Answered step by step

Verified Expert Solution

Question

1 Approved Answer

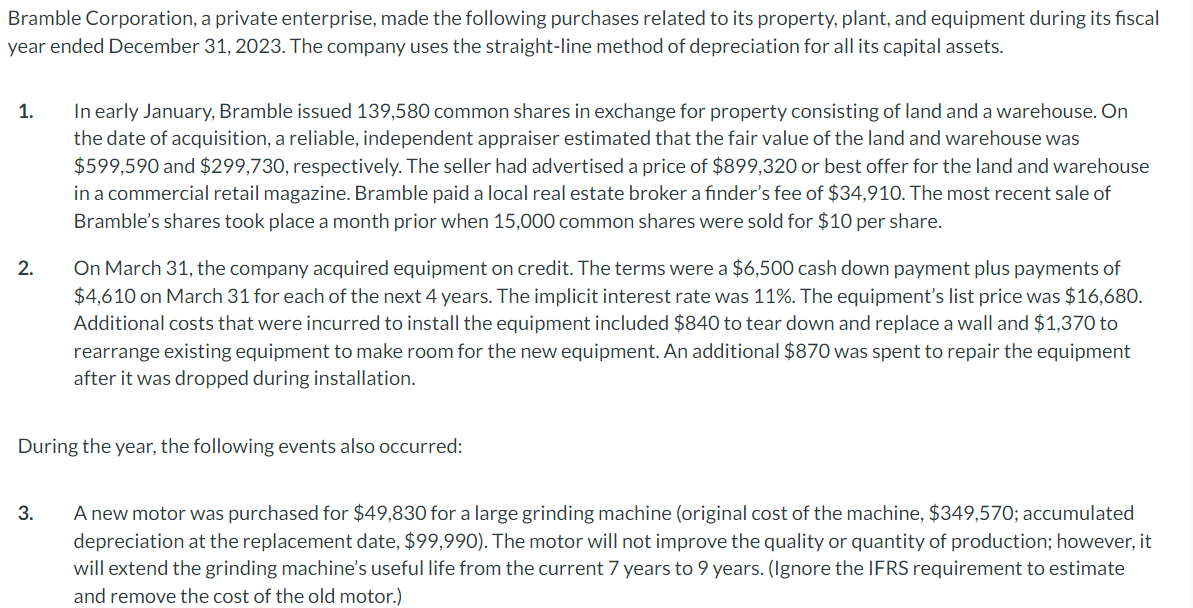

Bramble Corporation, a private enterprise, made the following purchases related to its property, plant, and equipment during its fiscal No . Account Titles and Explanation

Bramble Corporation, a private enterprise, made the following purchases related to its property, plant, and equipment during its fiscal No Account Titles and Explanation

To record purchase of equipment

To record repairs and maintenance expense

To record depreciation expenseTo record purchase of

equipment with tradein

year ended December The company uses the straightline method of depreciation for all its capital assets.

In early January, Bramble issued common shares in exchange for property consisting of land and a warehouse. On

the date of acquisition, a reliable, independent appraiser estimated that the fair value of the land and warehouse was

$ and $ respectively. The seller had advertised a price of $ or best offer for the land and warehouse

in a commercial retail magazine. Bramble paid a local real estate broker a finder's fee of $ The most recent sale of

Bramble's shares took place a month prior when common shares were sold for $ per share.

On March the company acquired equipment on credit. The terms were a $ cash down payment plus payments of

$ on March for each of the next years. The implicit interest rate was The equipment's list price was $

Additional costs that were incurred to install the equipment included $ to tear down and replace a wall and $ to

rearrange existing equipment to make room for the new equipment. An additional $ was spent to repair the equipment

after it was dropped during installation.

During the year, the following events also occurred:

A new motor was purchased for $ for a large grinding machine original cost of the machine, $; accumulated

depreciation at the replacement date, $ The motor will not improve the quality or quantity of production; however, it

will extend the grinding machine's useful life from the current years to years. Ignore the IFRS requirement to estimate

and remove the cost of the old motor.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started