Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bramble Company purchased land for $114500 with the intentions of constructing a new operating facility. The land purchase included a dilapidated building that was removed

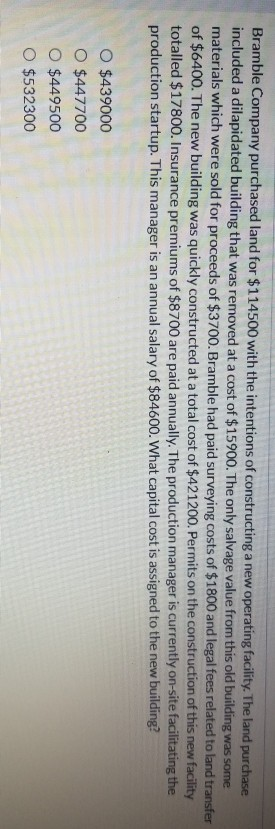

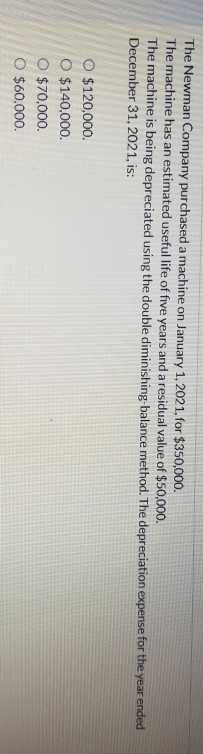

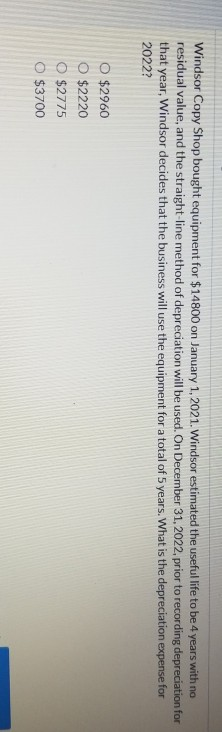

Bramble Company purchased land for $114500 with the intentions of constructing a new operating facility. The land purchase included a dilapidated building that was removed at a cost of $15900. The only salvage value from this old building was some materials which were sold for proceeds of $3700. Bramble had paid surveying costs of $1800 and legal fees related to land transfer of $6400. The new building was quickly constructed at a total cost of $421200. Permits on the construction of this new facility totalled $17800. Insurance premiums of $8700 are paid annually. The production manager is currently on-site facilitating the production startup. This manager is an annual salary of $84600. What capital cost is assigned to the new building? O $439000 O $447700 O $449500 O $532300 The Newman Company purchased a machine on January 1, 2021, for $350,000. The machine has an estimated useful life of five years and a residual value of $50,000. The machine is being depreciated using the double diminishing balance method. The depreciation expense for the year ended December 31, 2021, is: O $120,000. O $140.000. O $70,000. O $60,000. Windsor Copy Shop bought equipment for $14800 on January 1, 2021. Windsor estimated the useful life to be 4 years with no residual value, and the straight-line method of depreciation will be used. On December 31, 2022, prior to recording depreciation for that year, Windsor decides that the business will use the equipment for a total of 5 years. What is the depreciation expense for 2022? O $2960 O $2220 O $2775 $3700 Concord Ltd. reviews its assets every fiscal year for potential asset impairments. In the current year Concord realized through its impairment assessment that a specialized machine has a recoverable amount of $361100. This asset carries a cost of $896000 and up-to-date accumulated depreciation of $549100. What amount would be reported as an impairment loss on Concord's current income statement at year end? O $0 O $-549100 O $361100 O $910200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started