Question

Bramble Corporation began operations on January 2 . ?Its year end is December 3 1 , ?and it adjusts its accounts annually. Selected transactions for

Bramble Corporation began operations on January ?Its year end is December ?and it adjusts its accounts annually. Selected

transactions for the current year follow:

On February ?purchased a $ ?oneyear insurance policy for cash. The policy came into effect on that date.

On March ?Bramble sold $ ?in annual subscriptions for cash, with service to begin on April

Purchased a delivery drone for $ ?on July ?Bramble paid $ ?in cash and signed a $ ?bank loan for the

balance. The drone is estimated to have a useful life of four years and the company uses straightline depreciation. The bank

loan has an interest rate of

On November ?the compary purchased six months of digital advertising at a cost of $ ?Bramble paid $ ?cash and

the balance on account. The advertising was to commence on December ?and run at a constant level for six consecutive

months.

On December ?Bramble received $ ?from the sale of gift cards which could be redeemed for services at a future date. On

December ?it was determined that ?of the cards had been redeemed.

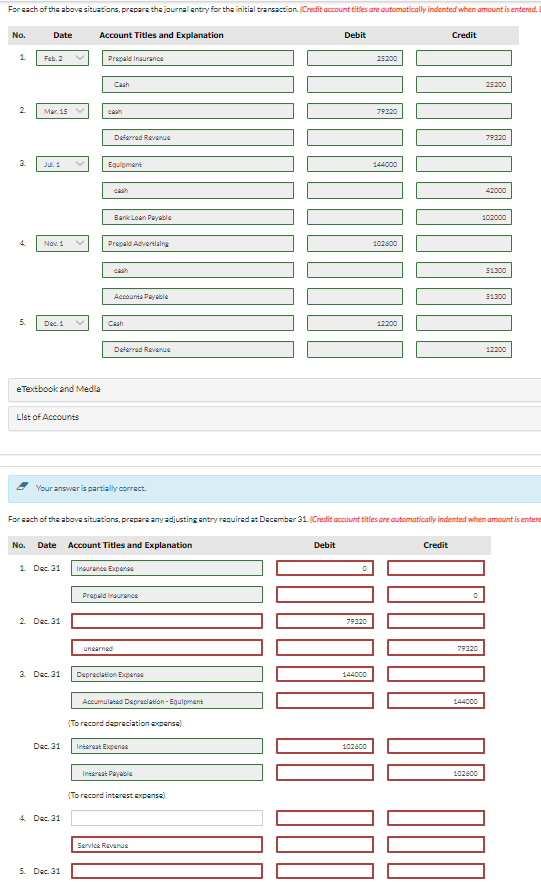

For each of the above situations, prepare the journal entry for the initial transaction. (Credit account titles are automatically indented when amount is entered. I No. Date Account Titles and Explanation 1 Feb. 2 Prepaid Insurance Cash N 2 Mar 15 V cash Deferred Revenue 3. Jul.1 Equipment cash Bank Loan Payable 4 Nov. 1 Prepaid Advertising cash Accounts Payable 5 Dec. 1 Cash eTextbook and Media List of Accounts Deferred Revenue Debit 25200 79320 144000 102600 12200 Credit 25200 79320 42000 102000 51300 51300 12200 Your answer is partially correct. For each of the above situations, prepare any adjusting entry required at December 31. (Credit account titles are automatically indented when amount is entere No. Date Account Titles and Explanation 1. Dec. 31 Insurance Expense 2. Dec. 31 Prepeld Insurance unearned 3. Dec. 31 Depreciation Expense Debit 79320 144000 Accumulated Depreciation-Equipment (To record depreciation expense) Dec. 31 Interest Expense 102600 4. Dec. 31 5. Dec. 31 Interest Payable (To record interest expense) Service Revenue Credit 79320 144000 102600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the adjusting entries for Bramble Corporation as of December 31 1 Feb 2 insurance expense a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started