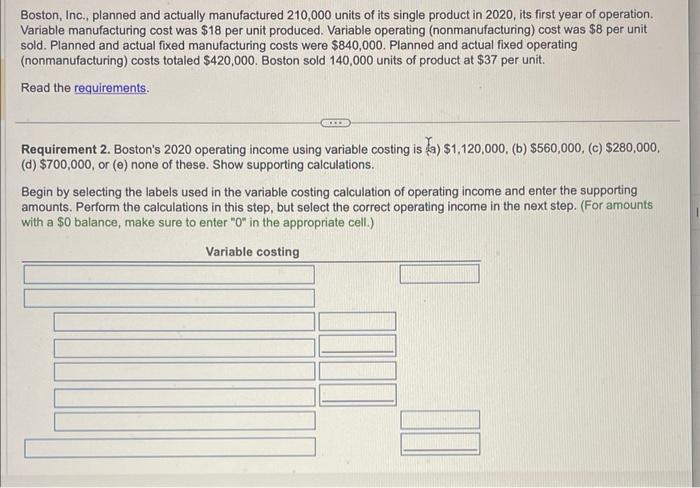

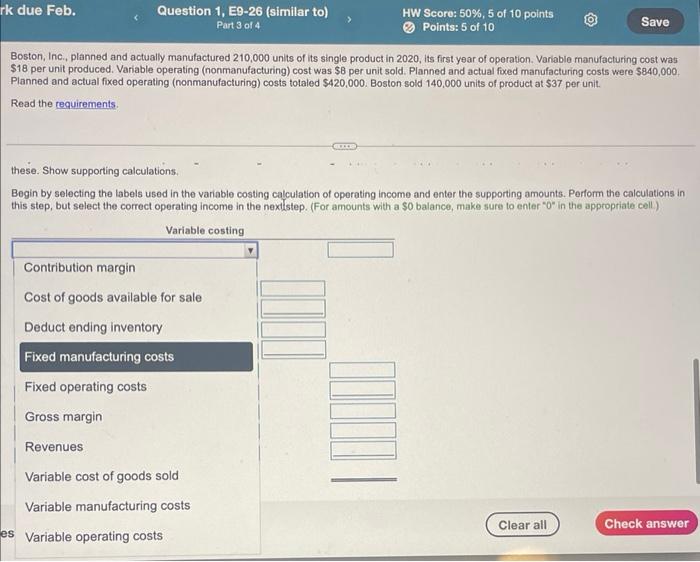

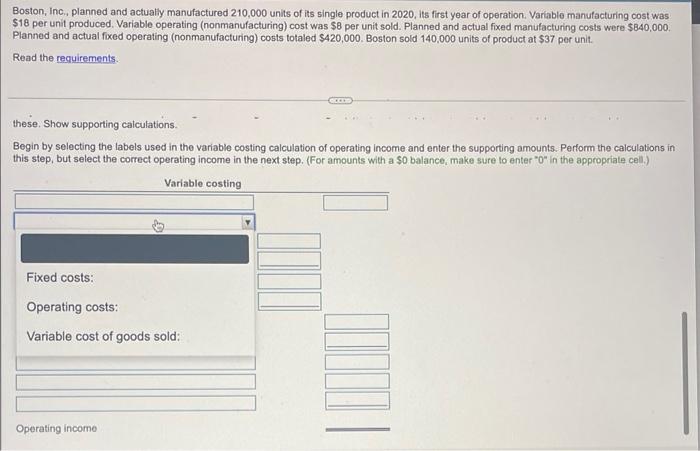

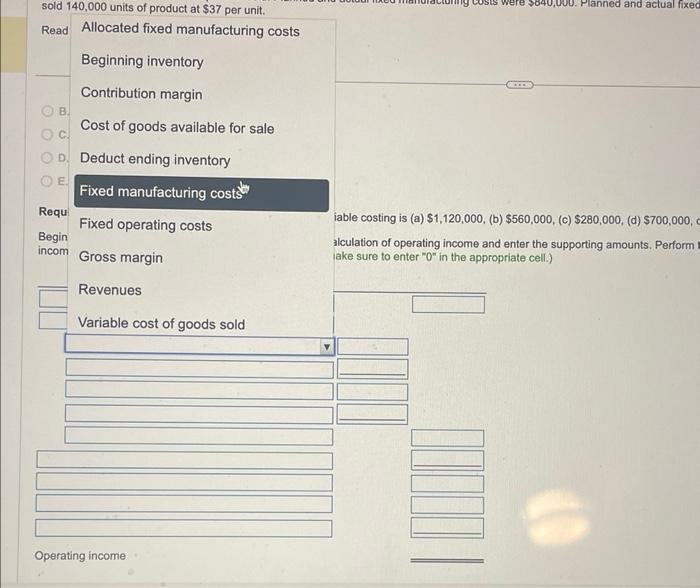

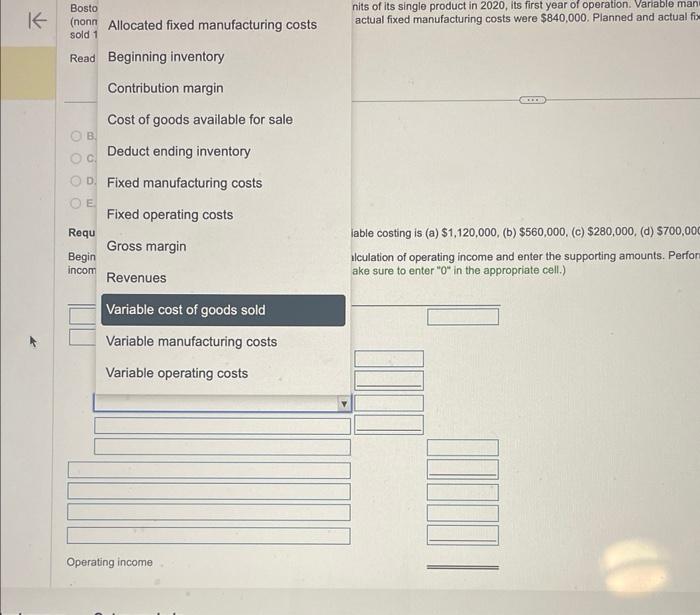

Boston, Inc., planned and actually manufactured 210,000 units of its single product in 2020 , its first year of operation. Variable manufacturing cost was $18 per unit produced. Variable operating (nonmanufacturing) cost was $8 per unit sold. Planned and actual fixed manufacturing costs were $840,000. Planned and actual fixed operating (nonmanufacturing) costs totaled $420,000. Boston sold 140,000 units of product at $37 per unit. Read the requirements. Requirement 2. Boston's 2020 operating income using variable costing is sa) $1,120,000, (b) $560,000, (c) $280,000, (d) $700,000, or (e) none of these. Show supporting calculations. Begin by selecting the labels used in the variable costing calculation of operating income and enter the supporting amounts. Perform the calculations in this step, but select the correct operating income in the next step. (For amounts with a $0 balance, make sure to enter " 0 in the appropriate cell.) Boston, Inc., planned and actually manufactured 210,000 units of its single product in 2020 , its first year of operation. Variable manufacturing cost was $18 per unit produced. Variable operating (nonmanufacturing) cost was $8 per unit sold. Planned and actual fixed manufacturing costs were $840,000. Planned and actual fixed operating (nonmanufacturing) costs totaled $420,000. Boston sold 140,000 units of product at $37 per unit. Read the requirements. these. Show supporting