Answered step by step

Verified Expert Solution

Question

1 Approved Answer

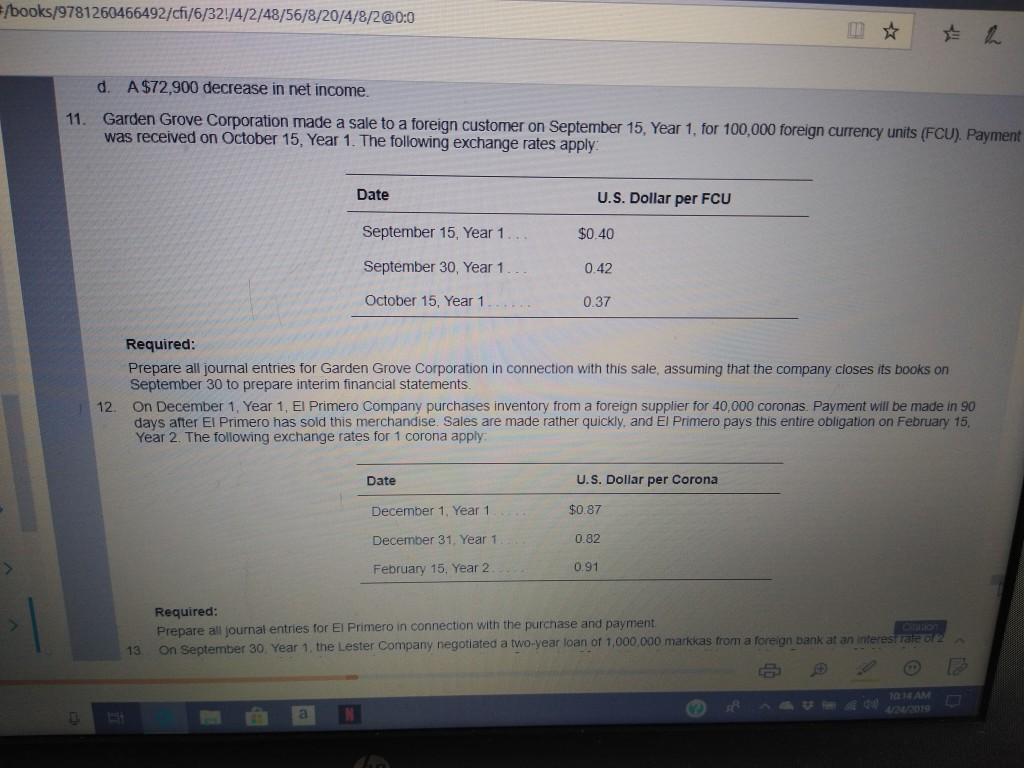

/books/9781260466492/cfi/6/321/4/2/48/56/8/20/4/8/2@0:0 A$72,900 decrease in net income. d. 11. Garden Grove Corporation made a sale to a foreign customer on September 15, Year 1, for 100,000

/books/9781260466492/cfi/6/321/4/2/48/56/8/20/4/8/2@0:0 A$72,900 decrease in net income. d. 11. Garden Grove Corporation made a sale to a foreign customer on September 15, Year 1, for 100,000 foreign currency units (FCU) ). Payment was received on October 15, Year 1. The following exchange rates apply Date U.S. Dollar per FCU $0.40 0.42 0.37 September 15, Year 1 September 30, Year 1 October 15, Year 1 Required Prepare all journal entries for Garden Grove Corporation in connection with this sale, assuming that the company closes its books on September 30 to prepare interim financial statements 12. On December 1, Year 1, El Primero Company purchases inventory from a foreign supplier for 40,000 coronas. Payment will be made in 90 days after El Primero has sold this merchandise. Sales are made rather quickly, and El Primero pays this entire obligation on February 15, Year 2. The following exchange rates for 1 corona apply U.S. Dollar per Corona Date December 1, Year 1 December 31, Year 1 February 15, Year 2 $0.87 0.82 0.91 Required: Prepare all journal entries for El Primero in connection with the purchase and payment On September 30, Year 1. the Lester Company negotiated a two-year loan dr 1,000,000 markkas from a foreign bank at an interest rate 13 014 AM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started