A business has supplied the following information relating to the year ended 30 June 2022 Trial Balance as at 30 June 2022 Note: $8,000 of

A business has supplied the following information relating to the year ended 30 June 2022

Trial Balance as at 30 June 2022

Note: $8,000 of the loan will be repaid in the next year.

Adjustments Required: (NB: Adjusted trial balance on page 6 is NOT required to be completed)

- A physical stock take conducted on 30/6/2022 showed total Inventory on hand of $19,000

- Insurance of $900 has expired

- Calculate depreciation on the Equipment at 12% per year

- The business has earned $3,600 in commission revenue which it has not yet recorded

Required

- Prepare balance day adjustment journals at 30 June 2022

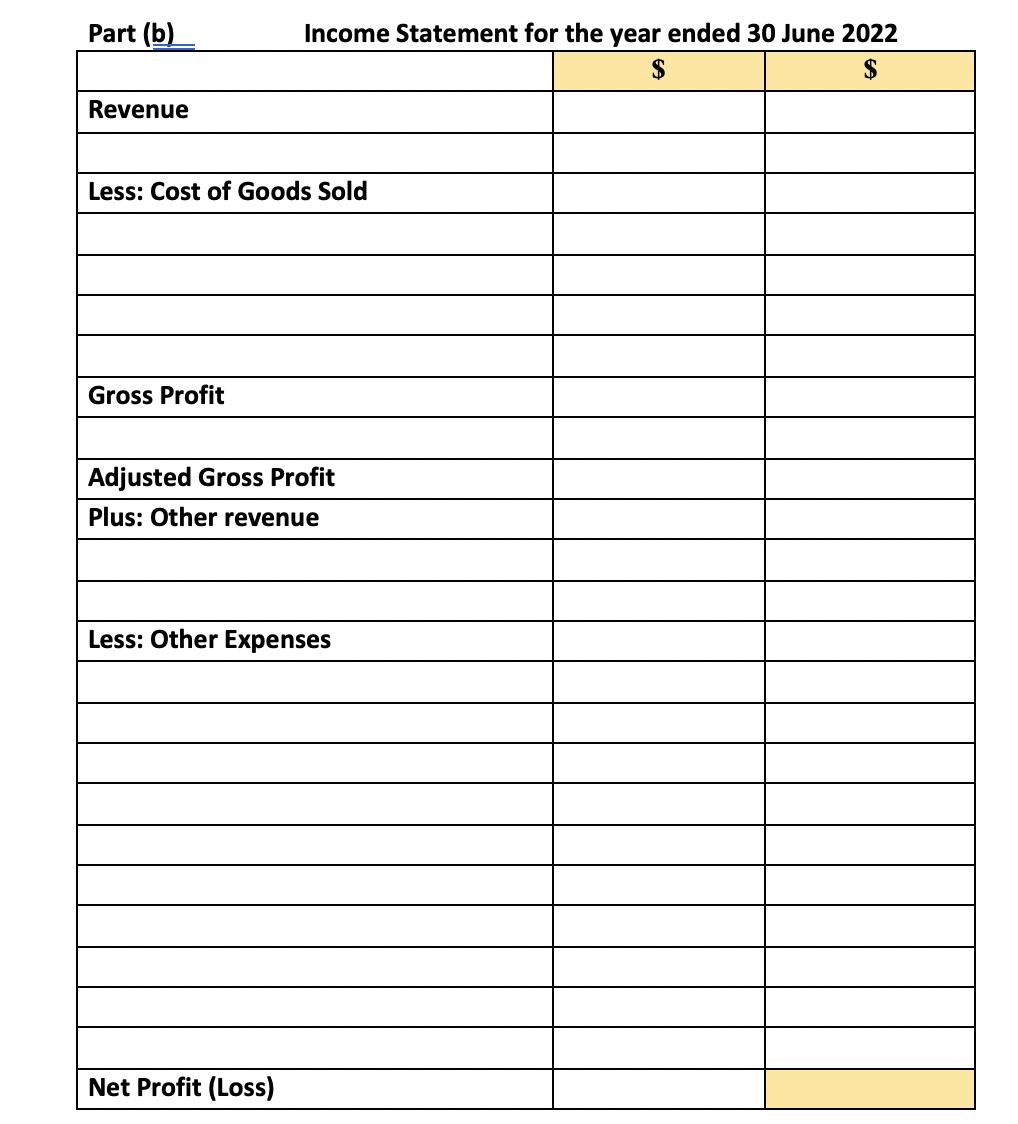

- Prepare an Income Statement

- Prepare a classified Balance Sheet

Accounts Payable Accounts Receivable Accumulated Depreciation - Equipment Advertising Buying Expenses Capital Cartage Out Cash at Bank Cost of Sales Trial Balance as at 30 June 2022 Drawings Electricity Equipment GST Clearing Insurance Expense Inventory Loan-3 years Packaging Costs Prepaid Insurance Rent Sales Wages Expense Website Expenses Note: $8,000 of the loan will be repaid in the next year. Dr $ 16,300 7,500 1,200 1,150 82,500 92,000 4,000 13,600 162,000 1,500 18,200 840 3,100 15,000 98,600 750 518,240 Cr $ 24,800 22,500 117,490 6,450 24,000 323,000 518,240

Step by Step Solution

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started