Answered step by step

Verified Expert Solution

Question

1 Approved Answer

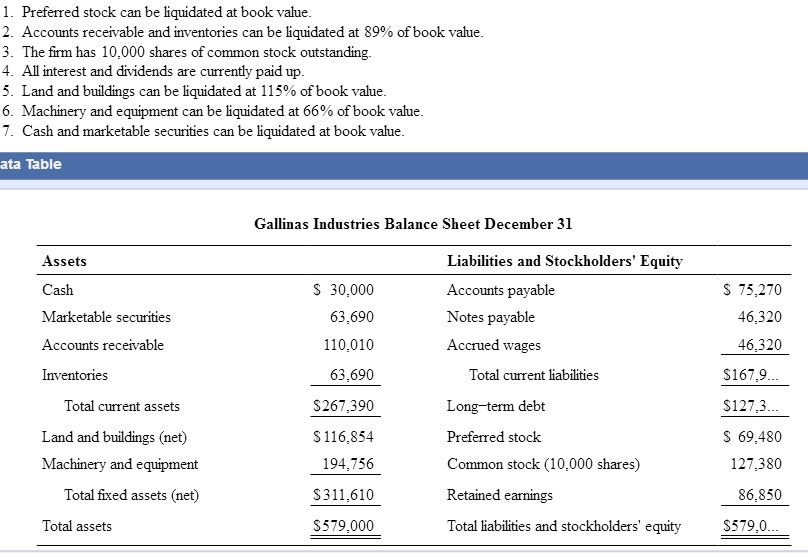

Book and liquidation value. The balance sheet for Gallinas Industries is as follows: a. Galiinas Industries' book value per share is ________________? b. Gallinas Industries'

Book and liquidation value.

The balance sheet for Gallinas Industries is as follows:

a. Galiinas Industries' book value per share is ________________?

b. Gallinas Industries' liquidation value per share is ____________?

1. Preferred stock can be liquidated at book value. 2. Accounts receivable and inventories can be liquidated at 89% of book value 3. The firm has 10,000 shares of common stock outstanding 4. Allinterest and dividends are currently paid up. 5. Land and buildings can be liquidated at 115% of book value. 6. Machinery and equipment can be liquidated at 66% of book value. 7. Cash and marketable securities can be liquidated at book value ata Table Gallinas Industries Balance Sheet December 31 Liabilities and Stockholders' Equity Assets S 30,000 S 75,270 Accounts payable 63,690 Marketable securities 46.320 Notes payable 46,320 Accounts receivable 110.010 Accrued wages 63,690 $167,9 Inventories Total current liabilities $267,390 S127,3 Total current assets Long-term debt 116,854 69,480 Land and buildings (net) Preferred stock 127, 380 Machinery and equipment 194,756 Common stock (10.000 shares 311,610 Total fixed assets (net Retained earnings 86,850 $579,000 Total liabilities and stockholders' equity $579.0 Total assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started