Answered step by step

Verified Expert Solution

Question

1 Approved Answer

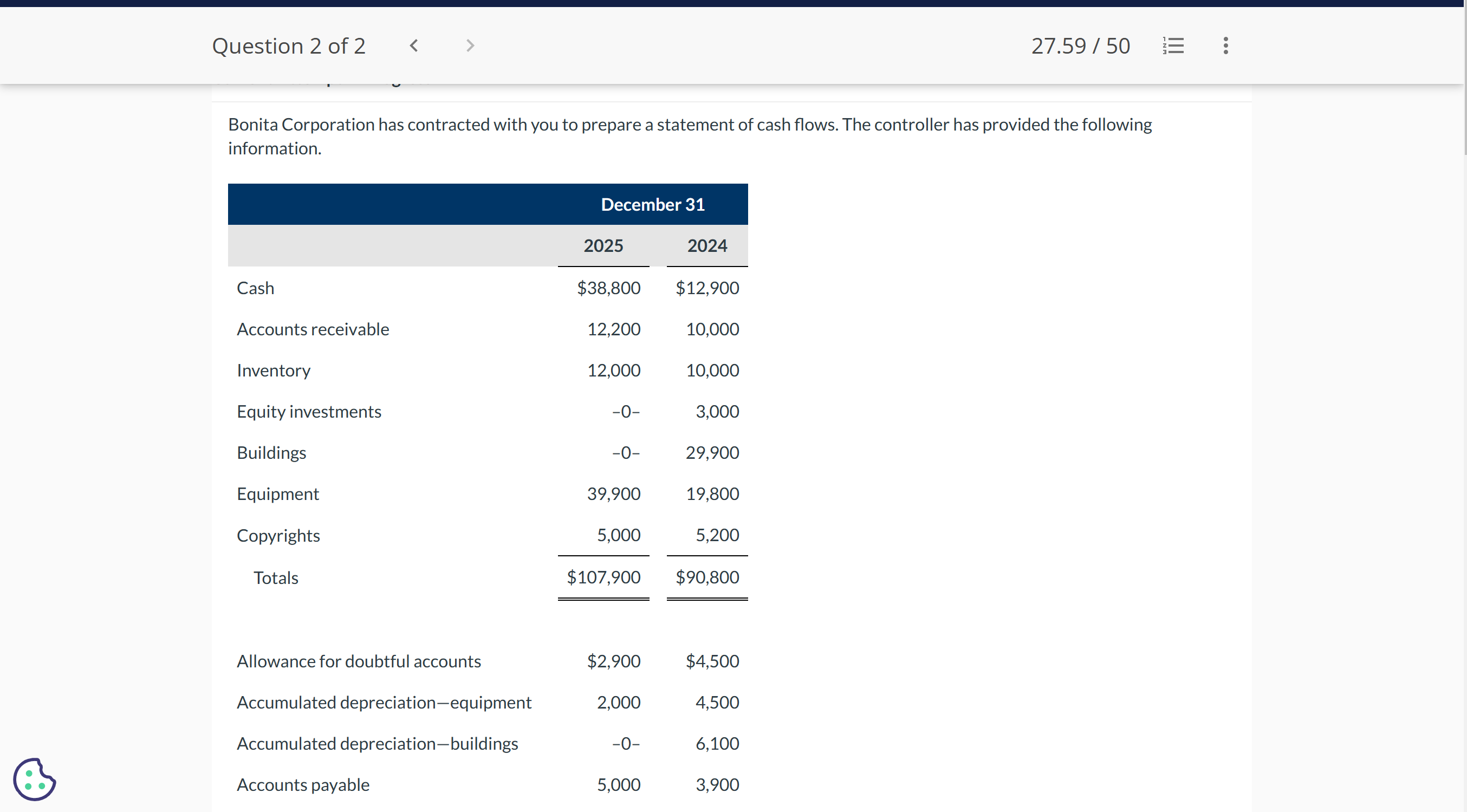

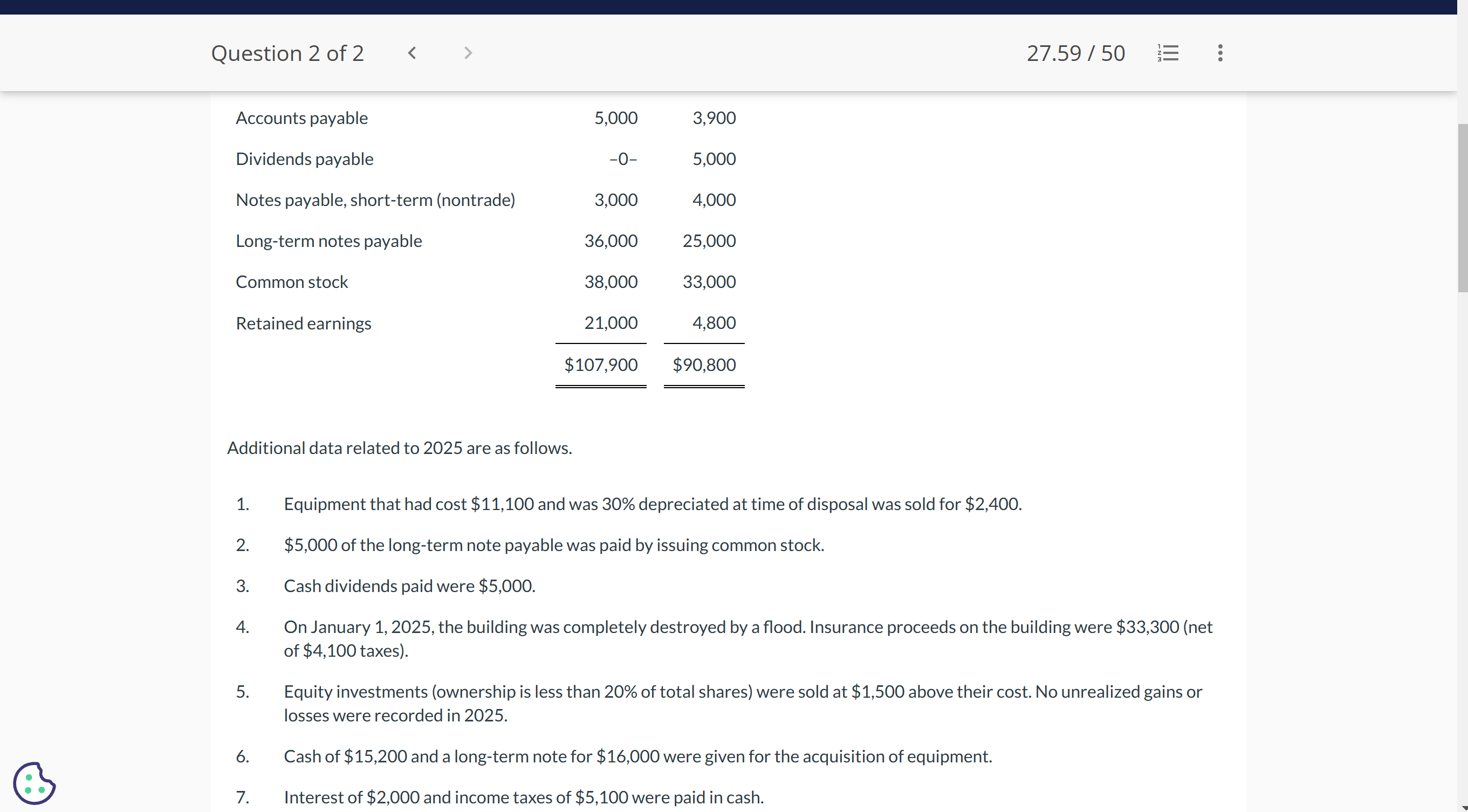

Bonita Corporation has contracted with you to prepare a statement of cash flows. The controller has provided the following information. Additional data related to 2025

