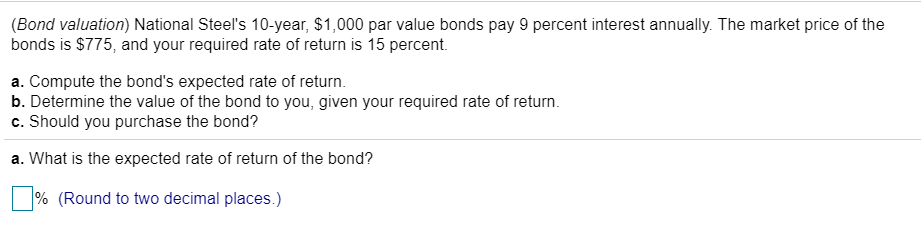

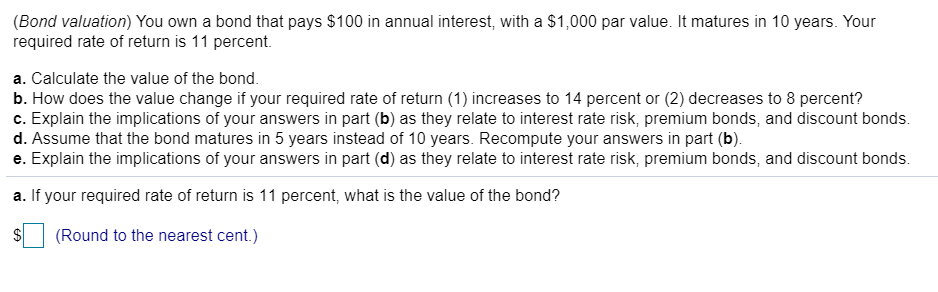

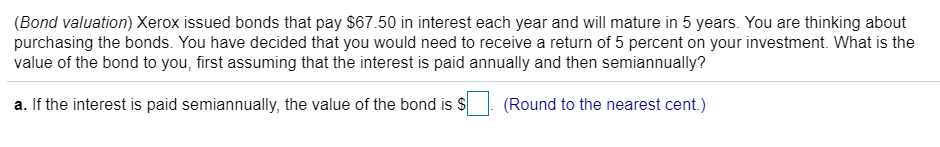

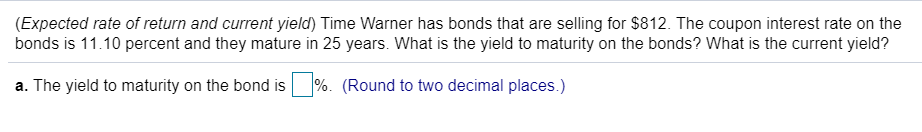

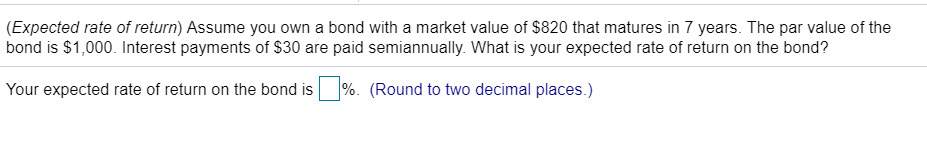

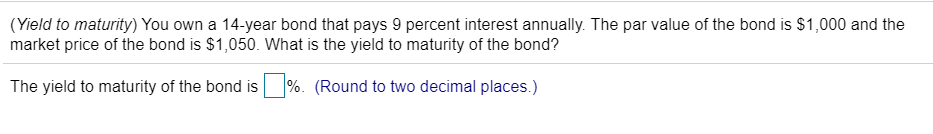

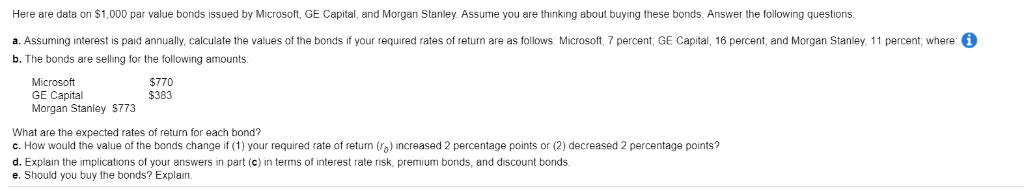

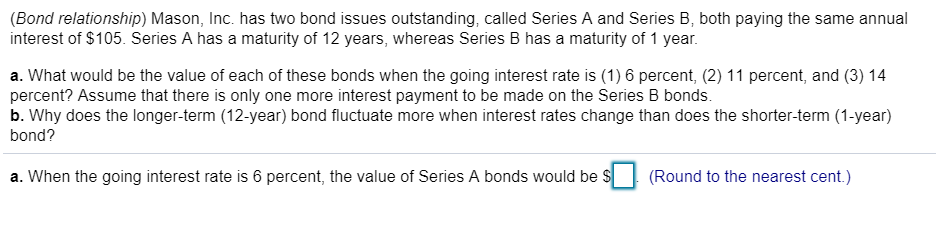

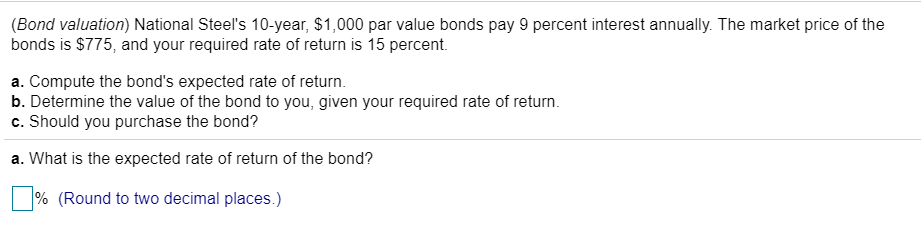

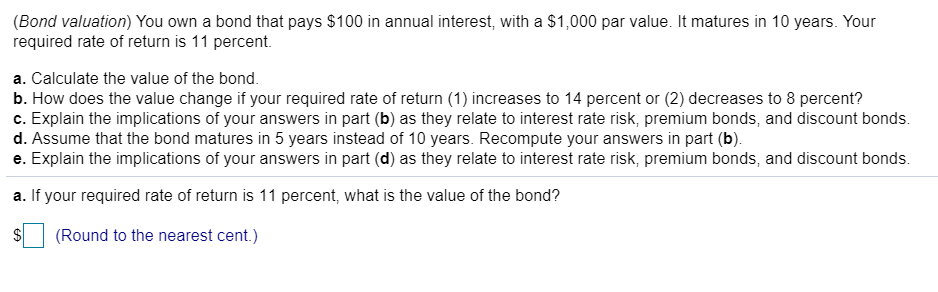

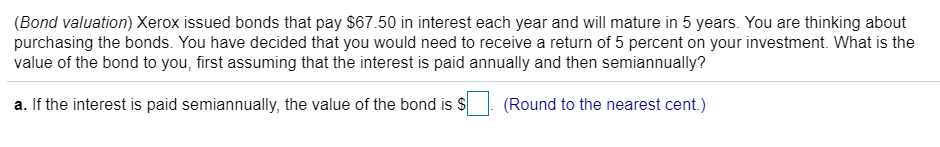

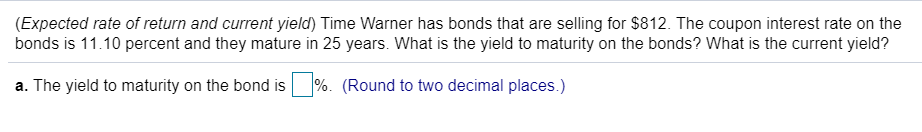

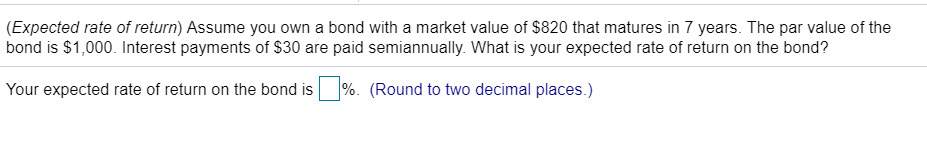

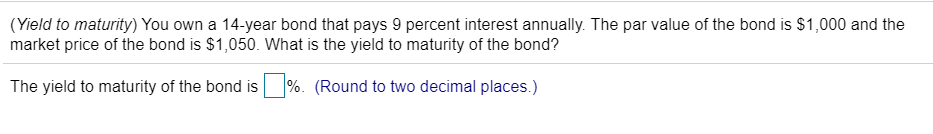

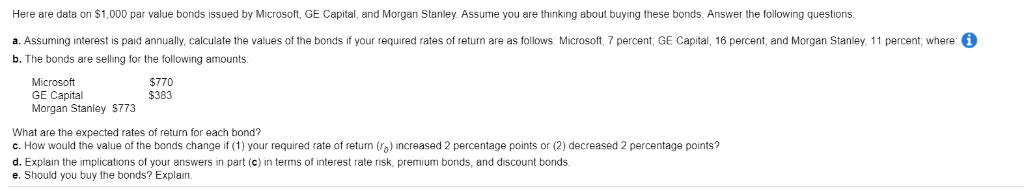

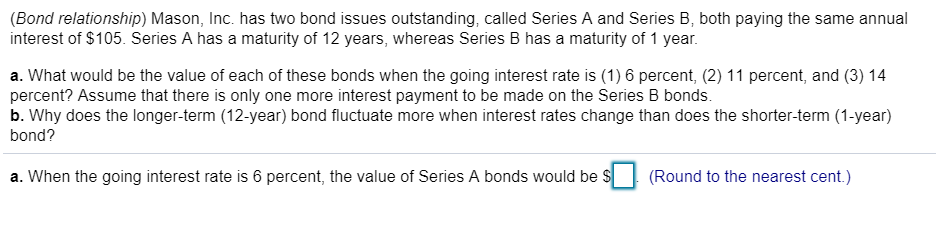

(Bond valuation) National Steel's 10-year, $1,000 par value bonds pay 9 percent interest annually. The market price of the bonds is $775, and your required rate of return is 15 percent. a. Compute the bond's expected rate of return. b. Determine the value of the bond to you, given your required rate of return. c. Should you purchase the bond? a. What is the expected rate of return of the bond? % (Round to two decimal places.) (Bond valuation) You own a bond that pays $100 in annual interest, with a $1,000 par value. It matures in 10 years. Your required rate of return is 11 percent. a. Calculate the value of the bond. b. How does the value change if your required rate of return (1) increases to 14 percent or (2) decreases to 8 percent? c. Explain the implications of your answers in part (b) as they relate to interest rate risk, premium bonds, and discount bonds. d. Assume that the bond matures in 5 years