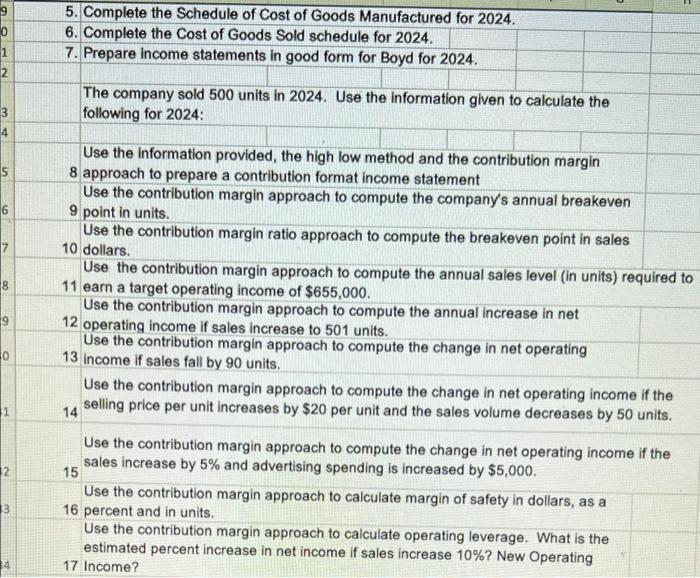

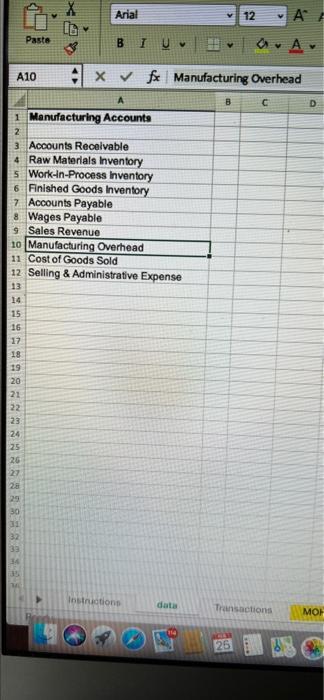

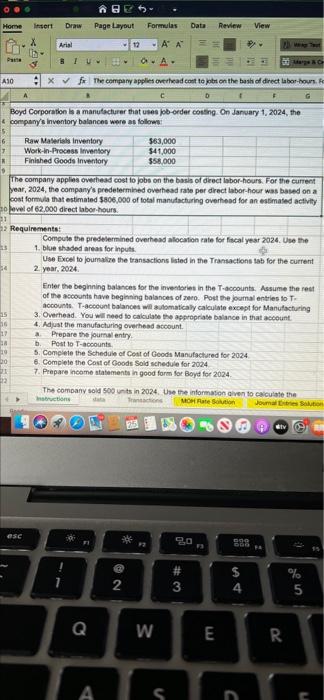

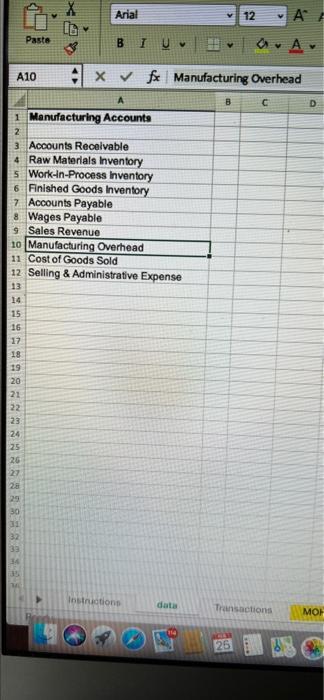

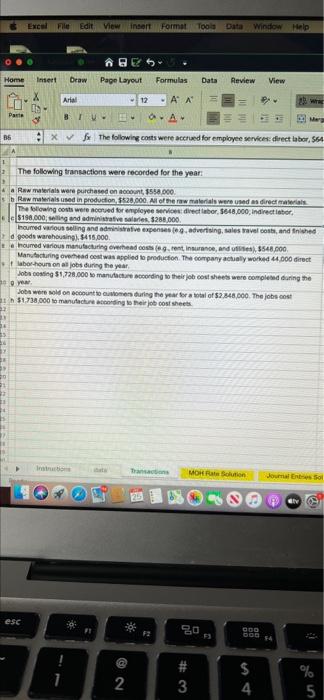

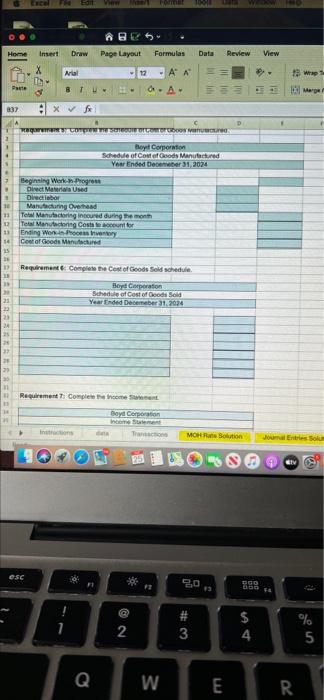

Boyd Corporation is a manufacturer that uses job-order costing. On January 1, 2024, the 4 company's inventory balances were as follows: 5. Raw Materlals Inventory Work-In-Process Inventory Finished Goods Inventory $63,000 $41,000 $58,000 17 8. 6. The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, 2024, the company's predetermined overhead rate per direct labor-hour was based on a cost formula that estimated $806,000 of total manufacturing overhead for an estimated activity 10 level of 62,000 direct labor-hours. 11 12 Requirements: Compute the predetermined overhead allocation rate for fiscal year 2024. Use the 1. blue shaded areas for inputs. 13 Use Excel to journalize the transactions listed in the Transactions tab for the current 2. year, 2024. 14 Enter the beginning balances for the inventories in the T-accounts. Assume the rest of the accounts have beginning balances of zero. Post the journal entries to T- accounts. T-account balances whtautomatically calculate except for Manufacturing 3. Overhead. You will need to calculate the appropriate balance in that account. 4. Adjust the manufacturing overhead account. Prepare the journal entry. b. 15 16 17 . 18 Post to T-accounts. 5. Complete the Schedule of Cost of Goods Manufactured for 2024. 6. Complete the Cost of Goods Sold schedule for 2024. 7. Prepare income statements in good form for Boyd for 2024. 19 20 21 22 The company sold 500 units in 2024. Use the information given to calculate the