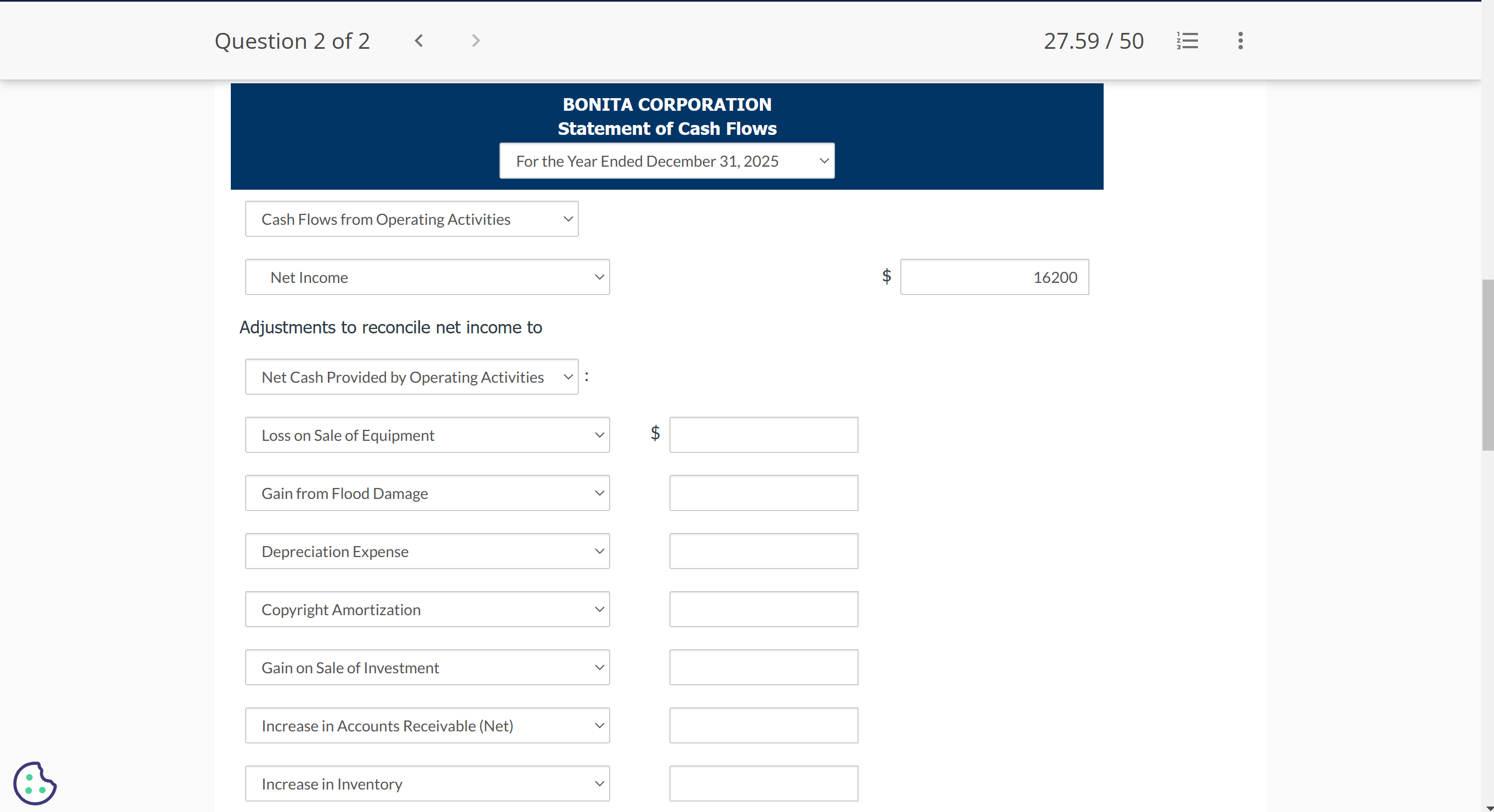

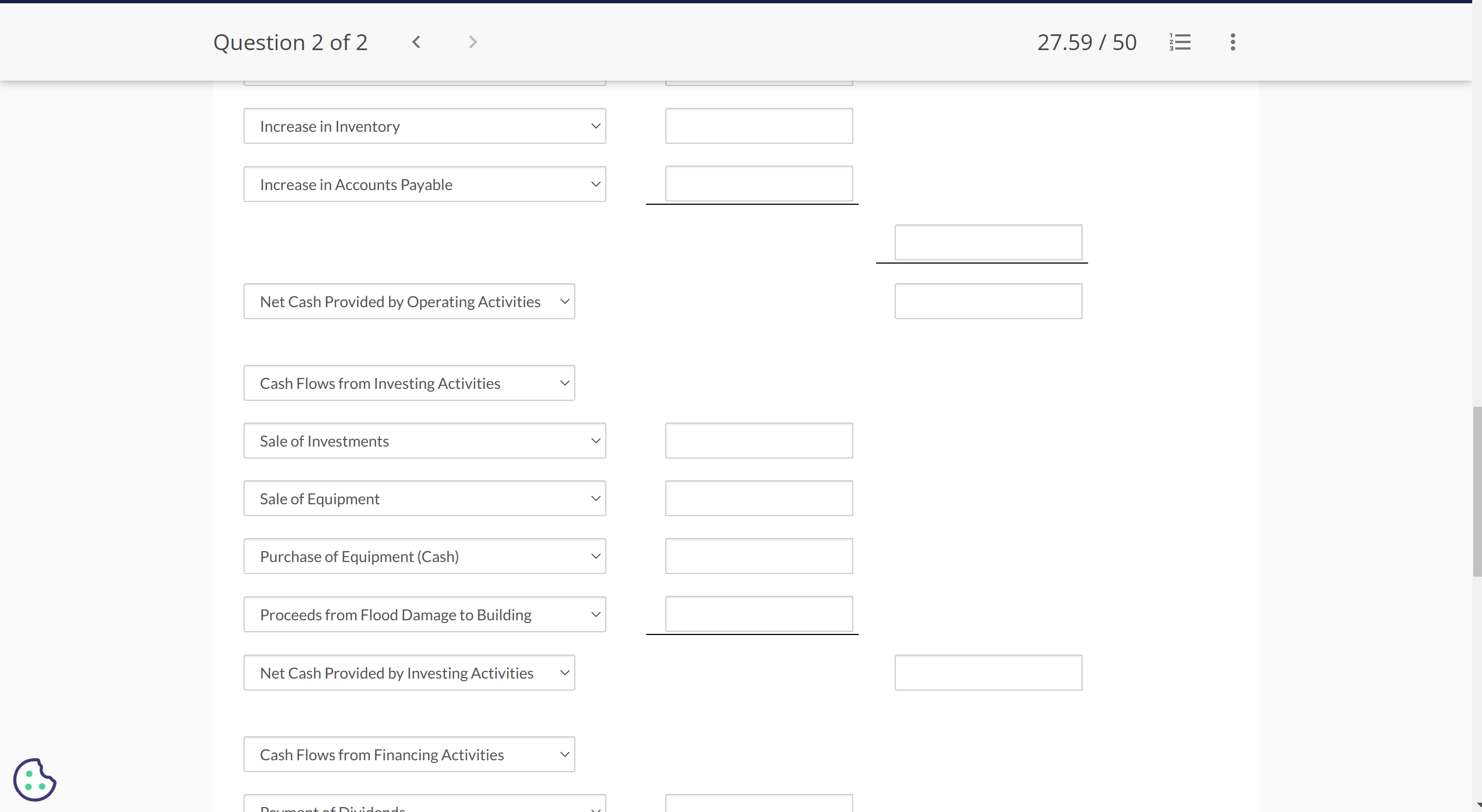

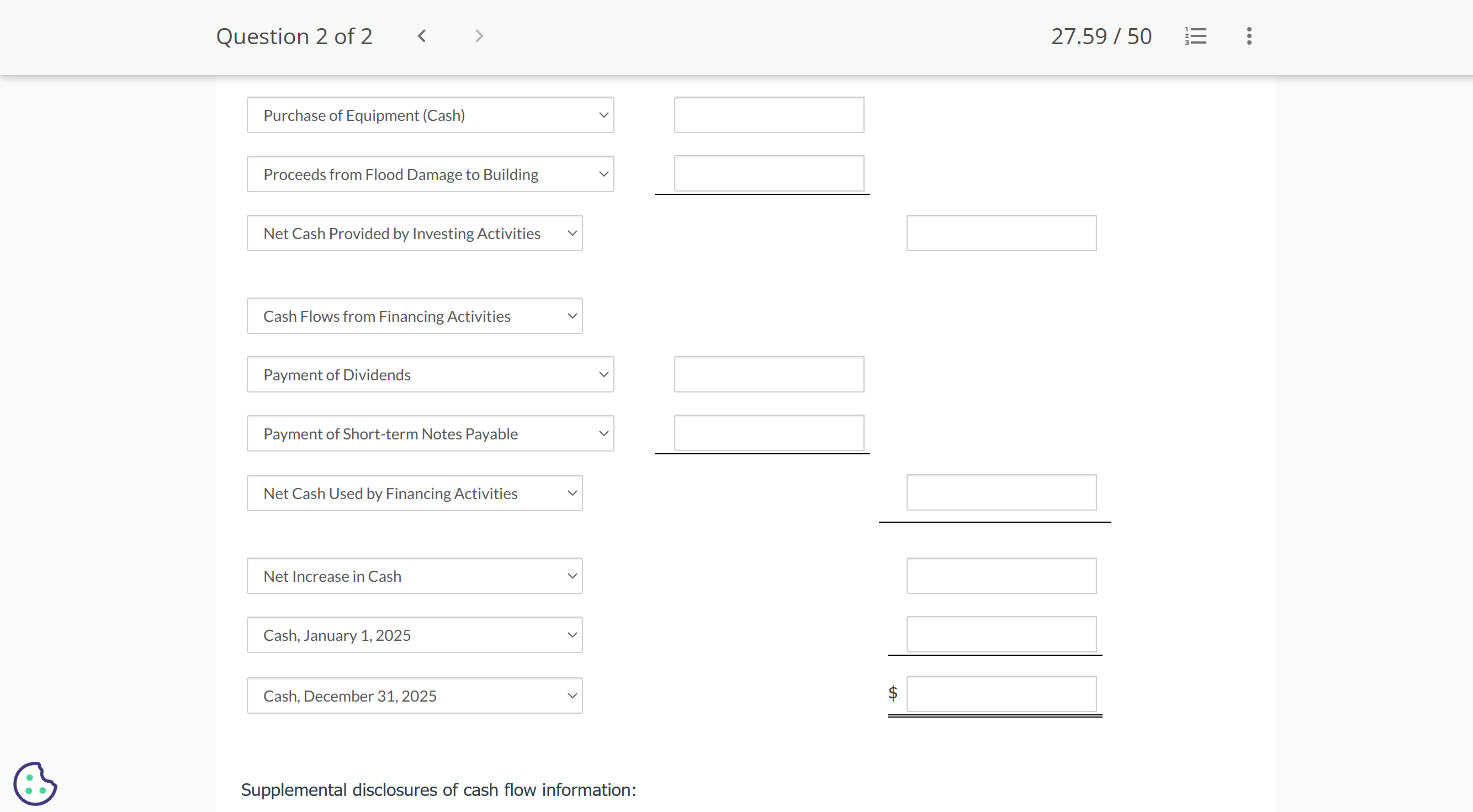

Bonita Corporation has contracted with you to prepare a statement of cash flows. The controller has provided the following information. Additional data related to 2025 are as follows. 1. Equipment that had cost $11,100 and was 30% depreciated at time of disposal was sold for $2,400. 2. $5,000 of the long-term note payable was paid by issuing common stock. 3. Cash dividends paid were $5,000. 4. On January 1, 2025, the building was completely destroyed by a flood. Insurance proceeds on the building were $33,300 (net of $4,100 taxes). 5. Equity investments (ownership is less than 20% of total shares) were sold at $1,500 above their cost. No unrealized gains or losses were recorded in 2025 . 6. Cash of $15,200 and a long-term note for $16,000 were given for the acquisition of equipment. 7. Interest of $2,000 and income taxes of $5,100 were paid in cash. Question 2 of 2 27.59/503i BONITA CORPORATION Statement of Cash Flows For the Year Ended December 31, 2025 Cash Flows from Operating Activities Net Income Adjustments to reconcile net income