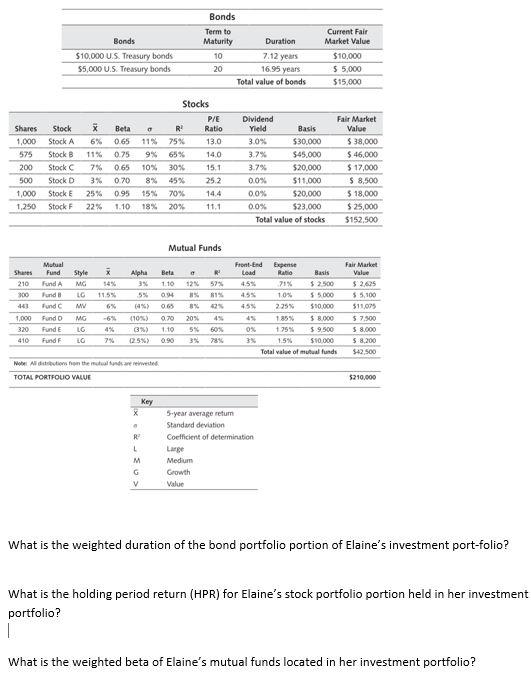

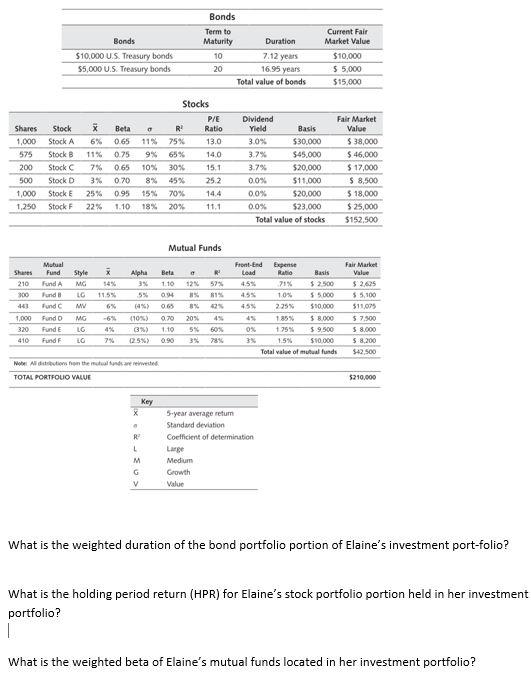

Bonds $10.000 US Treasury bonds $5,000 US Treasury bonds Bonds Term to Maturity Duration 10 7.12 years 20 16.95 years Total value of bonds Current Fair Market Value $10,000 5 5,000 $15,000 Stock X 6% Shares 1,000 575 200 500 1,000 1.250 Stock A Stock B Stock Stock D Stock Stock F Beta 065 0.75 0.65 0.70 0.95 1.10 Stocks P/E R Ratio 11% 75% 13.0 9% 65% 14.0 10% 30% 15.1 8% 45% 25.2 15% 70% 14.4 18% 20% 11.1 7% 3% 25% 22% Dividend Yield Basis 3.0% $30.000 3.7% $45.000 3.7% $20,000 0.0% $11,000 00% $20,000 0.0% $23,000 Total value of stocks Fair Market Value $ 38,000 $ 46,000 $ 17,000 $ 8,500 5 18.000 $ 25,000 $152.500 Mutual Funds Shares 210 Mutual Fund Fund A Style MG LG Bela 110 52 57% Fund 300 40 X 54% 11.5% 6% -6% 4% 7% Alpha 3% 5% (4%) (10%) 33%) 25%) 04 0.65 Fund Fundo Fund Fund F Front-End Expense Load Ratio Basis 4.55 71% $ 2.500 10% $5.000 455 2.29% $10.000 45 185% $ 8.000 ON 15 $9.500 35 1.5% $10.000 Total value of mutual funds Fair Market Value $ 205 $ 5.100 $11.09 5 7.500 $ 8.000 5.8.200 $42.500 1.000 320 410 MG LG LO 0.70 110 0.90 20% 5 50% 78% 3% Nobel Altitude TOTAL PORTFOUO VALVE 5210,000 Key X 5-year average retum Standard deviation Coefficient of determination Large R L M G V Medium Growth Value What is the weighted duration of the bond portfolio portion of Elaine's investment port-folio? What is the holding period return (HPR) for Elaine's stock portfolio portion held in her investment portfolio? | What is the weighted beta of Elaine's mutual funds located in her investment portfolio? Bonds $10.000 US Treasury bonds $5,000 US Treasury bonds Bonds Term to Maturity Duration 10 7.12 years 20 16.95 years Total value of bonds Current Fair Market Value $10,000 5 5,000 $15,000 Stock X 6% Shares 1,000 575 200 500 1,000 1.250 Stock A Stock B Stock Stock D Stock Stock F Beta 065 0.75 0.65 0.70 0.95 1.10 Stocks P/E R Ratio 11% 75% 13.0 9% 65% 14.0 10% 30% 15.1 8% 45% 25.2 15% 70% 14.4 18% 20% 11.1 7% 3% 25% 22% Dividend Yield Basis 3.0% $30.000 3.7% $45.000 3.7% $20,000 0.0% $11,000 00% $20,000 0.0% $23,000 Total value of stocks Fair Market Value $ 38,000 $ 46,000 $ 17,000 $ 8,500 5 18.000 $ 25,000 $152.500 Mutual Funds Shares 210 Mutual Fund Fund A Style MG LG Bela 110 52 57% Fund 300 40 X 54% 11.5% 6% -6% 4% 7% Alpha 3% 5% (4%) (10%) 33%) 25%) 04 0.65 Fund Fundo Fund Fund F Front-End Expense Load Ratio Basis 4.55 71% $ 2.500 10% $5.000 455 2.29% $10.000 45 185% $ 8.000 ON 15 $9.500 35 1.5% $10.000 Total value of mutual funds Fair Market Value $ 205 $ 5.100 $11.09 5 7.500 $ 8.000 5.8.200 $42.500 1.000 320 410 MG LG LO 0.70 110 0.90 20% 5 50% 78% 3% Nobel Altitude TOTAL PORTFOUO VALVE 5210,000 Key X 5-year average retum Standard deviation Coefficient of determination Large R L M G V Medium Growth Value What is the weighted duration of the bond portfolio portion of Elaine's investment port-folio? What is the holding period return (HPR) for Elaine's stock portfolio portion held in her investment portfolio? | What is the weighted beta of Elaine's mutual funds located in her investment portfolio