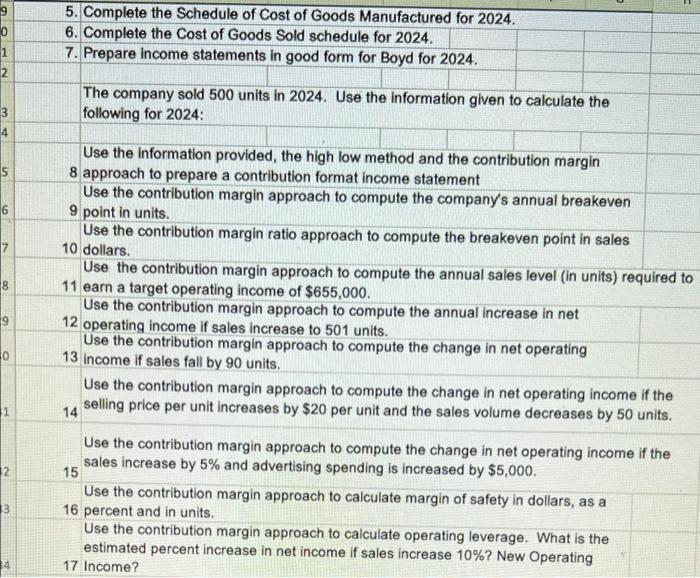

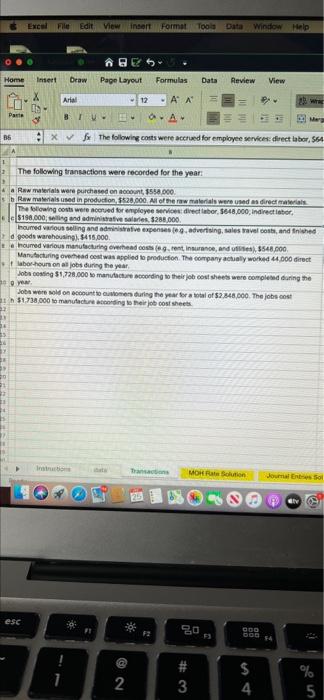

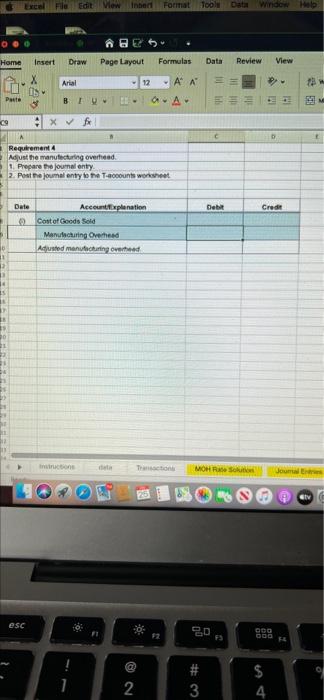

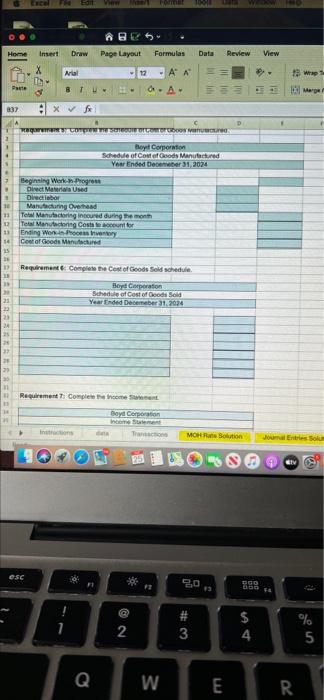

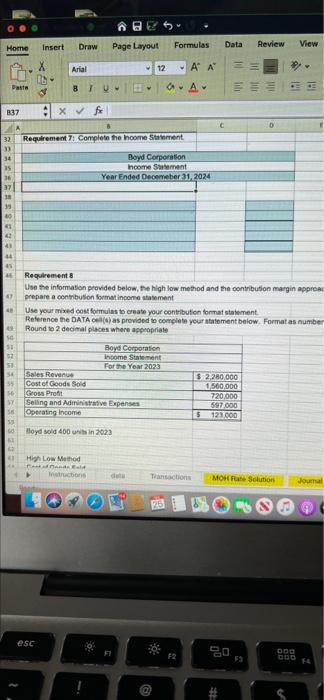

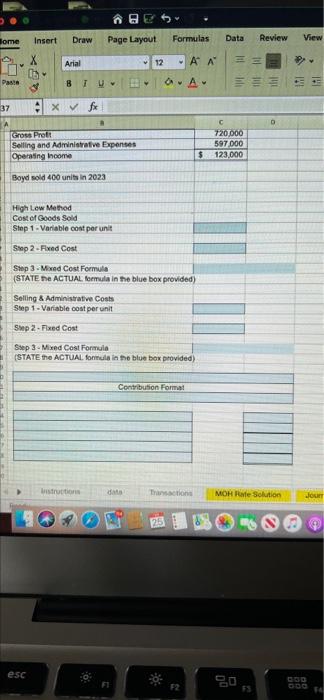

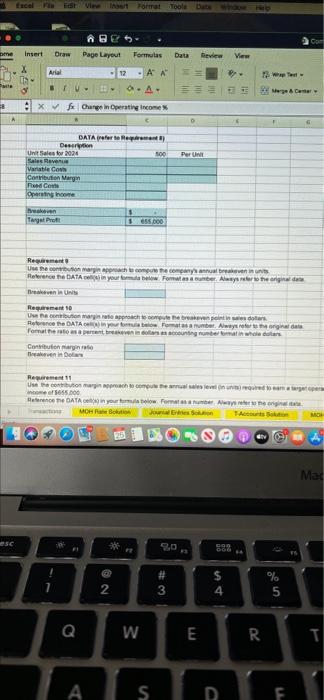

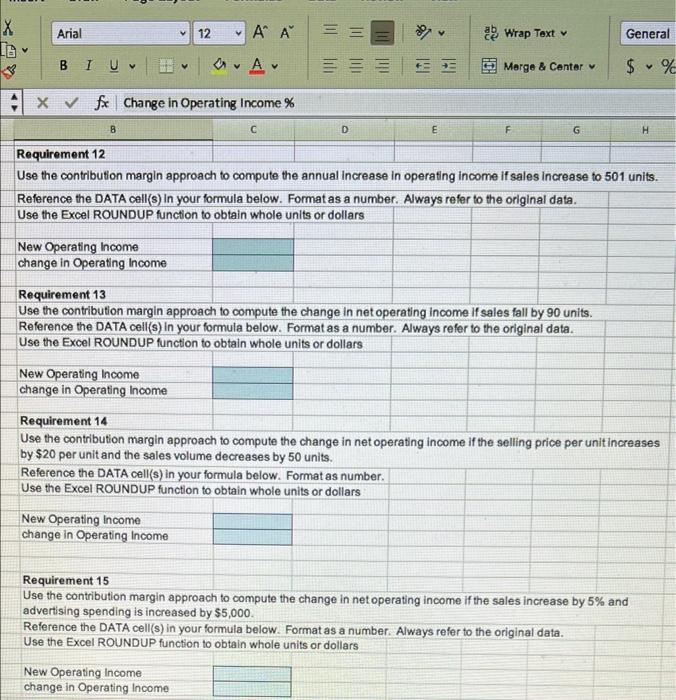

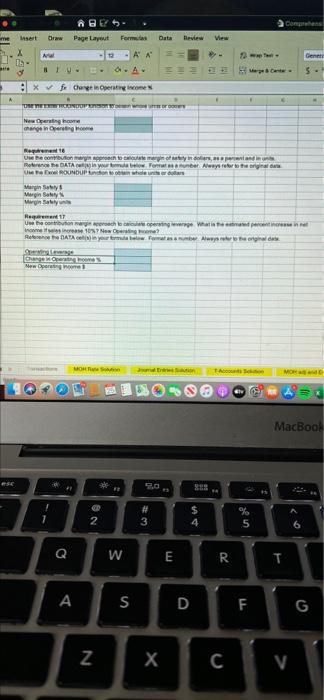

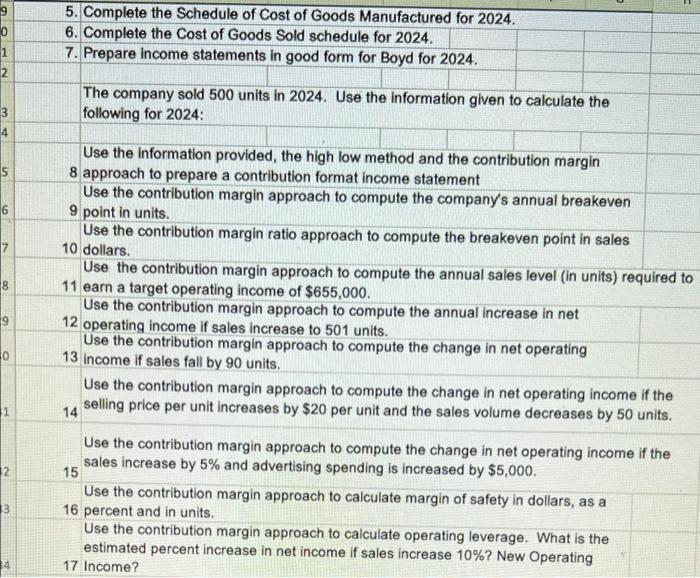

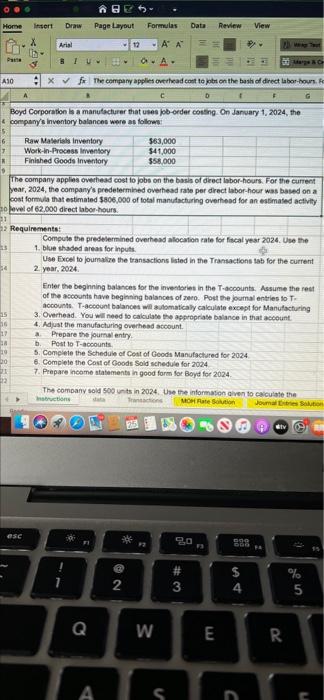

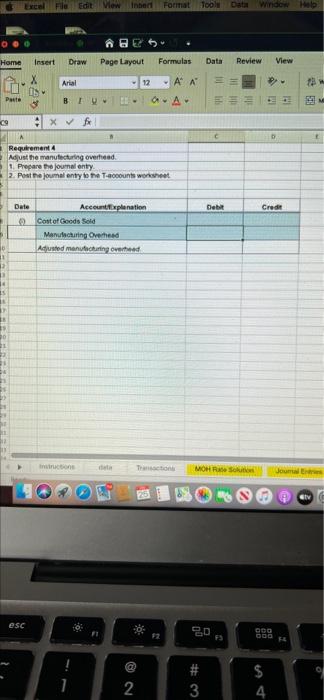

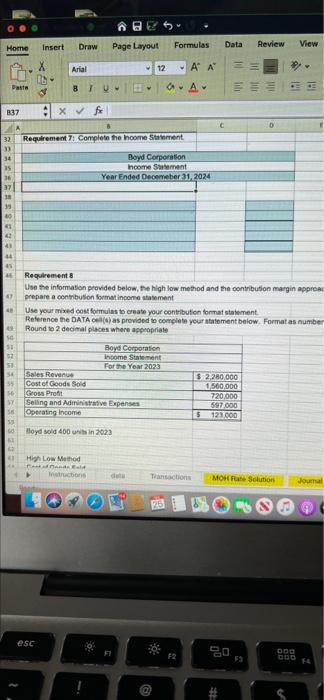

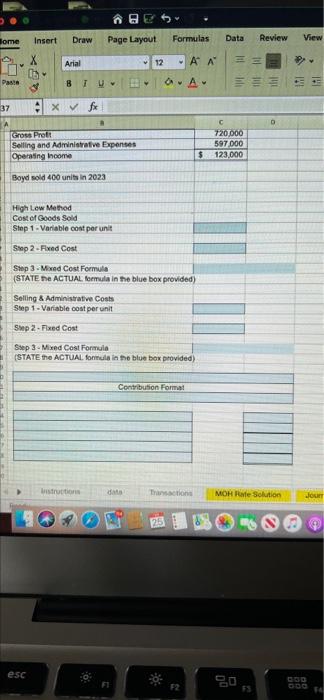

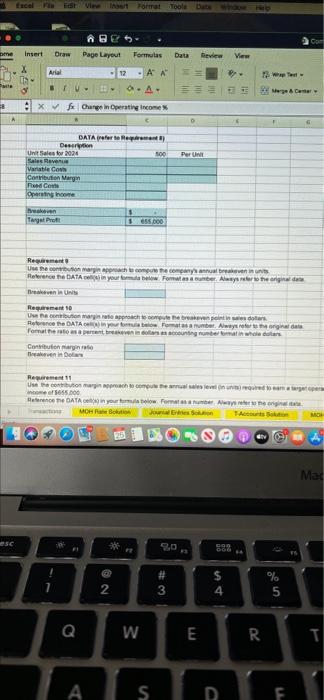

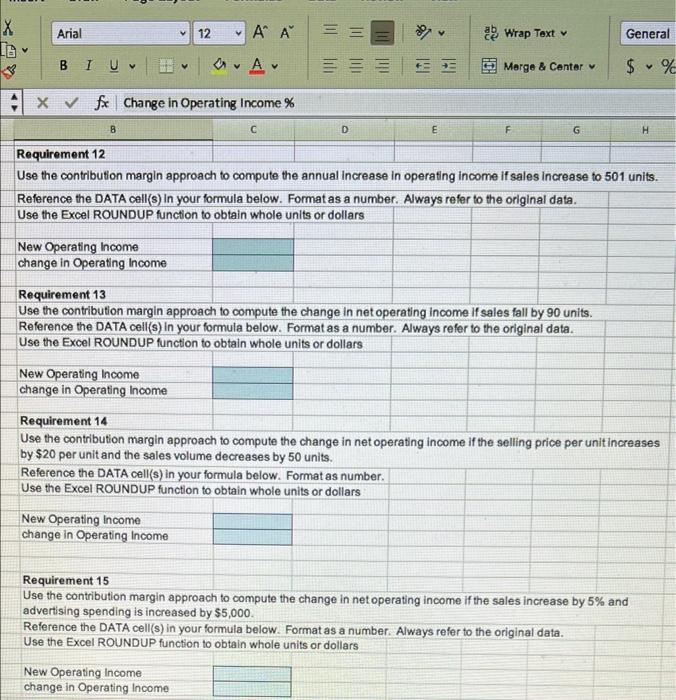

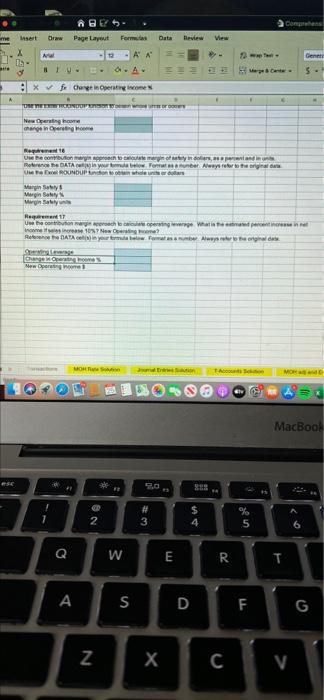

9 5. Complete the Schedule of Cost of Goods Manufactured for 2024. 6. Complete the cost of Goods Sold schedule for 2024. 7. Prepare Income statements in good form for Boyd for 2024. 2 The company sold 500 units in 2024. Use the information given to calculate the following for 2024: 3 4 5 6 7 18 9 Use the information provided, the high low method and the contribution margin 8 approach to prepare a contribution format income statement Use the contribution margin approach to compute the company's annual breakeven 9 point in units. Use the contribution margin ratio approach to compute the breakeven point in sales 10 dollars. Use the contribution margin approach to compute the annual sales level (in units) required to 11 earn a target operating income of $655,000. Use the contribution margin approach to compute the annual increase in net 12 operating income if sales increase to 501 units. Use the contribution margin approach to compute the change in net operating 13 income if sales fall by 90 units. Use the contribution margin approach to compute the change in net operating income if the selling price per unit increases by $20 per unit and the sales volume decreases by 50 units. 