Answered step by step

Verified Expert Solution

Question

1 Approved Answer

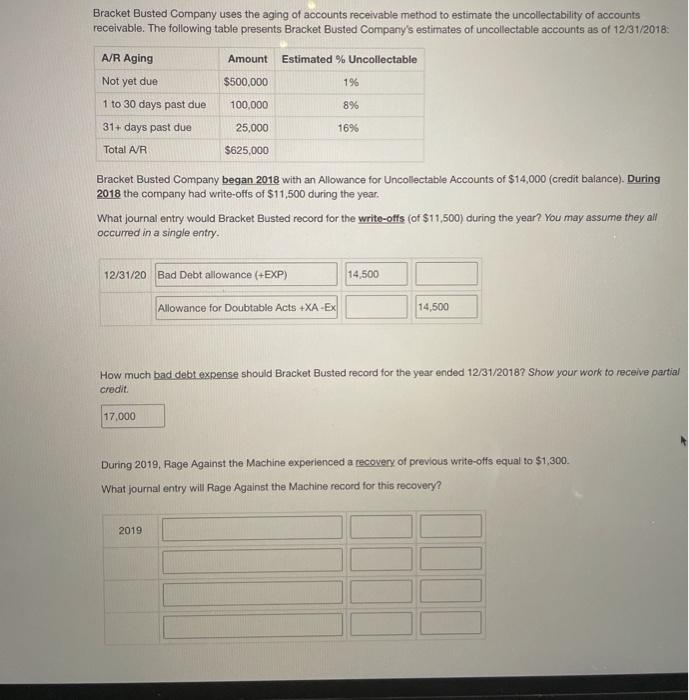

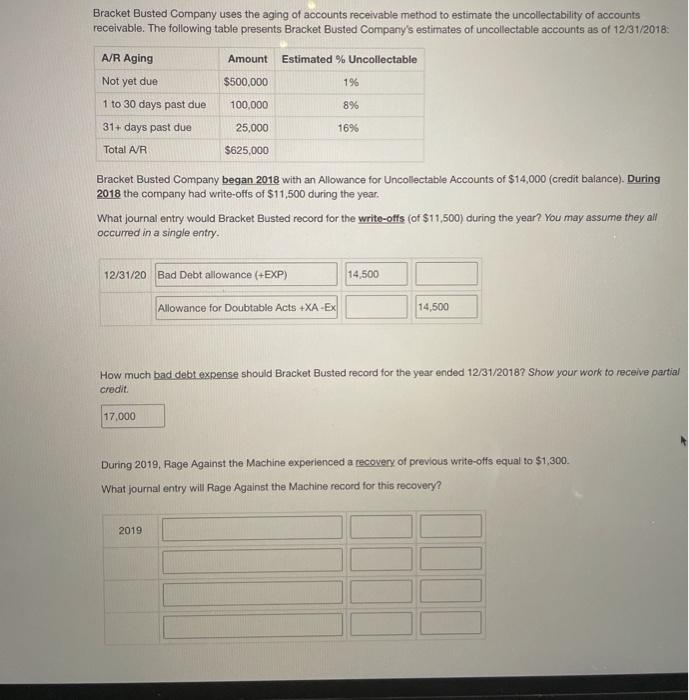

Bracket Busted Company uses the aging of accounts receivable method to estimate the uncollectability of accounts receivable. The following table presents Bracket Busted Company's estimates

Bracket Busted Company uses the aging of accounts receivable method to estimate the uncollectability of accounts receivable. The following table presents Bracket Busted Company's estimates of uncollectable accounts as of 12/31/2018 A/R Aging Amount Estimated % Uncollectable Not yet due $500,000 1% 1 to 30 days past due 100,000 896 31+ days past due 16% 25,000 $625,000 Total AVR Bracket Busted Company began 2018 with an Allowance for Uncollectable Accounts of $14,000 (credit balance). During 2018 the company had write-offs of $11,500 during the year. What journal entry would Bracket Busted record for the write-offs (of $11,500) during the year? You may assume they all occurred in a single entry. 12/31/20 Bad Debt allowance (+EXP) 14,500 Allowance for Doubtable Acts +XA-EX 14,500 How much bad debt expense should Bracket Busted record for the year ended 12/31/2018? Show your work to receive partial credit 17,000 During 2019, Rage Against the Machine experienced a recovery of previous write-offs equal to $1,300. What journal entry will Rage Against the Machine record for this recovery? 2019

Bracket Busted Company uses the aging of accounts receivable method to estimate the uncollectability of accounts receivable. The following table presents Bracket Busted Company's estimates of uncollectable accounts as of 12/31/2018 A/R Aging Amount Estimated % Uncollectable Not yet due $500,000 1% 1 to 30 days past due 100,000 896 31+ days past due 16% 25,000 $625,000 Total AVR Bracket Busted Company began 2018 with an Allowance for Uncollectable Accounts of $14,000 (credit balance). During 2018 the company had write-offs of $11,500 during the year. What journal entry would Bracket Busted record for the write-offs (of $11,500) during the year? You may assume they all occurred in a single entry. 12/31/20 Bad Debt allowance (+EXP) 14,500 Allowance for Doubtable Acts +XA-EX 14,500 How much bad debt expense should Bracket Busted record for the year ended 12/31/2018? Show your work to receive partial credit 17,000 During 2019, Rage Against the Machine experienced a recovery of previous write-offs equal to $1,300. What journal entry will Rage Against the Machine record for this recovery? 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started