Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bonus Problem (25 pts). A steel mill is considering adding additional, value-added processing to its output of rolled steel bars. The additional processing will provide

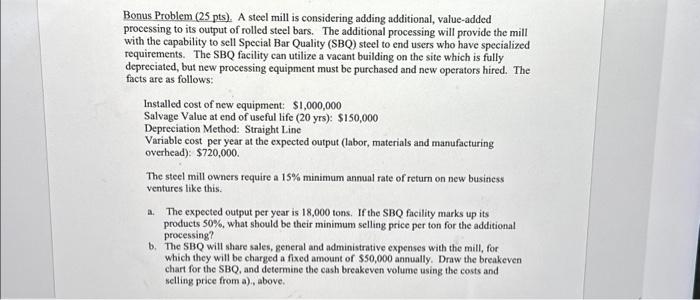

Bonus Problem (25 pts). A steel mill is considering adding additional, value-added processing to its output of rolled steel bars. The additional processing will provide the mill with the capability to sell Special Bar Quality (SBQ) steel to end users who have specialized requirements. The SBQ facility can utilize a vacant building on the site which is fully depreciated, but new processing equipment must be purchased and new operators hired. The facts are as follows: Installed cost of new equipment: $1,000,000 Salvage Value at end of useful life (20 yrs): $150,000 Depreciation Method: Straight Line Variable cost per year at the expected output (labor, materials and manufacturing overhead): $720,000. The steel mill owners require a 15% minimum annual rate of return on new business ventures like this. The expected output per year is 18,000 tons. If the SBQ facility marks up its products 50%, what should be their minimum selling price per ton for the additional processing? b. The SBQ will share sales, general and administrative expenses with the mill, for which they will be charged a fixed amount of $50,000 annually. Draw the breakeven chart for the SBQ, and determine the cash breakeven volume using the costs and selling price from a)., above. a.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started