14 Use the contribution margin approach to compute the change in net operating income if the sales increase by 5% and advertising spending is increased by $5,000. 15 Use the contribution margin approach to calculate margin of safety in dollars, as a 16 percent and in units. Use the contribution margin approach to calculate operating leverage. What is the estimated percent increase in net income if sales increase 10%? New Operating 17 Income? 2 3 Aria! 12 A Pasta B T U A A10 4 x fx Manufacturing Overhead B 1 Manufacturing Accounts 2 3 Accounts Receivable 4 Raw Materials Inventory 5 Work-in-Process Inventory 6 Finished Goods Inventory 7 Accounts Payable 8 Wages Payable 9 Sales Revenue 10 Manufacturing Overhead 11 Cost of Goods Sold 12 Selling & Administrative Expense 13 14 15 16 17 18 19 20 21 22 23 24 125 26 27 29 30 11 Institions data Transactions MOH 125 Excel File Edit View insert Format Tools Data window Help Home Insert Draw Page Layout Formulas Data Review View LD Parte Arial -AA BLU- OA = = x The following costs were accrued for employee services direct labor, 564 36 1 The following transactions were recorded for the year: a Raw materials were purchased on account 5558.000 Raw materials used in production 520,000. All of the raw materials were used as direct mail The following costs were scored for employee service direct labor, 5648,000 indirector c5198.000 og and admirative salaries $288.000 houred various soling and administrative expenses te advertising, sales vost, and finished d goods warehousing, 8415,000 noured various martutacturing overhead cos (rent Insurance, and $548,000 Manufacturing overhead cost was applied to production. The company