to Net Cash Provided by Operating Activities : Loss on Sale of Equipment $ Gain from Flood Damage Depreciation Expense Copyright Amortization Gain on Sale of Investment Increase in Accounts Receivable (Net) 0 Increase in Inventory Question 2 of 2 27.59/50 : Increase in Inventory Increase in Accounts Payable Net Cash Provided by Operating Activities Cash Flows from Investing Activities Sale of Investments Sale of Equipment Purchase of Equipment (Cash) Proceeds from Flood Damage to Building Net Cash Provided by Investing Activities Cash Flows from Financing Activities Supplemental disclosures of cash flow information: Bonita Corporation has contracted with you to prepare a statement of cash flows. The controller has provided the following information. Additional data related to 2025 are as follows. 1. Equipment that had cost $11,100 and was 30% depreciated at time of disposal was sold for $2,400. 2. $5,000 of the long-term note payable was paid by issuing common stock. 3. Cash dividends paid were $5,000. 4. On January 1, 2025, the building was completely destroyed by a flood. Insurance proceeds on the building were $33,300 (net of $4,100 taxes). 5. Equity investments (ownership is less than 20% of total shares) were sold at $1,500 above their cost. No unrealized gains or losses were recorded in 2025 . 6. Cash of $15,200 and a long-term note for $16,000 were given for the acquisition of equipment. 7. Interest of $2,000 and income taxes of $5,100 were paid in cash. Question 2 of 2 27.59/503i BONITA CORPORATION Statement of Cash Flows For the Year Ended December 31, 2025 Cash Flows from Operating Activities Net Income Adjustments to reconcile net income to Net Cash Provided by Operating Activities : Loss on Sale of Equipment $ Gain from Flood Damage Depreciation Expense Copyright Amortization Gain on Sale of Investment Increase in Accounts Receivable (Net) 0 Increase in Inventory Question 2 of 2 27.59/50 : Increase in Inventory Increase in Accounts Payable Net Cash Provided by Operating Activities Cash Flows from Investing Activities Sale of Investments Sale of Equipment Purchase of Equipment (Cash) Proceeds from Flood Damage to Building Net Cash Provided by Investing Activities Cash Flows from Financing Activities Supplemental disclosures of cash flow information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started