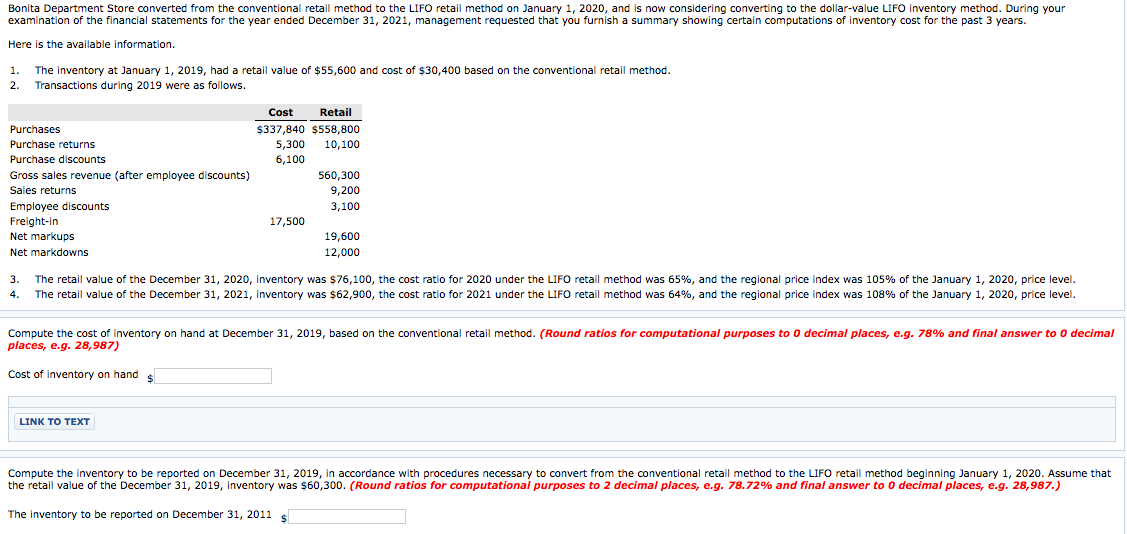

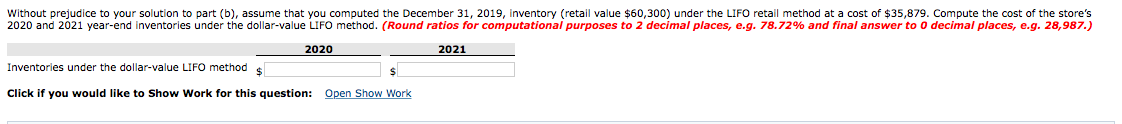

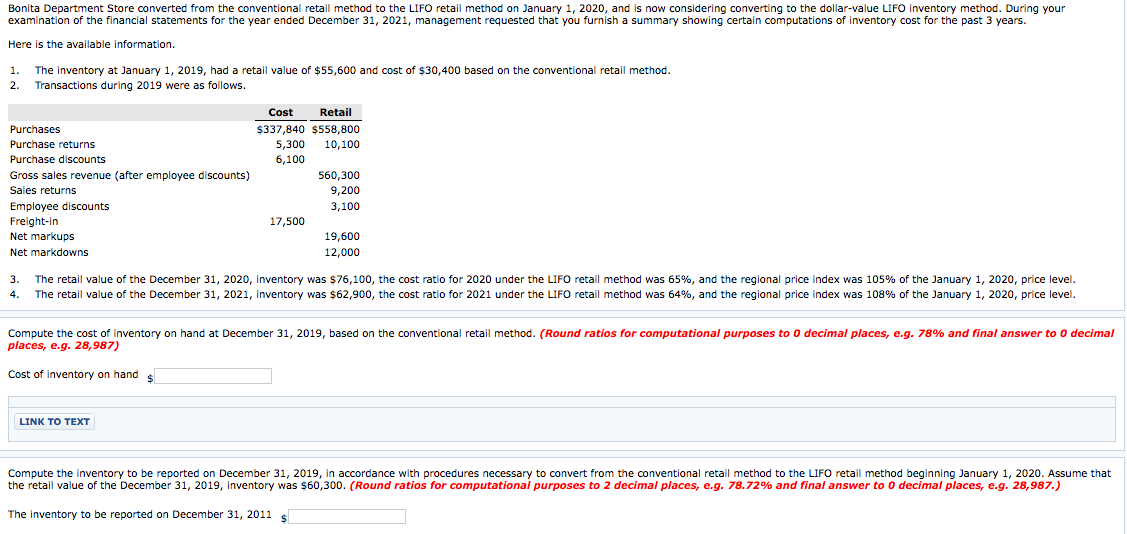

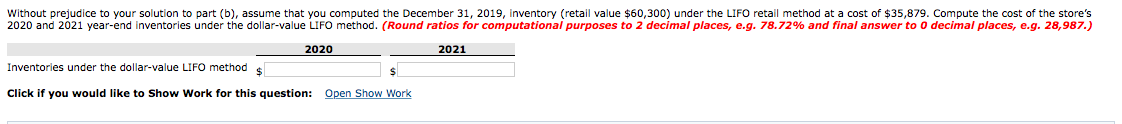

Bonita Department Store converted from the conventional retail method to the LIFO retail method on January 1, 2020, and is now considering converting to the dollar-value LIFO inventory method. During your examination of the financial statements for the year ended December 31, 2021, management requested that you furnish a summary showing certain computations of inventory cost for the past 3 years. Here is the available information. 1. 2. The inventory at January 1, 2019, had a retail value of $55,600 and cost of $30,400 based on the conventional retail method. Transactions during 2019 were as follows. Purchases Purchase returns Purchase discounts Gross sales revenue (after employee discounts) Sales returns Employee discounts Freight-in Net markups Net markdowns Cost Retail $337,840 $558,800 5,300 10,100 6,100 560,300 9,200 3,100 17,500 19,600 12,000 3. 4. The retail value of the December 31, 2020, inventory was $76,100, the cost ratio for 2020 under the LIFO retail method was 65%, and the regional price index was 105% of the January 1, 2020, price level. The retail value of the December 31, 2021, inventory was $62,900, the cost ratio for 2021 under the LIFO retail method was 64%, and the regional price index was 108% of the January 1, 2020, price level. Compute the cost of inventory on hand at December 31, 2019, based on the conventional retail method. (Round ratios for computational purposes to o decimal places, e.g. 78% and final answer to o decimal places, e.g. 28,987) Cost of inventory on hand $ LINK TO TEXT Compute the inventory to be reported on December 31, 2019, in accordance with procedures necessary to convert from the conventional retail method to the LIFO retail method beginning January 1, 2020. Assume that the retail value of the December 31, 2019, inventory was $60,300. (Round ratios for computational purposes to 2 decimal places, e.g. 78.72% and final answer to o decimal places, e.g. 28,987.) The inventory to be reported on December 31, 2011 si Without prejudice to your solution to part (b), assume that you computed the December 31, 2019, inventory (retail value $60,300) under the LIFO retail method at a cost of $35,879. Compute the cost of the store's 2020 and 2021 year-end Inventories under the dollar-value LIFO method. (Round ratios for computational purposes to 2 decimal places, e.g. 78.72% and final answer to o decimal places, e.g. 28,987.) 