Answered step by step

Verified Expert Solution

Question

1 Approved Answer

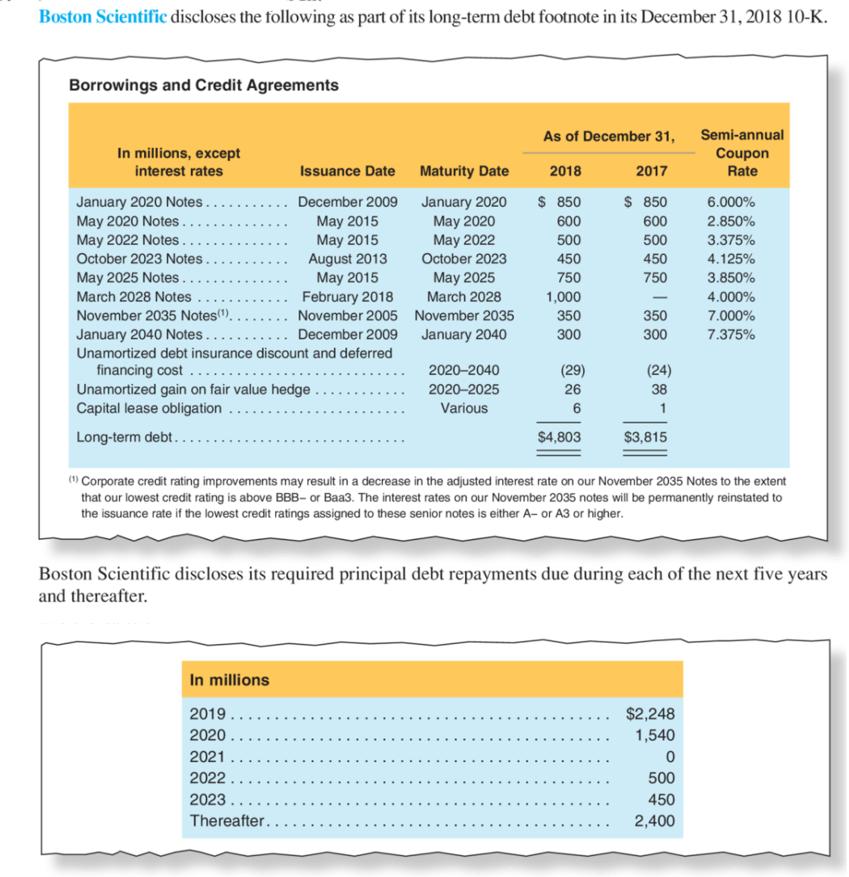

Boston Scientific discloses the following as part of its long-term debt footnote in its December 31, 2018 10-K. Borrowings and Credit Agreements In millions,