calculations. Begin by selecting the labels used in the variable costing calculation of operating income and enter the supporting amounts. Pertorm the calculations in this step, but select the correct operating income in the nextstep. (For amounts with a so balance, make sure to enter 0 in the appropriate cell) Boston, Inc, planned and actually manufactured 210,000 units of its single product in 2020 , its first year of operation. Variable manufacturing cost was $18 per unit produced. Variable operating (nonmanufacturing) cost was $8 per unit sold. Planned and actual fixed manufacturing costs were $840,000. Planned and actual fixed operating (nonmanufacturing) costs totaled $420,000. Boston sold 140,000 units of product at $37 per unit. Read the requirements. these. Show supporting calculations. Begin by selecting the labels used in the variable costing calculation of operating income and enter the supporting amounts. Perform the calculations in this step, but select the correct operating income in the next step. (For amounts with a $0 balance, make sure to enter " 0 in the appropriale cell.) iable costing is (a) $1,120,000, (b) $560,000, (c) $280,000, (d) $700,000, lculation of operating income and enter the supporting amounts. Perform ake sure to enter " 0" in the appropriate cell.) nits of its single product in 2020 , its first year of operation. Variable man actual fixed manufacturing costs were $840,000. Planned and actual fix lable costing is (a) $1,120,000, (b) $560,000, (c) $280,000, (d) $700,000 alculation of operating income and enter the supporting amounts. Perfon ake sure to enter " 0 " in the appropriate cell.)