both pictures relate to the same question :)

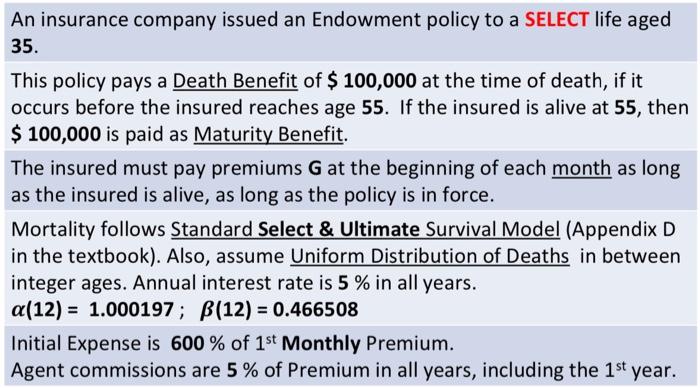

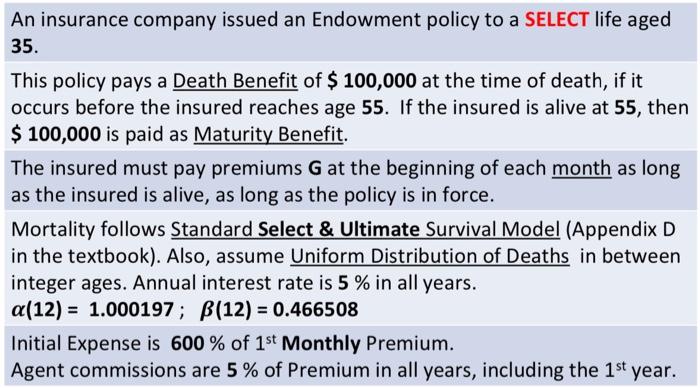

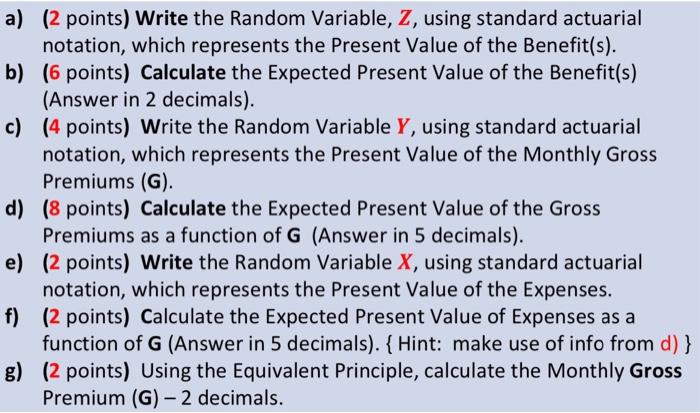

An insurance company issued an Endowment policy to a SELECT life aged 35. This policy pays a Death Benefit of $ 100,000 at the time of death, if it occurs before the insured reaches age 55. If the insured is alive at 55, then $ 100,000 is paid as Maturity Benefit. The insured must pay premiums G at the beginning of each month as long as the insured is alive, as long as the policy is in force. Mortality follows Standard Select & Ultimate Survival Model (Appendix D in the textbook). Also, assume Uniform Distribution of Deaths in between integer ages. Annual interest rate is 5% in all years. a(12) = 1.000197; B(12) = 0.466508 Initial Expense is 600 % of 1st Monthly Premium. Agent commissions are 5 % of Premium in all years, including the 1st year. a) (2 points) Write the Random Variable, Z, using standard actuarial notation, which represents the Present Value of the Benefit(s). b) (6 points) Calculate the Expected Present Value of the Benefit(s) (Answer in 2 decimals). c) (4 points) Write the Random Variable Y, using standard actuarial notation, which represents the Present Value of the Monthly Gross Premiums (G). d) (8 points) Calculate the Expected Present Value of the Gross Premiums as a function of G (Answer in 5 decimals). e) (2 points) Write the Random Variable X, using standard actuarial notation, which represents the Present Value of the Expenses. f) (2 points) Calculate the Expected Present Value of Expenses as a function of G (Answer in 5 decimals). { Hint: make use of info from d) } g) (2 points) Using the Equivalent Principle, calculate the Monthly Gross Premium (G) - 2 decimals. An insurance company issued an Endowment policy to a SELECT life aged 35. This policy pays a Death Benefit of $ 100,000 at the time of death, if it occurs before the insured reaches age 55. If the insured is alive at 55, then $ 100,000 is paid as Maturity Benefit. The insured must pay premiums G at the beginning of each month as long as the insured is alive, as long as the policy is in force. Mortality follows Standard Select & Ultimate Survival Model (Appendix D in the textbook). Also, assume Uniform Distribution of Deaths in between integer ages. Annual interest rate is 5% in all years. a(12) = 1.000197; B(12) = 0.466508 Initial Expense is 600 % of 1st Monthly Premium. Agent commissions are 5 % of Premium in all years, including the 1st year. a) (2 points) Write the Random Variable, Z, using standard actuarial notation, which represents the Present Value of the Benefit(s). b) (6 points) Calculate the Expected Present Value of the Benefit(s) (Answer in 2 decimals). c) (4 points) Write the Random Variable Y, using standard actuarial notation, which represents the Present Value of the Monthly Gross Premiums (G). d) (8 points) Calculate the Expected Present Value of the Gross Premiums as a function of G (Answer in 5 decimals). e) (2 points) Write the Random Variable X, using standard actuarial notation, which represents the Present Value of the Expenses. f) (2 points) Calculate the Expected Present Value of Expenses as a function of G (Answer in 5 decimals). { Hint: make use of info from d) } g) (2 points) Using the Equivalent Principle, calculate the Monthly Gross Premium (G) - 2 decimals