atly worked 41.000 direct borhon on jobs during the year Jobs costing 51.728.000 manator coording to their job cost sheets were completed during the a year Jobs were no on sccount to customers during the year for a total of 52,848,000. The jobs out 151738,000 to manufacture ording to their job cost sheets Trans MORP Solution Journal le esc 20 GOG F6 2 # 3 $ 4 % 5 O Home sort Draw Page Layout Formulas Data Review View X Arial A A ASO X for The company applies overhead cost tot on the basis of direct labor-hours. A C D Boyd Corporation is a manufacturer that uses pb-order costing On January 1, 2024, the company's inventory balances were as follows ES 6 Raw Materials Inventory $63,000 7 Work-In-Process Inventory $41,000 Finished Goods Inventory $58,000 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, 2024, the company's predetermined overhead rate per direct labor-hour was based on a cost formula that estimated $806,000 of total manufacturing overhead for an estimated activity 30 level of 62.000 direct labor. hours > Requirements: Compute the predetermined overhead allocation rate for fiscal year 2024. Use the 3 1. blue shaded areas for inputs. Use Excel to ouma re the transactions listed in the Transactions tab for the current 34 2 year, 2024 Enter the beginning balances for the inventories in the accounts. Assume the rest of the accounts have beginning balances of 700. Post the journal entries to T. count. T-account balances wilsutomatically calculate except for Manufacturing 3. Overhead. You will need to calculate the appropriate balance in that account 16 4. Adjust the manufacturing overhead account 11 Prepare the journal entry b. Post 10 T-accounts 10 5. Complete the Schedule of Cost of Goods Manufactured for 2024 DO 6. Complete the cost of Goods Sold