2020 2021 Inventories under the dollar-value LIFO methods Click if you would like to Show Work for this question: Open Show Work Bonita Department Store converted from the conventional retail method to the LIFO retail method on January 1, 2020, and is now considering converting to the dollar-value LIFO inventory method. During your examination of the financial statements for the year ended December 31, 2021, management requested that you furnish a summary showing certain computations of inventory cost for the past 3 years. Here is the available information. 1. 2. The inventory at January 1, 2019, had a retail value of $55,600 and cost of $30,400 based on the conventional retail method. Transactions during 2019 were as follows. Purchases Purchase returns Purchase discounts Gross sales revenue (after employee discounts) Sales returns Employee discounts Freight-in Net markups Net markdowns Cost Retail $337,840 $558,800 5,300 10,100 6,100 560,300 9,200 3,100 17,500 19,600 12,000 3. 4. The retail value of the December 31, 2020, inventory was $76,100, the cost ratio for 2020 under the LIFO retail method was 65%, and the regional price index was 105% of the January 1, 2020, price level. The retail value of the December 31, 2021, inventory was $62,900, the cost ratio for 2021 under the LIFO retail method was 64%, and the regional price index was 108% of the January 1, 2020, price level. Compute the cost of inventory on hand at December 31, 2019, based on the conventional retail method. (Round ratios for computational purposes to o decimal places, e.g. 78% and final answer to o decimal places, e.g. 28,987) Cost of inventory on hand $ LINK TO TEXT Compute the inventory to be reported on December 31, 2019, in accordance with procedures necessary to convert from the conventional retail method to the LIFO retail method beginning January 1, 2020. Assume that the retail value of the December 31, 2019, inventory was $60,300. (Round ratios for computational purposes to 2 decimal places, e.g. 78.72% and final answer to o decimal places, e.g. 28,987.) The inventory to be reported on December 31, 2011 si Without prejudice to your solution to part (b), assume that you computed the December 31, 2019, inventory (retail value $60,300) under the LIFO retail method at a cost of $35,879. Compute the cost of the store's 2020 and 2021 year-end Inventories under the dollar-value LIFO method. (Round ratios for computational purposes to 2 decimal places, e.g. 78.72% and final answer to o decimal places, e.g. 28,987.) 2020 2021 Inventories under the dollar-value LIFO methods Click if you would like to Show Work for this question: Open Show Work