bonding a convention the maturity is 20 years? SE (Round to the nearest cent) Calable bond Cons Books has just sold a colbie bond is a thirty year semiannual bond with an annual coupon rate of 5% and $1.000 par value. The is however can call the bond starting at the end of 6 years the yield to call on his bond is 8% and the requires Corso Booksto pay one year of ditional rest at the 12 coupon payment what is the bond pricepriced with the assumption that the call will be on the travable Gall date? What is the band price i priced with the assumption that the call will be on the first be calle? (Round to the nearest cent) PUSH U) What is the price in dollars of the February 2006 Tr o wth semana Treasury notes and bonds. Use the information in the following table payments par value is $100.000? What is the current ved o n ? What is the price in dollars of the February 2006 Treasury not? (Round to the nearest cont.) Treasury notes and bonds. Use the information in the following table: Assume a $100,000 per value. What is the yield to maturity of the August 2000 Treasury bond with semiannual payment? Compare the yield to maturity and the current yield. How do you explain this relationship? What is the yield to maturity of the August 2000 Treasury bond? 90,570% (Round to three decimal places.)