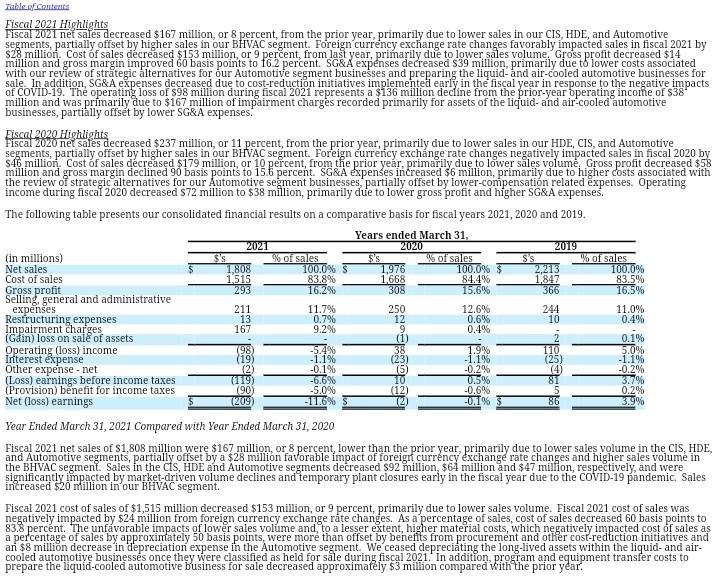

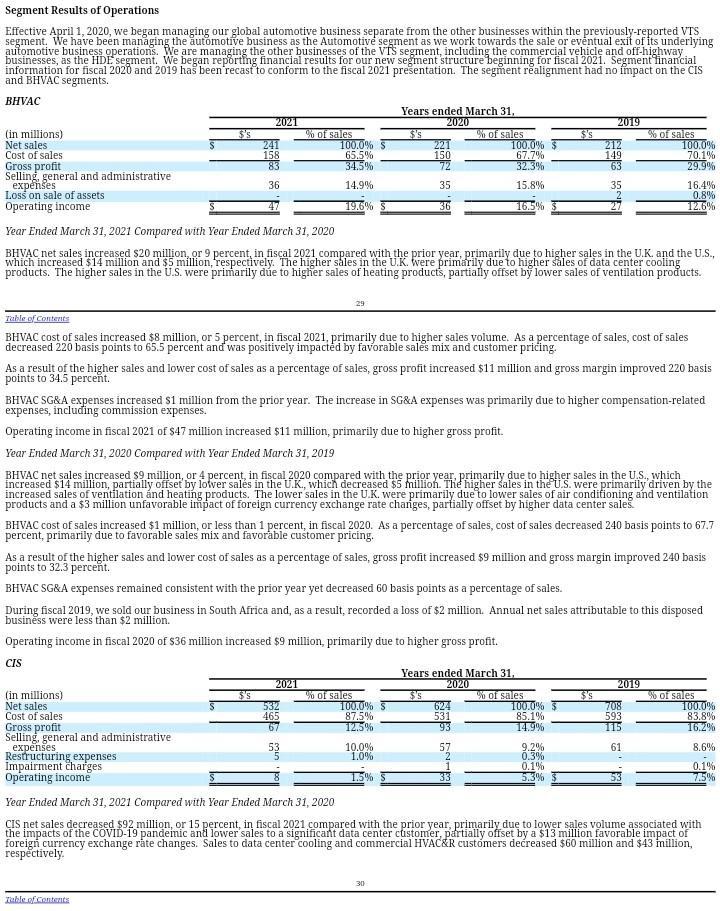

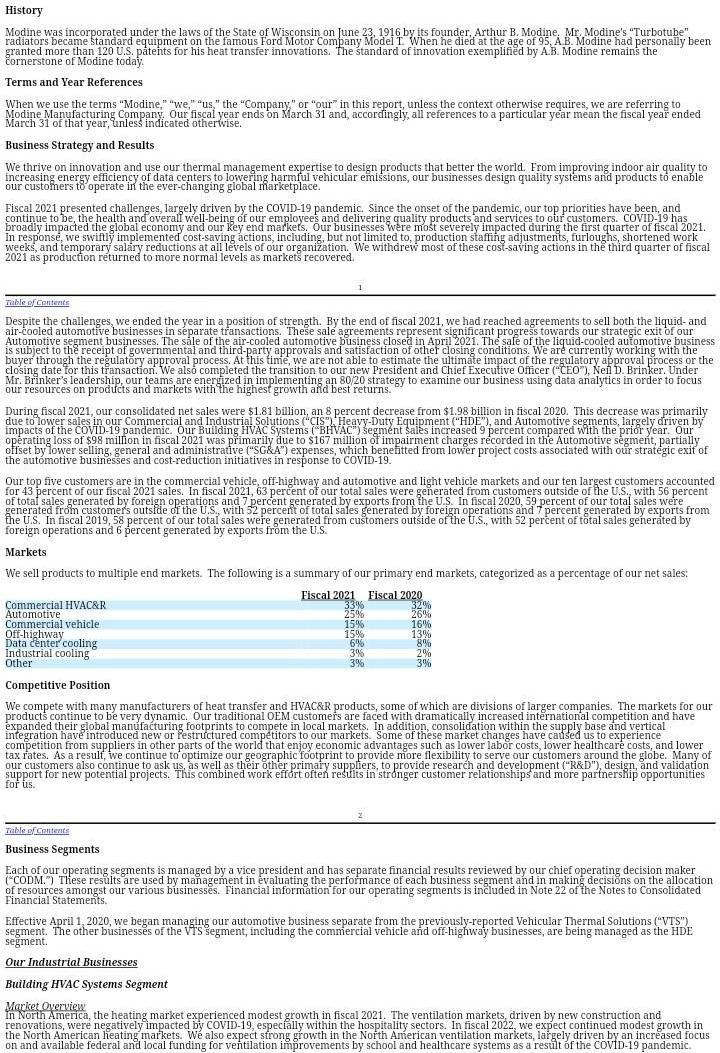

History Modine was incorporated under the laws of the State of Wisconsin on June 23, 1916 by its founder, Arthur B. Modine. Mr. Modine's