schedule for 2024 7. Prepare income statements in good form for Boyd for 2024 312 The company sold 500 units in 2024 Use the information given to calculate the struction Tranh MOH Rate Journalist SC 20 299 73 BOB @ 2 # 3 % 5 4 Q 3 E R . S D Excel File Edit View Inbart Format Tool Data Help Home Insert Draw Data Review View Arial Page Layout Formulas 12 - A A aA. Paste BI 9 fo Requirements Adjust the manufacturing overhead 1. Prepare the journalenty. 2. Post the journal entry to the T-counts worst Date Debat Crede Account Explanation Cost of Goods Sold Manufacturing Overhead Adjusted manufacturing over D 1 15 Inicio Trimson MOHS Joma 75 GV esc RD 000 55 @ 1 N # 3 $ 4 om Home Insert Draw Page Layout Formulas Data Review View X Arial 17 - A 18 wrap BT a.A- Merge 837 X TESTOSTEROICOTTON Boy Corporation Schedule of Cost of Goods Manufactured Year Ended December 31, 2024 Beginning Werkrogen Di Maria Used Director 10 Manufacturing Owerhead 11 Te Manacoring intoured during the month 12 Tell Manuteng Contact for 1 Ending West 16 Cost of Goods Mand 25 1) Requirement Complete the cost of Goods sold schedule Boyd Corporation Schedef Cost of Good So Year Ended December 31, 2024 25 2 Requirement i Complete the Boyd Corporation Income fondement MO Solution Jumal solu esc 09.0 go so 2 (4) $ 4. 3 % 5 Q W E R Draw Home Insert Page Layout Formulas Data Review View X Arial 12 - A A Pasta 8 TU A 337 x for C D 32 Requirement: Complete the income Statement 34 Boyd Corporation Income Sement Year Ended December 21, 2024 10 37 35 43 67 Requirements Use the information provided below, the high low method and the contribution marginapproa prepare a contribution format income statement Use your mixed Commules to create your contribution format statement Reference the DATA (as provided to complete