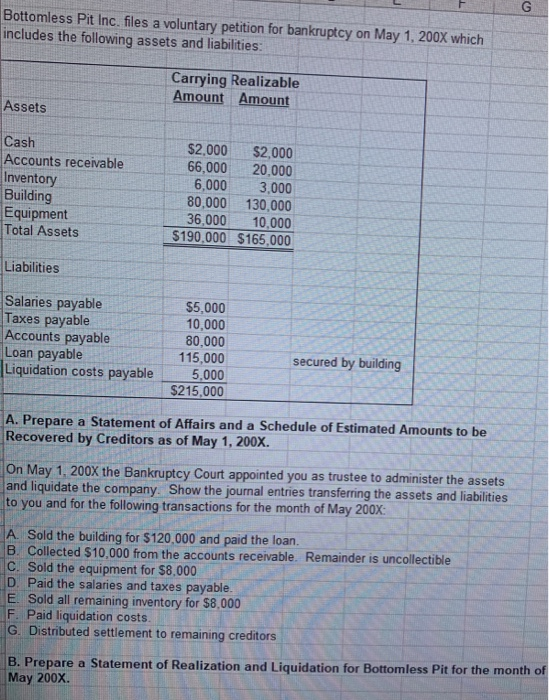

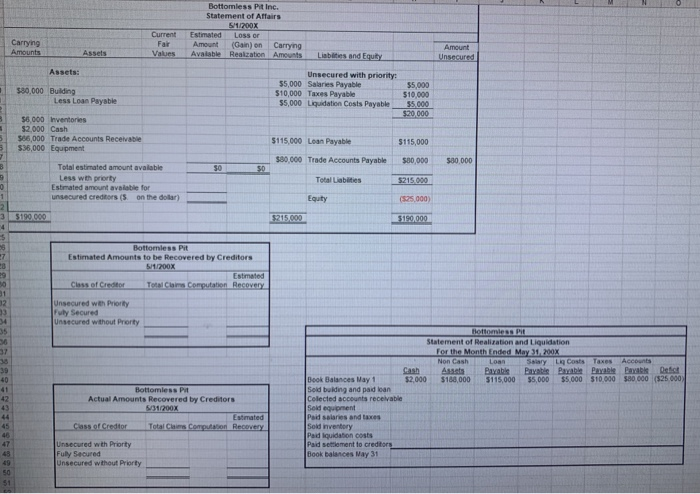

Bottomless Pit Inc. files a voluntary petition for bankruptcy on May 1, 200x which includes the following assets and liabilities: Carrying Realizable Amount Amount Assets Cash Accounts receivable Inventory Building Equipment Total Assets $2,000 $2,000 66,000 20.000 6,000 3,000 80,000 130,000 36,000 10,000 $190,000 $165,000 Liabilities Salaries payable Taxes payable Accounts payable Loan payable Liquidation costs payable $5.000 10,000 80,000 115,000 5.000 $215.000 secured by building A. Prepare a Statement of Affairs and a Schedule of Estimated Amounts to be Recovered by Creditors as of May 1, 200X. On May 1, 200X the Bankruptcy Court appointed you as trustee to administer the assets and liquidate the company. Show the journal entries transferring the assets and liabilities to you and for the following transactions for the month of May 200X: A. Sold the building for $120.000 and paid the loan. B. Collected $10,000 from the accounts receivable. Remainder is uncollectible C. Sold the equipment for $8.000 D. Paid the salaries and taxes payable. E Sold all remaining inventory for $8,000 F. Paid liquidation costs. G. Distributed settlement to remaining creditors B. Prepare a Statement of Realization and Liquidation for Bottomless Pit for the month of May 200X. Bottomless Put Inc. Statement of Affairs 5/1/200X Estimated Loss or Amount (Gain) on Carrying Avalable Realization Amounts Current Fair Values Carrying Liabilities and Equity Assets: 530,000 Building Less Loan Payable Unsecured with priority: $5,000 Salaries Payable $10,000 Taxes Payable $5,000 Liquidation Costs Payable 55.000 $10.000 55,000 $20,000 55 000 inventories $2000 Cash $36,000 Trade Accounts Receivable 536,000 Equipment $115,000 Loan Payable $115,000 $80,000 Trade Accounts Payable 500.000 500.000 Total estimated amount available Less with priarty Estimated amount available for unsecured creditors ( S on the dollar) Total Liabilities $215.000 - Equity 325.000) $190,000 8 Bottomless Pit Estimated Amounts to be Recovered by Creditors 5111200X Estimated Class of creditor Totalcom Computation Recovery Unsecured with Priority Fully Secured Unsecured without priority Accounts Payat Deft $80.000 (525 000 888=999999988 Bottomless Pat Actual Amounts Recovered by Creditors Statement of Realization and Liquidation For the Month Ended May 11, 200X Non Cash Lo a ry Costs Taxes Cash Assets Payable Pasti Pawab Purable Book Balances May 1 $2,000 $180,000 $115,000 $5,000 $5,000 $10,000 Sold building and paid loan Colected accounts receivable Sold equipment Paid salaries and taxes Sold inventory Paid Iquidaton costs Paid settlement to creditors Book balances May 31 Class of Creditor Total Claims Computation Recovery Unsecured with Priority