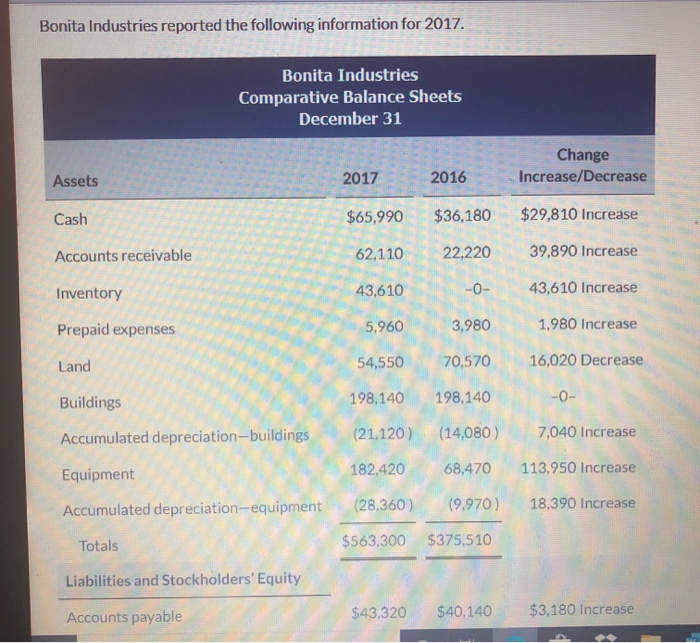

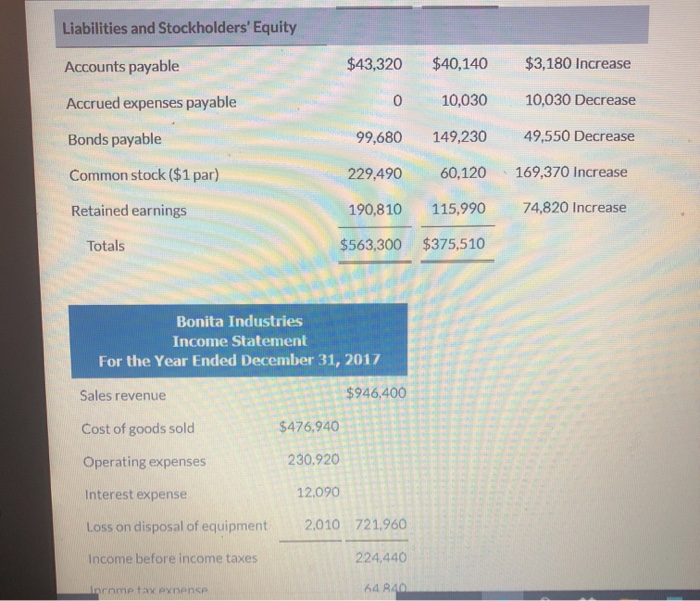

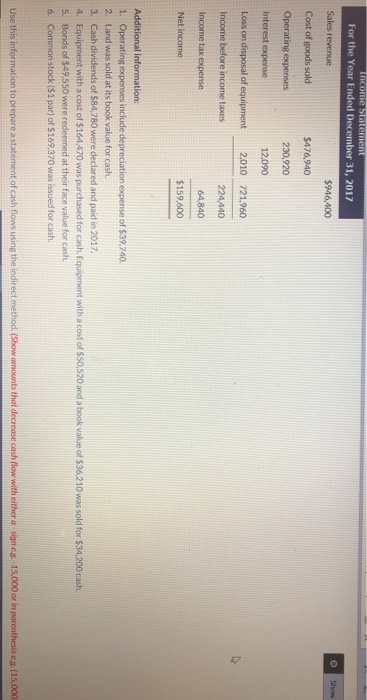

Bonita Industries reported the following information for 2017. Bonita Industries Comparative Balance Sheets December 31 Change Increase/Decrease Assets 2017 2016 Cash $65,990 $36,180 $29,810 Increase Accounts receivable 62,110 22,220 39,890 Increase Inventory 43,610 -0- 43,610 Increase Prepaid expenses 5,960 3,980 1,980 Increase Land 54,550 70,570 16,020 Decrease Buildings 198,140 198,140 -O- Accumulated depreciation-buildings (21,120) (14,080) 7,040 Increase Equipment 182,420 68,470 113,950 Increase Accumulated depreciation-equipment (28,360) (9,970 ) 18,390 Increase Totals $563,300 $375,510 Liabilities and Stockholders' Equity $43.320 Accounts payable $40,140 $3,180 Increase Liabilities and Stockholders' Equity Accounts payable $43,320 $40,140 $3,180 Increase Accrued expenses payable 0 10,030 10,030 Decrease 99,680 149,230 49,550 Decrease Bonds payable Common stock ($1 par) 229,490 60.120 169,370 Increase Retained earnings 190,810 115,990 74,820 Increase Totals $563,300 $375,510 Bonita Industries Income Statement For the Year Ended December 31, 2017 Sales revenue $946,400 Cost of goods sold $476,940 Operating expenses 230.920 Interest expense 12,090 Loss on disposal of equipment 2.010 721,960 Income before income taxes 224,440 prometax pynense 64 R40 Income Statement For the Year Ended December 31, 2017 Show $946,400 Sales revenue Cost of goods sold $476,940 Operating expenses 230,920 Interest expense 12,090 Loss on disposal of equipment 2,010 721,960 Income before income taxes 224.440 Income tax expense 64,840 Net Income $159.600 Additional information: 1. Operating expenses include depreciation expense of $39.740. 2. Land was sold at its book value for cash 3. Cash dividends of $84,780 were declared and paid in 2017 4. Equipment with a cost of $164,470 was purchased for cash. Equipment with a cost of $50,520 and a book value of $36.210 was sold for $34,200 cash 5. Bonds of $49,550 were redeemed at their face value for cash. 6. Common stock (51 par) of $169,370 was issued for cash. Use this information to prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a signes. 15.000 or in parenthesis es. (15.000 Bonita Industries Statement of Cash Flows-Indirect Method $ Adjustments to reconcile net income to $ > > > > >