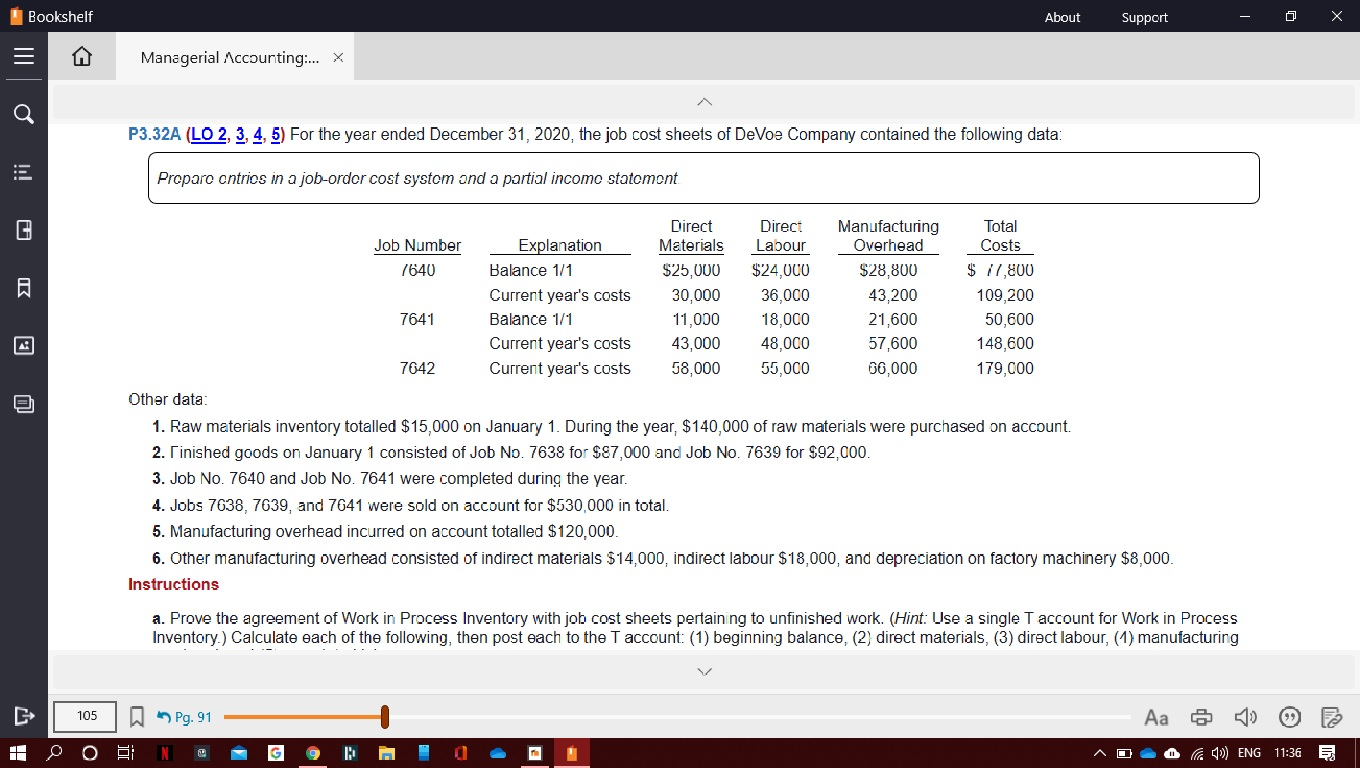

Question

Instructions a. Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. (Hint: Use a single T account for

Instructions

a. Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. (Hint: Use a single T account for Work in Process Inventory.) Calculate each of the following, then post each to the T account: (1) beginning balance, (2) direct materials, (3) direct labour, (4) manufacturing overhead, and (5) completed jobs.

Job 7642: $179,000

b. Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold.

Amount = $6,800

c. Determine the gross profit to be reported for 2020.

$158,600

Instructions

a. Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. (Hint: Use a single T account for Work in Process Inventory.) Calculate each of the following, then post each to the T account: (1) beginning balance, (2) direct materials, (3) direct labour, (4) manufacturing overhead, and (5) completed jobs.

Job 7642: $179,000

b. Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold.

Amount = $6,800

c. Determine the gross profit to be reported for 2020.

$158,600

Bookshelf About Support Managerial Accounting.... X P3.32A (LO 2, 3, 4, 5) For the year ended December 31, 2020, the job cost sheets of DeVoe Company contained the following data: Proparc cntrios in a job-order cost systom and a partial income statomont 30,000 Direct Direct Manufacturing Total Job Number Explanation Materials Labour Overhead Costs 7640 Balance 1/1 $25,000 $24,000 $28,800 $ 17,800 Current year's costs 36,000 43,200 109,200 7641 Balance 1/1 11,000 18,000 21,600 50,600 Current year's costs 43,000 48,000 57,600 148,600 7642 Current year's costs 58,000 55,000 66,000 179,000 Other data: 1. Raw materials inventory totalled $15,000 on January 1. During the year, $140,000 of raw materials were purchased on account. 2. Tinished goods on January 1 consisted of Job No. 7638 for $87,000 and Job No. 7639 for $92,000. 3. Job No. 7640 and Job No. 7641 were completed during the year. 4. Jobs 7638, 7639, and 7641 were sold on account for $530,000 in total. 5. Manufacturing overhead incurred on account totalled $120,000. 6. Other manufacturing overhead consisted of indirect materials $14,000, indirect labour $18,000, and depreciation on factory machinery $8,000. Instructions a. Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. (Hint: Use a single T account for Work in Process Inventory.) Calculate each of the following, then post each to the T account: (1) beginning balance, (2) direct materials, (3) direct labour, (1) manufacturing 105 Pg. 91 N ) ENG 11:36 5 Bookshelf About Support Managerial Accounting.... X P3.32A (LO 2, 3, 4, 5) For the year ended December 31, 2020, the job cost sheets of DeVoe Company contained the following data: Proparc cntrios in a job-order cost systom and a partial income statomont 30,000 Direct Direct Manufacturing Total Job Number Explanation Materials Labour Overhead Costs 7640 Balance 1/1 $25,000 $24,000 $28,800 $ 17,800 Current year's costs 36,000 43,200 109,200 7641 Balance 1/1 11,000 18,000 21,600 50,600 Current year's costs 43,000 48,000 57,600 148,600 7642 Current year's costs 58,000 55,000 66,000 179,000 Other data: 1. Raw materials inventory totalled $15,000 on January 1. During the year, $140,000 of raw materials were purchased on account. 2. Tinished goods on January 1 consisted of Job No. 7638 for $87,000 and Job No. 7639 for $92,000. 3. Job No. 7640 and Job No. 7641 were completed during the year. 4. Jobs 7638, 7639, and 7641 were sold on account for $530,000 in total. 5. Manufacturing overhead incurred on account totalled $120,000. 6. Other manufacturing overhead consisted of indirect materials $14,000, indirect labour $18,000, and depreciation on factory machinery $8,000. Instructions a. Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. (Hint: Use a single T account for Work in Process Inventory.) Calculate each of the following, then post each to the T account: (1) beginning balance, (2) direct materials, (3) direct labour, (1) manufacturing 105 Pg. 91 N ) ENG 11:36 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started