Fuly secured Unsecured without Priarty Bottomless Pit Inc. files a voluntary petition for bankruptcy on May 1, 200x which includes the following assets and liabilities: Carrying Realizable Amount Amount Assets Cash Accounts receivable Inventory Building Equipment Total Assets $2,000 $2,000 66,000 20.000 6,000 3,000 80,000 130,000 36,000 10,000 $190,000 $165,000 Liabilities Salaries payable Taxes payable Accounts payable Loan payable Liquidation costs payable $5.000 10,000 80,000 115,000 5.000 $215.000 secured by building A. Prepare a Statement of Affairs and a Schedule of Estimated Amounts to be Recovered by Creditors as of May 1, 200X. On May 1, 200X the Bankruptcy Court appointed you as trustee to administer the assets and liquidate the company. Show the journal entries transferring the assets and liabilities to you and for the following transactions for the month of May 200X: A. Sold the building for $120.000 and paid the loan. B. Collected $10,000 from the accounts receivable. Remainder is uncollectible C. Sold the equipment for $8.000 D. Paid the salaries and taxes payable. E Sold all remaining inventory for $8,000 F. Paid liquidation costs. G. Distributed settlement to remaining creditors B. Prepare a Statement of Realization and Liquidation for Bottomless Pit for the month of May 200X. Bottomless Put Inc. Statement of Affairs 5/1/200X Estimated Loss or Amount (Gain) on Carrying Avalable Realization Amounts Current Fair Values Carrying Liabilities and Equity Assets: 530,000 Building Less Loan Payable Unsecured with priority: $5,000 Salaries Payable $10,000 Taxes Payable $5,000 Liquidation Costs Payable 55.000 $10.000 55,000 $20,000 55 000 inventories $2000 Cash $36,000 Trade Accounts Receivable 536,000 Equipment $115,000 Loan Payable $115,000 $80,000 Trade Accounts Payable 500.000 500.000 Total estimated amount available Less with priarty Estimated amount available for unsecured creditors ( S on the dollar) Total Liabilities $215.000 - Equity 325.000) $190,000 8 Bottomless Pit Estimated Amounts to be Recovered by Creditors 5111200X Estimated Class of creditor Totalcom Computation Recovery Unsecured with Priority Fully Secured Unsecured without priority Accounts Payat Deft $80.000 (525 000 888=999999988 Bottomless Pat Actual Amounts Recovered by Creditors Statement of Realization and Liquidation For the Month Ended May 11, 200X Non Cash Lo a ry Costs Taxes Cash Assets Payable Pasti Pawab Purable Book Balances May 1 $2,000 $180,000 $115,000 $5,000 $5,000 $10,000 Sold building and paid loan Colected accounts receivable Sold equipment Paid salaries and taxes Sold inventory Paid Iquidaton costs Paid settlement to creditors Book balances May 31 Class of Creditor Total Claims Computation Recovery Unsecured with Priority Fuly secured Unsecured without Priarty