instead of 10 years. Recompute your answers in part (b). e. Explain the implications of your answers in part (d) as they relate to interest rate risk, premium bonds, and discount bonds. a. If your required rate of return is 11 percent, what is the value of the bond? $ (Round to the nearest cent.) (Bond valuation) Xerox issued bonds that pay $67.50 in interest each year and will mature in 5 years. You are thinking about purchasing the bonds. You have decided that you would need to receive a return of 5 percent on your investment. What is the value of the bond to you, first assuming that the interest is paid annually and then semiannually? a. If the interest is paid semiannually, the value of the bond is $ (Round to the nearest cent.) (Expected rate of return and current yield) Time Warner has bonds that are selling for $812. The coupon interest rate on the bonds is 11.10 percent and they mature in 25 years. What is the yield to maturity on the bonds? What is the current yield? a. The yield to maturity on the bond is %. (Round to two decimal places.) (Expected rate of return) Assume you own a bond with a market value of $820 that matures in 7 years. The par value of the bond is $1,000. Interest payments of $30 are paid semiannually. What is your expected rate of return on the bond? Your expected rate of return on the bond is. %. (Round to two decimal places.) (Yield to maturity) You own a 14-year bond that pays 9 percent interest annually. The par value of the bond is $1,000 and the market price of the bond is $1,050. What is the yield to maturity of the bond? The