Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Now very urgent, write 200, 300 words or so on it, thank you very much! I want an answer within an hour 1 PART 1

Now very urgent, write 200, 300 words or so on it, thank you very much! I want an answer within an hour

1

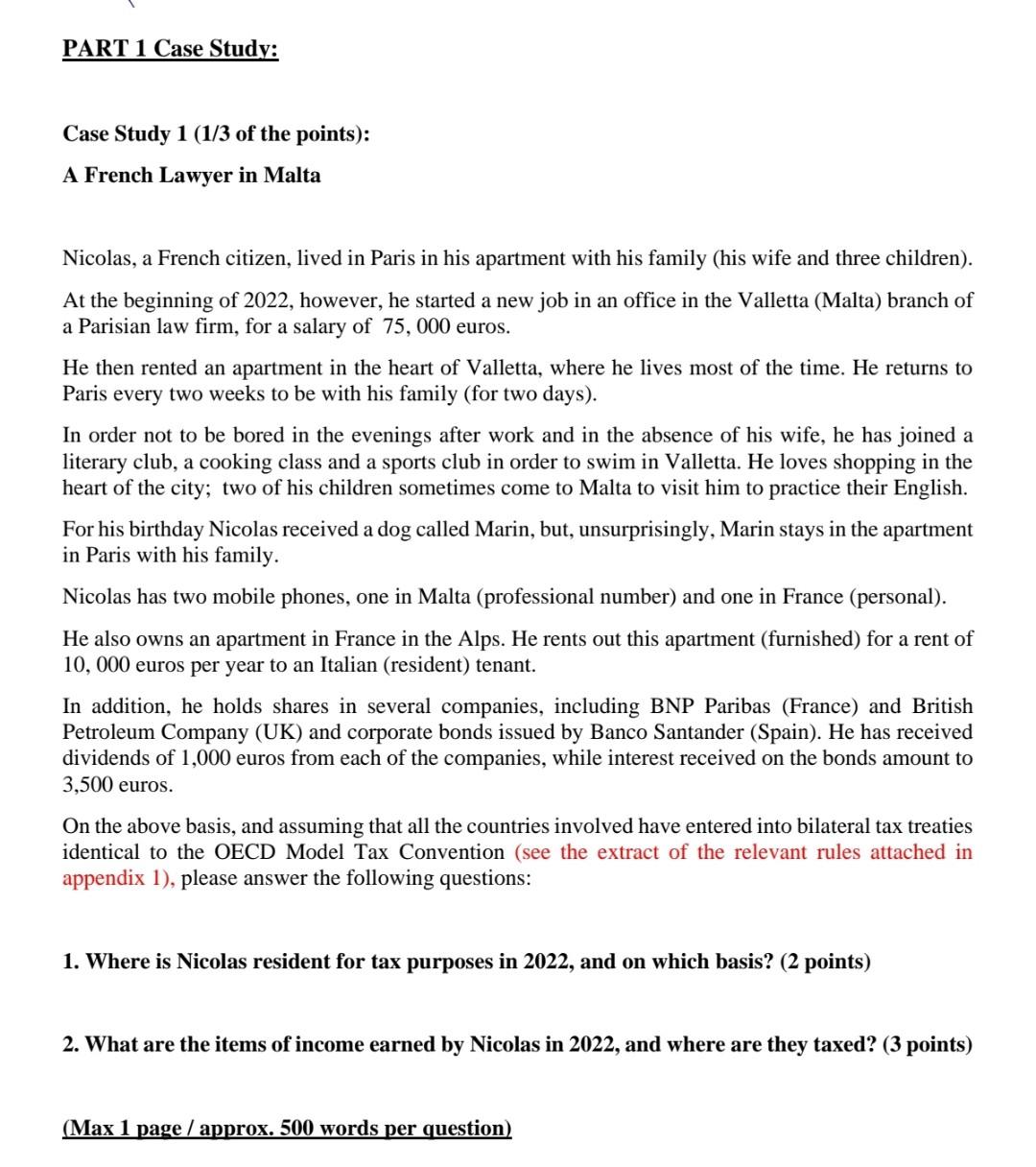

PART 1 Case Study: Case Study 1 (1/3 of the points): A French Lawyer in Malta Nicolas, a French citizen, lived in Paris in his apartment with his family (his wife and three children). At the beginning of 2022, however, he started a new job in an office in the Valletta (Malta) branch of a Parisian law firm, for a salary of 75, 000 euros. He then rented an apartment in the heart of Valletta, where he lives most of the time. He returns to Paris every two weeks to be with his family (for two days). In order not to be bored in the evenings after work and in the absence of his wife, he has joined a literary club, a cooking class and a sports club in order to swim in Valletta. He loves shopping in the heart of the city; two of his children sometimes come to Malta to visit him to practice their English. For his birthday Nicolas received a dog called Marin, but, unsurprisingly, Marin stays in the apartment in Paris with his family. Nicolas has two mobile phones, one in Malta (professional number) and one in France (personal). He also owns an apartment in France in the Alps. He rents out this apartment (furnished) for a rent of 10, 000 euros per year to an Italian (resident) tenant. In addition, he holds shares in several companies, including BNP Paribas (France) and British Petroleum Company (UK) and corporate bonds issued by Banco Santander (Spain). He has received dividends of 1,000 euros from each of the companies, while interest received on the bonds amount to 3,500 euros. On the above basis, and assuming that all the countries involved have entered into bilateral tax treaties identical to the OECD Model Tax Convention (see the extract of the relevant rules attached in appendix 1), please answer the following questions: 1. Where is Nicolas resident for tax purposes in 2022, and on which basis? (2 points) 2. What are the items of income earned by Nicolas in 2022, and where are they taxed? (3 points) (Max 1 page / approx. 500 words per question)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started