your statement below. Formatas number Round to 2 decimal places where appropriate so SI 51 54 55 6 Bovd Corporation Income Statement For the Year 2023 Sales Revenge Cost of Goods Sold Gross Profit Selling and Administrative Expenses Operating Income 5 2.280.000 1500,000 720,000 597000 5 123.000 56 Boyd sold 400 is in 2023 High Low Method Pand Iron Transactions MOHF Solution Journal 25 SS esc 20 F2 000 Duo 59 Insert Draw Page Layout Home Formulas Data Review View Arial 12 ' = = OS Paal B 1 a.A- D 37 A x x A Gross Prot Selling and Administrative Expenses Operating Income 720.000 597 000 123.000 $ Boyd sold 400 units in 2023 High Low Method Cost of Goods Sold Step 1 - Variable cont per unit Step 2. Flved Cost Step 3 - Mored Cost Formula (STATE DE ACTUAL formula in the blue box provided) Selling & Administrative Costs Step 1 . Variable cost per unit Smp 2 - Fixed Cost Step 3 - Mixed Cost Formula (STATE the ACTUAL formula in the blue box provided) Contribution Format struction Traction MOHR Solution JOU 25 esc 20 Etsi Vilatort Toolbat wa are Data Deview View AB Insert Draw Page Layout Formulas X Arial A. ex fc Change in operating income & DATA refer to Reman) Desert Unit Sales 2924 SOO Per UNE Vanatle com Con Margen Pendo Operating the 155.000 Reamento Un marginapproach to come the company's annual revenit Reference DATA in your formed bw Formulas anter. Also the origine Breen UN Requirement 10 Use contrition marginate approach to the brain dan Reference ne DATA in your ma pamats amet. Always on el Format tento sabes contgronbermain white Contorno en in Requirement 11 U corbuton recomes even more to me 5655.000 Heren DATA in your doors were MOH ME 88 Mac esc COD # 3 % 5 2 4 Q W E R A S D X Arial 12 A A = Wrap Text General BIU a. Av Marge & Center $ % V 8 D H 4 x fx