yield to maturity of the bond is %. (Round to two decimal places.) Here are data on $1,000 par value bonds issued by Microsoft, GE Capital, and Morgan Stanley. Assume you are thinking about buying these bonds. Answer the following questions i a. Assuming interest is paid annually, calculate the values of the bonds if your required rates of return are as follows Microsoft 7 percent; GE Capital, 16 percent, and Morgan Stanley 11 percent, where b. The bonds are selling for the following amounts Microsoft GE Capital Morgan Stanley S773 $770 $383 What are the expected rates of return for each bond? c. How would the value of the bonds change if (1) your required rate of return (ro) increased 2 percentage points or (2) decreased 2 percentage points? d. Explain the implications of your answers in part (c) in terms of interest rate risk, premium bonds, and discount bonds. e. Should you buy the bonds? Explain. (Bond relationship) Mason, Inc. has two bond issues outstanding, called Series A and Series B, both paying the same annual interest of $105. Series A has a maturity of 12 years, whereas Series B has a maturity of 1 year. a. What would be the value of each of these bonds when the going interest rate is (1) 6 percent, (2) 11 percent, and (3) 14 percent? Assume that there is only one more interest payment to be made on the Series B bonds. b. Why does the longer-term (12-year) bond fluctuate more when interest rates change than does the shorter-term (1-year) bond? a. When the going interest rate is 6 percent, the value of Series A bonds would be $ (Round to the nearest cent.)