Answered step by step

Verified Expert Solution

Question

1 Approved Answer

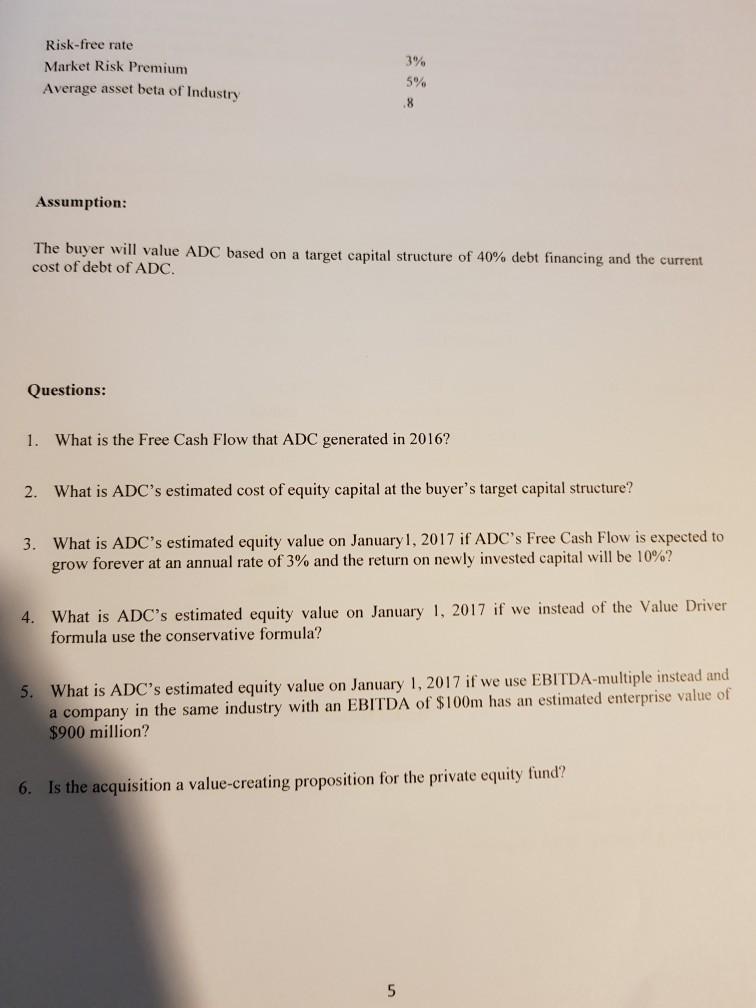

question 6 please Assume that we are now in January 2017. A private equity fund is potentially interested in acc Advanced Devices Company (ADC), a

question 6 please

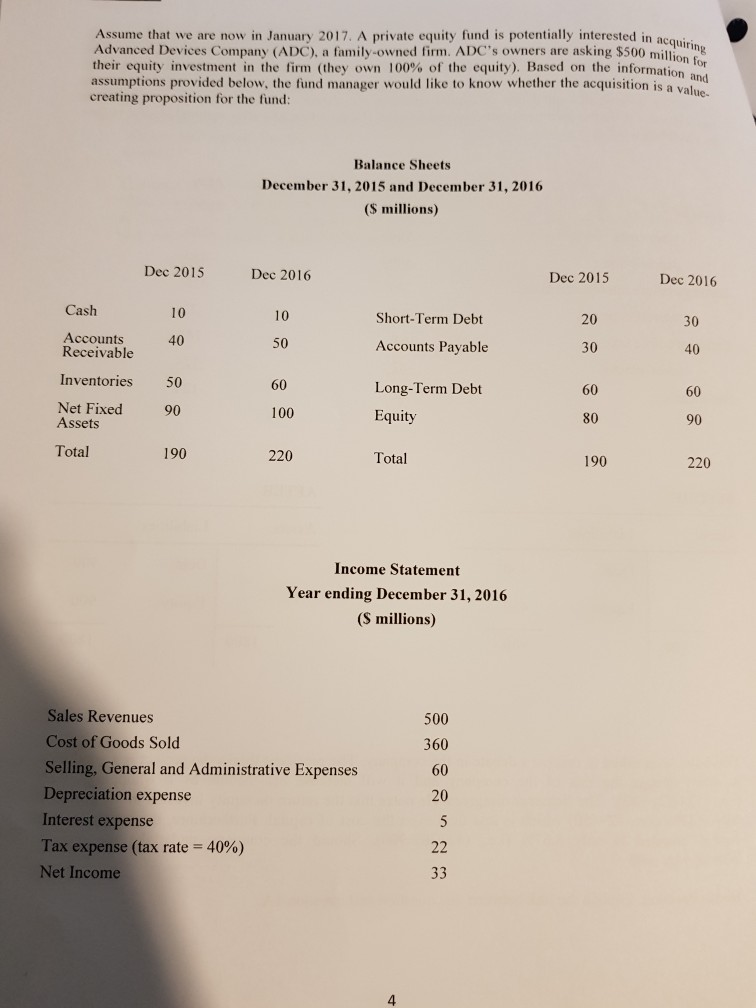

Assume that we are now in January 2017. A private equity fund is potentially interested in acc Advanced Devices Company (ADC), a family-owned firm. ADC's owners are asking $500 million t their equity investment in the firm' (they own 100% of the equity). Based on the information assumptions provided below, the fund manager would like to know whether the acquisition is a value creating proposition for the fund: cquiri Balance Sheets December 31, 2015 and December 31, 2016 (S millions) Dec 2015 Dec 2016 Dec 2015 Dec 2016 Cash 10 10 Short-Term Debt Accounts Payable Long-Term Debt 20 30 60 80 30 Accounts Receivable 40 50 40 Inventories 50 60 60 Net Fixed 90 100 Assets 90 Total 190 220 Total 190 220 Income Statement Year ending December 31,2016 S millions) Sales Revenues Cost of Goods Sold Selling, General and Administrative Expenses Depreciation expense Interest expense Tax expense (tax rate = 40%) Net Income 500 360 60 20 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started