Change in Operating Income % E Requirement 12 Use the contribution margin approach to compute the annual increase in operating income if sales increase to 501 units. Reference the DATA cell(s) In your formula below. Format as a number. Always refer to the original data. Use the Excel ROUNDUP function to obtain whole units or dollars New Operating Income change in Operating Income Requirement 13 Use the contribution margin approach to compute the change in net operating income if sales fall by 90 units. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data. Use the Excel ROUNDUP function to obtain whole units or dollars New Operating Income change in Operating Income Requirement 14 Use the contribution margin approach to compute the change in net operating income if the selling price per unit increases by $20 per unit and the sales volume decreases by 50 units. Reference the DATA cell(s) in your formula below. Format as number. Use the Excel ROUNDUP function to obtain whole units or dollars New Operating Income change in Operating Income Requirement 15 Use the contribution margin approach to compute the change in net operating income if the sales increase by 5% and advertising spending is increased by $5,000 Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data. Use the Excel ROUNDUP function to obtain whole units or dollars New Operating Income change in Operating Income Com ABS- Page Layout Form me Draw Data Review View " 12 - Genesi 15 fe Care Operating comes A Newporting the change in the este De Decorating proto se menor, prandin Porno DATA Ymer Always refer to the original TROUNDUP were rare Margin Soy Mergin Soy Marginal Reqm17 Uw he crechering percent of New RDATA agna as CHOCO Merwe MOR TA MORA MacBook ESE 2 NO 2 $ 4 3 % 5 Q 3 E 70 R T S S D F G N C V