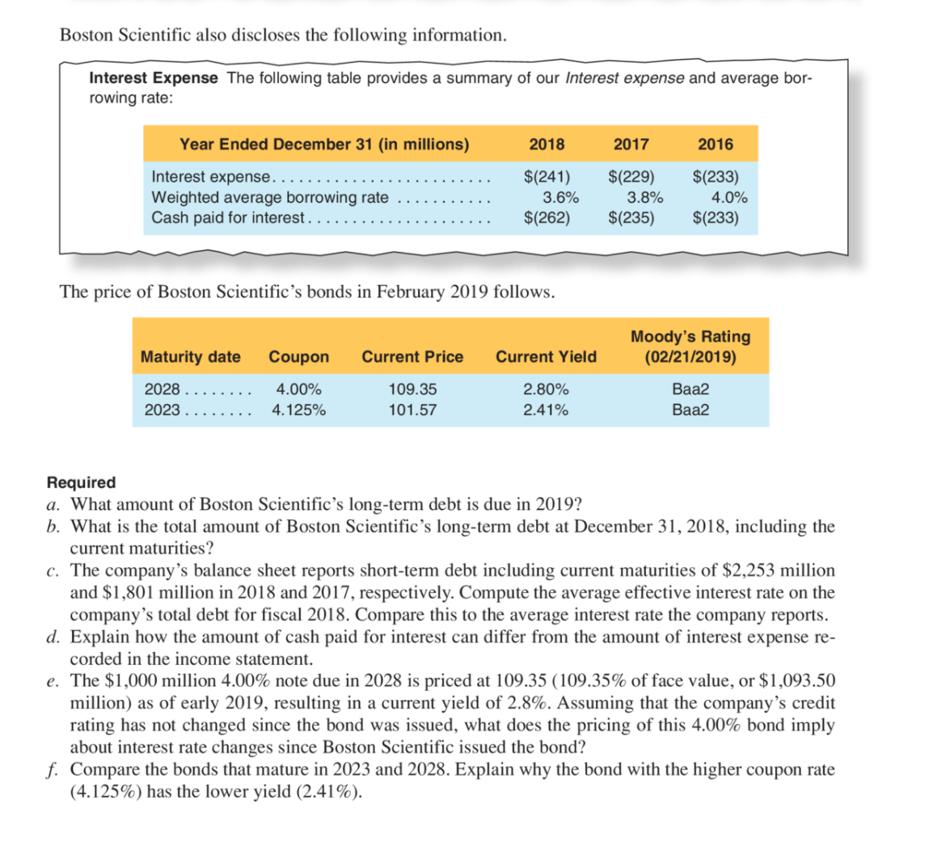

Boston Scientific discloses the following as part of its long-term debt footnote in its December 31, 2018 10-K. Borrowings and Credit Agreements In millions, except interest rates January 2020 Notes.. May 2020 Notes... May 2022 Notes.. October 2023 Notes. May 2025 Notes... March 2028 Notes. November 2035 Notes().. January 2040 Notes.... December 2009 Unamortized debt insurance discount and deferred financing cost..... Unamortized gain on fair value hedge. Capital lease obligation .. Long-term debt........ Issuance Date December 2009 May 2015 May 2015 August 2013 May 2015 February 2018 November 2005 In millions Maturity Date January 2020 May 2020 May 2022 October 2023 2019.. 2020.. 2021.. 2022.. 2023.. Thereafter. May 2025 March 2028 November 2035 January 2040 2020-2040 2020-2025 Various As of December 31, 2017 $ 850 600 500 450 750 2018 $ 850 600 500 450 750 1,000 350 300 (29) 26 6 $4,803 350 300 (24) 38 1 $3,815 (1) Corporate credit rating improvements may result in a decrease in the adjusted interest rate on our November 2035 Notes to the extent that our lowest credit rating is above BBB- or Baa3. The interest rates on our November 2035 notes will be permanently reinstated to the issuance rate if the lowest credit ratings assigned to these senior notes is either A- or A3 or higher. Boston Scientific discloses its required principal debt repayments due during each of the next five years and thereafter. Semi-annual Coupon Rate $2,248 1,540 6.000% 2.850% 3.375% 4.125% 3.850% 4.000% 7.000% 7.375% 0 500 450 2,400 Boston Scientific also discloses the following information. Interest Expense The following table provides a summary of our Interest expense and average bor- rowing rate: Year Ended December 31 (in millions) Interest expense.... Weighted average borrowing rate Cash paid for interest..... Maturity date Coupon 4.00% 2028... 2023. 4.125% .... The price of Boston Scientific's bonds in February 2019 follows. Current Price 2018 $(241) 109.35 101.57 3.6% $(262) Current Yield 2.80% 2.41% 2017 $(229) 3.8% 2016 $(233) 4.0% $(235) $(233) Moody's Rating (02/21/2019) Baa2 Baa2 Required a. What amount of Boston Scientific's long-term debt is due in 2019? b. What is the total amount of Boston Scientific's long-term debt at December 31, 2018, including the current maturities? c. The company's balance sheet reports short-term debt including current maturities of $2,253 million and $1,801 million in 2018 and 2017, respectively. Compute the average effective interest rate on the company's total debt for fiscal 2018. Compare this to the average interest rate the company reports. d. Explain how the amount of cash paid for interest can differ from the amount of interest expense re- corded in the income statement. e. The $1,000 million 4.00% note due in 2028 is priced at 109.35 (109.35% of face value, or $1,093.50 million) as of early 2019, resulting in a current yield of 2.8%. Assuming that the company's credit rating has not changed since the bond was issued, what does the pricing of this 4.00% bond imply about interest rate changes since Boston Scientific issued the bond? f. Compare the bonds that mature in 2023 and 2028. Explain why the bond with the higher coupon rate (4.125%) has the lower yield (2.41%).

Step by Step Solution

★★★★★

3.37 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

a The amount of Boston Scientifics longterm debt due in 2019 can be calculated by summing up the principal debt repayments due in that year According to the information provided the principal debt rep...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started